Ethereum’s Early August Surge Meets Reality Check as Bears Eye Dip Below $4,000

After Ethereum's early August surge to $4,793, sell-offs and profit-taking have created significant pressure, leaving ETH vulnerable to a dip below $4,000. With weak sentiment among derivatives traders, bears are eyeing a drop to $3,491.

Ethereum’s rally in early August drove the largest altcoin to a cycle peak of $4,793 by August 14, marking one of its strongest performances of the year.

However, the sharp rise also triggered a wave of profit-taking, which has since put significant pressure on the asset and caused it to lose much of its recent gains. With selloffs intensifying in the derivatives market, ETH now faces the risk of a breakdown below the $4,000 price mark.

ETH Faces Heavy Sell Pressure

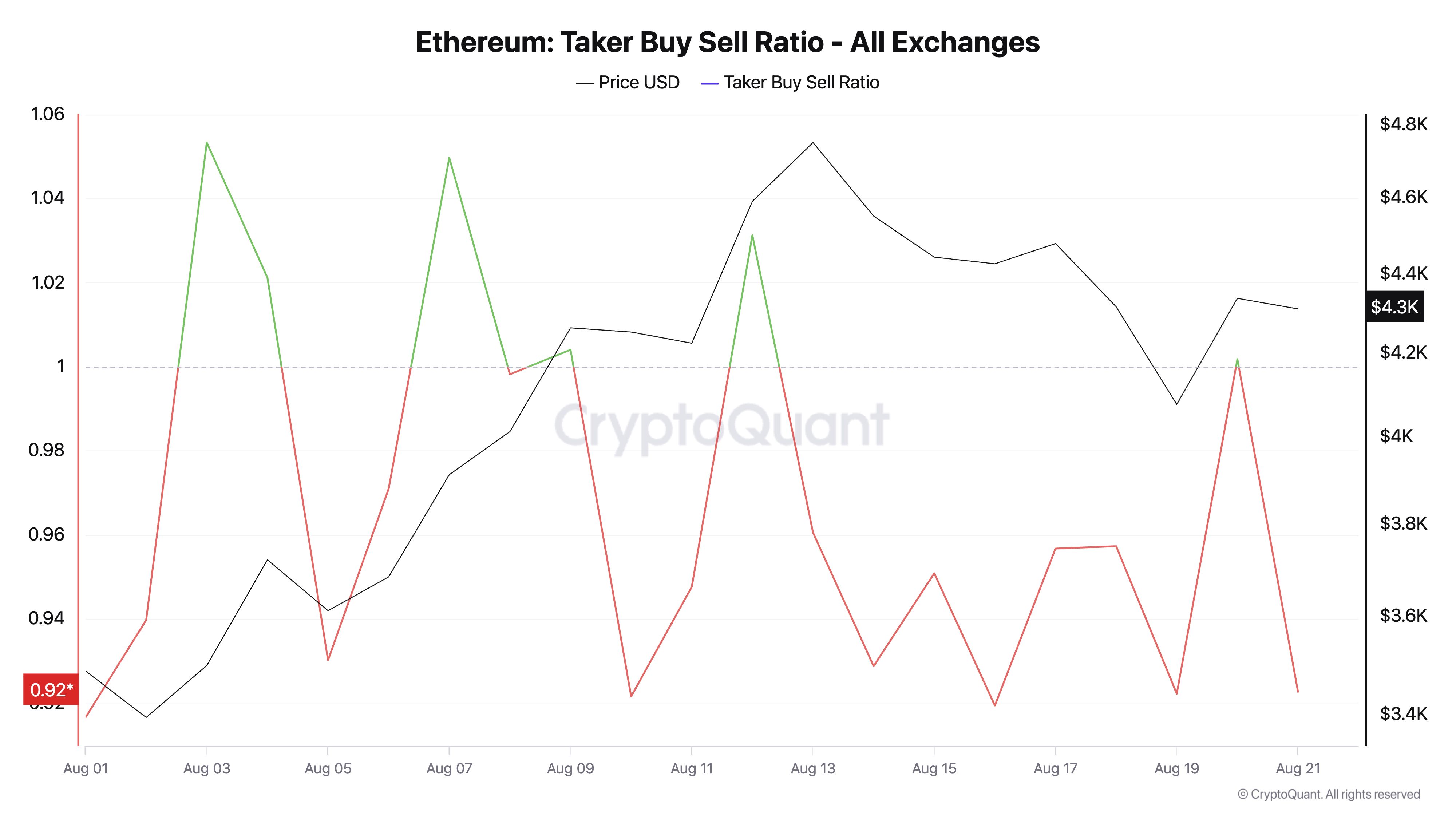

ETH’s price has been weighed down by the bearish tilt in sentiment among its derivatives traders. This is reflected by its taker-buy/sell ratio, which has mostly remained under one since the beginning of August.

At press time, this stands at 0.92 per CryptoQuant, indicating that sell orders dominate buy orders across the ETH futures market.

ETH Taker Buy Sell Ratio. Source:

CryptoQuant

ETH Taker Buy Sell Ratio. Source:

CryptoQuant

The taker buy-sell ratio measures the balance between buy and sell orders in an asset’s futures market. A ratio above one indicates stronger buying pressure, showing traders are actively chasing price gains. On the other hand, a value below one reflects dominant selling pressure, often linked to profit-taking or bearish sentiment.

Since August began, ETH’s taker buy/sell ratio has stayed mostly below one, confirming persistent sell-offs among futures traders.

For context, the coin’s performance had been largely muted for much of the year, so when an uptrend finally began in July and extended into early August, many traders seized the opportunity to lock in profits.

This mounting sell-side pressure confirms the weakening bullish sentiment and could worsen ETH’s price fall if it continues.

Traders Ditch High-Risk Bets Amid Price Pressure

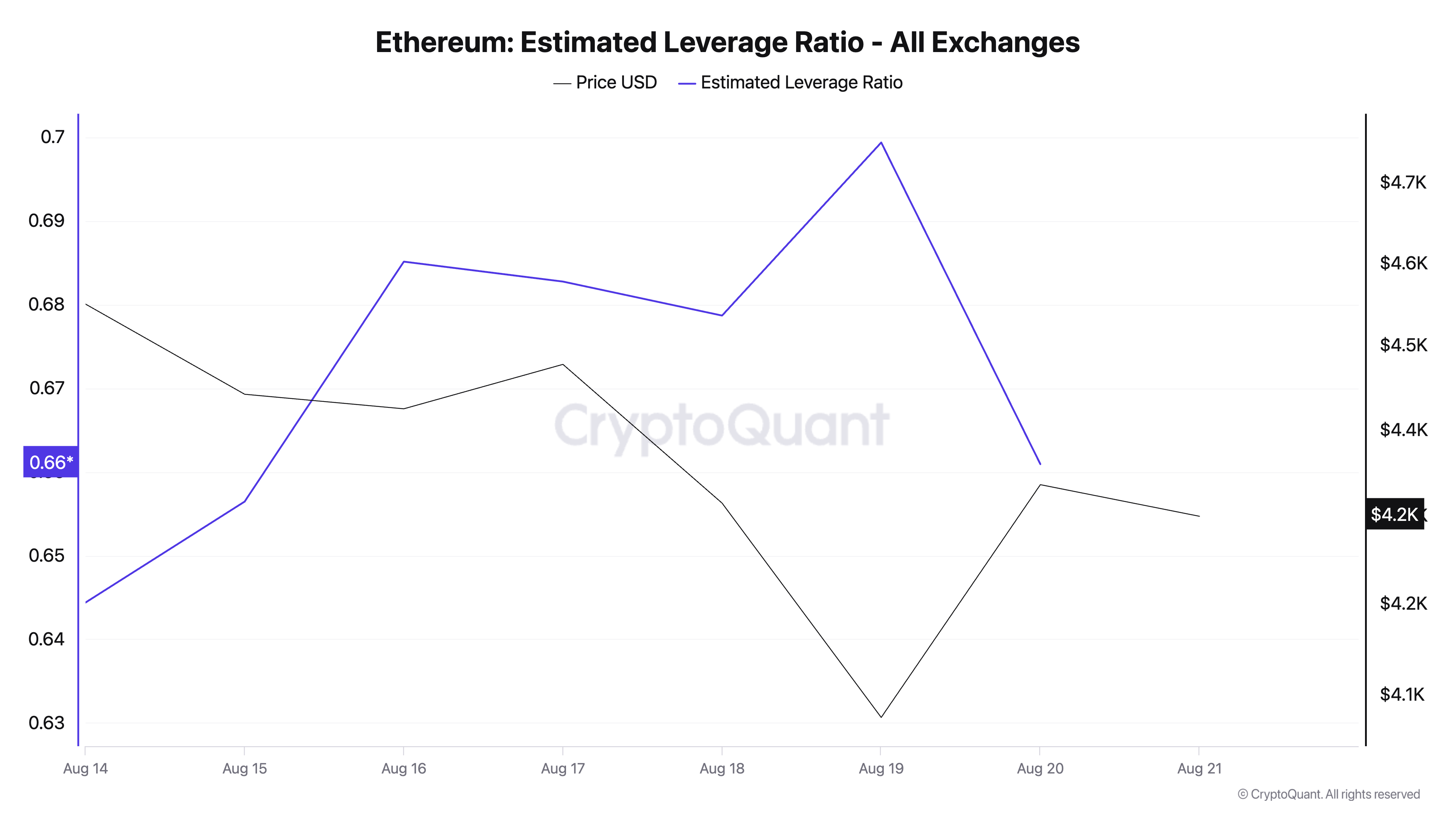

The recent decline in ETH’s Estimated Leverage Ratio (ELR) also confirms the low confidence among coin holders. According to CryptoQuant, ETH’s ELR currently sits at 0.66 — its lowest value in the past five days.

ETH Estimated Leverage. Source:

CryptoQuant

ETH Estimated Leverage. Source:

CryptoQuant

An asset’s ELR measures the average leverage its traders use to execute trades on a cryptocurrency exchange. It is calculated by dividing the asset’s open interest by the exchange’s reserve for that currency.

When an asset’s ELR falls, it indicates a reduced risk appetite among traders. This trend signals that ETH investors have grown increasingly cautious this week and are now avoiding high-leverage positions that could worsen potential losses.

Which Comes First: $3,491 or $4,793?

As of this writing, ETH trades at $4,295. If sell-side pressure strengthens, the altcoin could retest the support floor at $4,063. Should this key price mark give way, ETH could plunge to $3,491.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

Conversely, ETH could see a rebound and rally to $4,793 if new demand enters the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: BlockDAG’s Hybrid Tech Drives 2,900% Presale Surge and Real-World Adoption

- Ethereum Classic (ETC) surged 30% in August 2025, driven by Ethereum ecosystem updates and Bitmine's $20B corporate purchase plans. - PEPE memecoin rose 11% weekly, fueled by whale accumulation (8.95T tokens held) and sustained market optimism. - BlockDAG achieved 2,900% presale growth ($385M raised), with 25.5B tokens sold and 2.5M X1 app users before mainnet launch. - BlockDAG's hybrid DAG-Proof-of-Work architecture enables scalable mining and real-world adoption through gamified tools and education.

Senator Pushes Blockchain Budget for Trust or Transparency?

- Senator Bam Aquino proposes blockchain for national budget to enhance transparency and accountability. - The system would allow real-time tracking of public spending, using Polygon’s network and BayaniChain’s infrastructure. - While still conceptual, the initiative aims to set a global precedent for fiscal accountability through immutable records.

Bitcoin News Today: Inflows Stall, Bulls Defend $110K as Bitcoin ETFs Bleed $1B

- Bitcoin ETFs recorded $972M outflows this month, the second-largest since January 2024, per SoSoValue data. - Analysts link declining inflows to BTC's price drop from $124K to $100K, requiring $404B inflows to reach $150K by year-end. - Institutional buyers like MicroStrategy added 3,081 BTC ($356.9M), countering bearish sentiment amid $1B ETF outflows. - Market dynamics show shifting capital to ETH ETPs ($2.5B inflows) and whale-driven BTC-to-ETH trading activity. - S&P 500's bullish reversal contrasts

"AI's Hidden Hazard: How Overloaded Tools Are Slowing Down LLMs"

- Model Context Protocol (MCP) servers enable LLMs to integrate external tools but face misuse risks and performance degradation from overloading context windows. - Excessive tool registrations consume tokens, shrink usable context, and cause non-deterministic behavior due to inconsistent prompt handling across LLMs. - Security concerns include untrusted third-party MCP servers enabling supply chain attacks, contrasting with controlled first-party solutions. - Platforms like Northflank streamline MCP deplo