SharpLink Approves $1.5B Stock Buyback Plan

- SharpLink initiates $1.5B buyback to address share value.

- Focus on shares trading below net asset value.

- Market response shows a 5.27% price increase.

SharpLink Gaming approved a $1.5 billion stock buyback to enhance shareholder value. This decision focuses on purchasing stocks when trading below ETH holdings’ net asset value, potentially increasing share value.

SharpLink Gaming, a key Ethereum treasury firm, has approved a $1.5 billion stock repurchase plan to boost shareholder value when shares trade below their net asset value. Announced by Co-CEO Joseph Chalom, the plan aims to provide stability using capital efficiently.

The buyback is a strategic response to market conditions, highlighting SharpLink’s intention to increase each share’s value-accrual through tactical repurchases. Shares surged 5.27% in pre-market trading following the announcement .

SharpLink Gaming, owning 740,800 ETH, is implementing a $1.5 billion stock buyback program. The firm, based in Minneapolis, is the second-largest global corporate ETH holder. This move aims to optimize shareholder value, particularly under specific market conditions. Co-CEO Joseph Chalom explained that the program ensures flexibility to act swiftly on opportunities, reflecting confidence in their long-term growth strategy. Actions will occur through open markets or private negotiations without a set timeline or fixed share count.

Joseph Chalom, Co-CEO, SharpLink Gaming, said, “The program ensures the company can move quickly when opportunities arise… providing stability, using capital efficiently, and showing a commitment to sustainable growth” – source .

The buyback authorization underscores SharpLink’s goal of enhancing shareholder value amid current market trends. Shares experienced a notable rise of 5.27% pre-market after the announcement. While the Ethereum price remained stable, the corporate equity market shifted due to the buyback plan. The strategic similarity to MicroStrategy’s past actions emphasizes its potential to shape corporate ETH treasury tactics. The immediate focus on ETH-treasury accountability might spearhead institutional strategies.

Analysts anticipate increased strategic treasury activity in the Ethereum community. Corporate buybacks could become more prevalent strategies, provided firms possess significant ETH. This aligns financial tactics with ongoing market changes, promoting corporate fiscal agility. With its tactical repurchase strategy, SharpLink could lead a trend of organizational adaptation in cryptocurrency finance narratives. Economic outcomes remain subject to further volatility, benefiting from robust strategic alignments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ether gains 10% after Fed's Jackson Hole, ETF holdings top 6.4M ETH

ETH ‘god candle’ emerges amid Fed rate cut hopes: Is $6K Ether next?

ETH data and return of investor risk appetite pave path to $5K Ether price

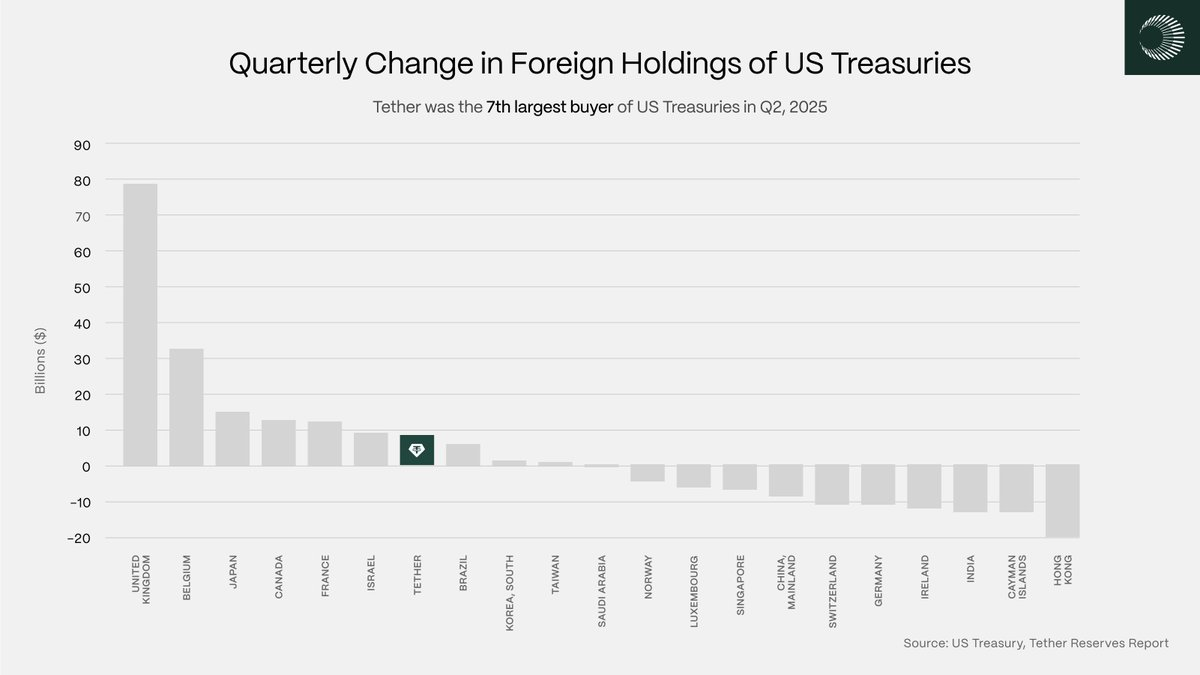

Tether: Quasi-sovereign allocator

Tether’s ascent as a top-10 foreign buyer of Treasurys signals stablecoin issuers are no longer just liquidity users