Crypto investor loses $1M in Uniswap scam exploiting Ethereum’s EIP-7702

A single phishing attack drained nearly $1 million worth of tokens from a crypto investor who unknowingly signed a batch of malicious transactions disguised as Uniswap swaps, according to blockchain security firm Scam Sniffer.

In an Aug. 22 post on X, Yu Xiang, founder of blockchain security firm SlowMist, noted that the incident involved five tokens siphoned through a transaction exploiting Ethereum’s new EIP-7702 mechanism.

He explained:

“From the perspective of a phished user, it goes like this: the user opens a phishing website, a wallet signature prompt pops up, the user clicks confirm, and with just that one action, all valuable assets in the wallet address vanish in a snap.”

EIP-7702 was introduced in the Pectra upgrade to streamline the Ethereum user experience. The feature allows a wallet to act like a temporary smart contract, making it possible to batch multiple transactions, enable gas sponsorship, or set spending limits in one step.

In principle, the delegation is revocable and network-specific. However, attackers have found ways to weaponize the feature in practice.

Crypto market maker Wintermute has warned that the standard’s implementation is being exploited at scale. Its June analysis showed that more than 90% of EIP-7702 delegations were linked to malicious contracts.

The firm pointed out that many of these contracts are simple copy-paste scripts that scan for vulnerable wallets and drain their holdings automatically.

Considering this, Scam Sniffer and Xiang urged crypto users to take extra care before signing wallet requests. They recommended verifying domain names, avoiding rushed confirmations, and rejecting signatures that seem unclear or overly broad.

They also stated that some of the red flags that could arise include requests for unlimited token approvals, contract upgrades under EIP-7702, or transaction simulations that do not match expectations.

The post Crypto investor loses $1M in Uniswap scam exploiting Ethereum’s EIP-7702 appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

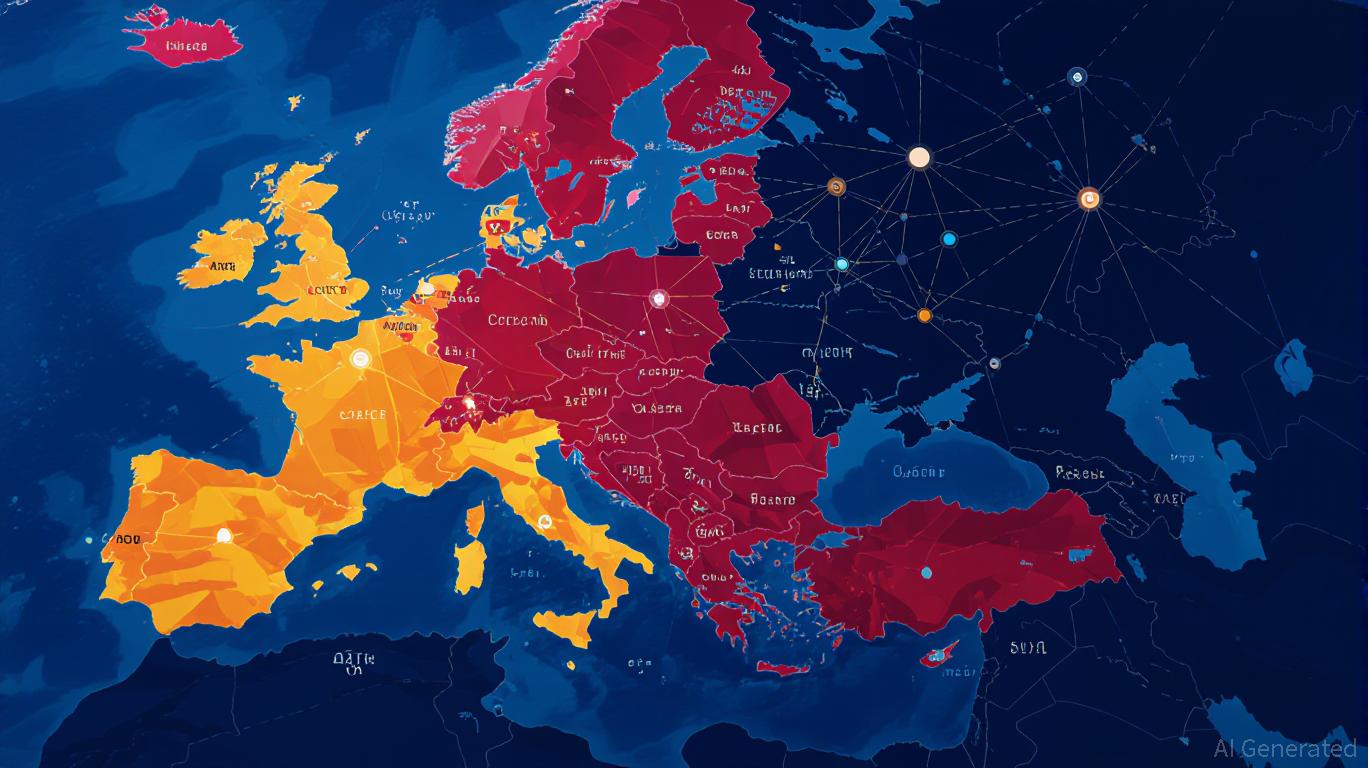

Navigating the Shifting Crypto Media Landscape in Eastern Europe: Strategic Opportunities Amid Traffic Declines

- Eastern European crypto media saw 18.3% Q2 2025 traffic decline, with 17 outlets capturing 80.71% of regional traffic amid regulatory and algorithmic shifts. - Tier-3 platforms (10,000–99,999 visits) retained 17.33% traffic through localized relevance and AI-optimized content in markets like Poland and Czech Republic. - AI-driven discovery tools and regional partnerships (e.g., Kriptoworld.hu) are reshaping distribution, with 20.6% of outlets reporting traffic from platforms like Perplexity. - Investors

Is This the Final Dip Before Altseason?

- Crypto market signals suggest altcoins may outperform Bitcoin amid waning dominance and bullish technical indicators. - Ethereum's 54% August surge and rising ETH/BTC ratio historically precede altcoin growth cycles. - Dovish Fed policy and $3B Ethereum ETF inflows create favorable conditions for altcoin capital rotation. - Institutional confidence in Bitcoin indirectly supports altcoin momentum through liquidity and risk-on appetite. - Strategic entry points for high-conviction investors include Ethereu

The EU's Ethereum-Based Digital Euro: A Strategic Catalyst for Blockchain Infrastructure and DeFi Growth

- EU selects Ethereum as foundational layer for digital euro, challenging U.S. stablecoin dominance and validating its scalability and compliance. - Ethereum's smart contracts, energy-efficient post-Merge model, and GDPR-aligned ZK-Rollups address scalability, privacy, and regulatory needs. - Infrastructure providers (Infura, zkSync) and DeFi platforms (Uniswap) stand to benefit from increased demand for CBDC operations and liquidity. - Geopolitical shift reduces reliance on U.S. payment systems, with Ethe

Metaplanet's $887M Bitcoin Play: A Catalyst for Institutional Adoption and Long-Term BTC Value

- Metaplanet allocated $887M of its ¥130.3B fundraising to Bitcoin in 2025, reflecting corporate treasury strategies shifting toward digital assets amid macroeconomic instability. - Japan's weak yen and 260% debt-to-GDP ratio drive institutional adoption of Bitcoin as a hedge against currency depreciation, with 948,904 BTC now held across public company treasuries. - Metaplanet's 1% Bitcoin supply target (210,000 BTC) and inclusion in global indices signal growing legitimacy, as regulatory reforms in Japan