Ethereum’s Bullish Signal as Institutions Accumulate Heavily

- Ethereum’s bullish engulfing candle highlights market shift potential.

- Institutional buying adds upward pressure on ETH prices.

- Rising open interest suggests renewed market confidence in ETH.

Ethereum prints a bullish engulfing candle near $4,200, with institutional buyers increasing positions, including significant ETH movements by U.S. government entities, indicating a possible pivotal market shift.

The rising institutional interest and open interest surge suggest Ethereum’s growing acceptance as a staple financial asset, with potential implications for market dynamics and future valuation.

Ethereum (ETH) has printed a bullish engulfing candle near $4,200, accompanied by a surge in open interest and visible institutional accumulation. This occurrence suggests a possible turning point where large entities actively increase their exposure to ETH.

Key players include institutional buyers and major exchanges like CME. Open interest for ETH derivatives has surged globally, with CME reporting a record $8.3 billion, affirming increased institutional activity. An analyst remarked, “Ethereum’s bullish engulfing at a major support zone and all-time high open interest reflects matured institutional belief in its long-term role as the core settlement layer.”

The rise in institutional buying is expected to have a significant impact on Ethereum’s market presence. High open interest levels could further elevate prices, while increasing institutional participation signals potential structural shifts in the crypto market.

ETH’s dominance in the market suggests a potential rotation of capital from BTC , underscoring the increasing importance of Ethereum within the crypto landscape. These developments could alter investment strategies and market dynamics significantly.

Regulatory and technological outcomes might include greater scrutiny of institutional crypto activities, fostering a stronger regulatory environment. Such shifts could spur innovation in blockchain technology and smart contract applications, bolstering Ethereum’s role as a financial tool.

Historical data indicates similar trends during the 2021 CME OpEx , where increased institutional flows led to ATH breakouts. Current developments may mirror these past events, leading to potential advances for ETH and associated blockchain projects.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

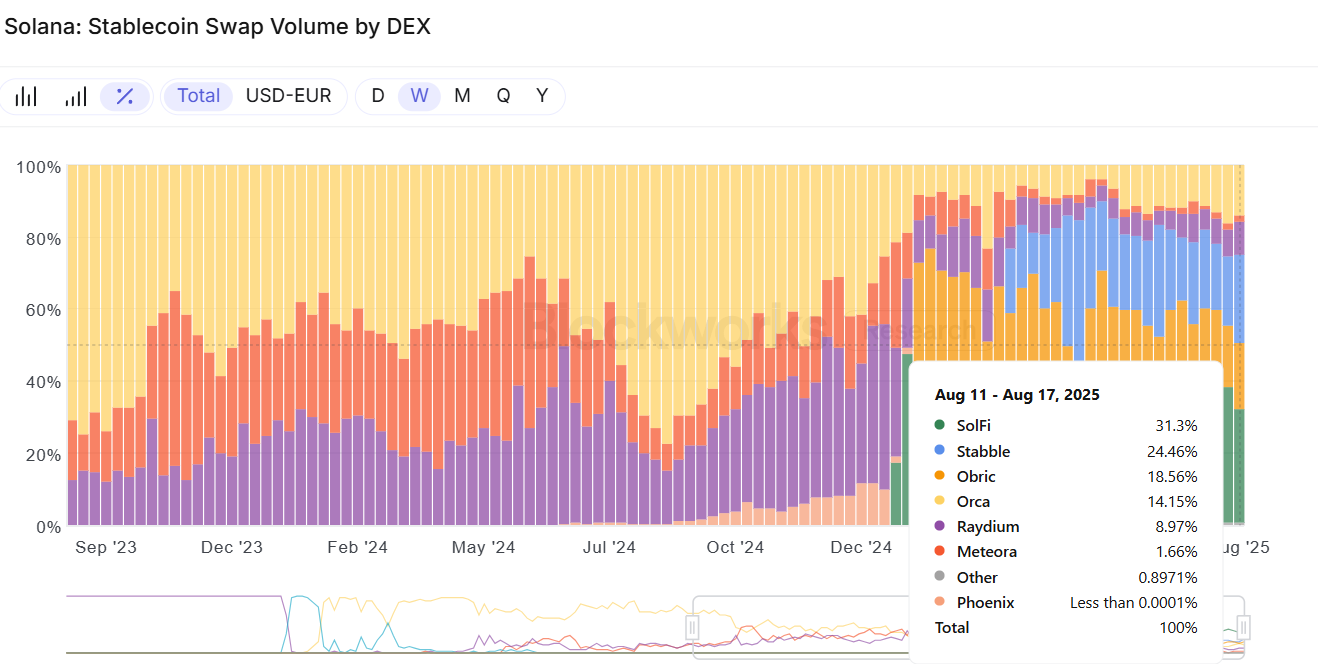

Solana’s proprietary AMMs are reshaping liquid asset markets for users

Prop AMMs like SolFi, HumidFi and Obric are taking over liquid capital markets

Pennsylvania Bill Proposes Jail for Crypto-Holding Officials

Federal Reserve Impact Sparks Crypto Market Surge

U.S. GENIUS Act Prompts ECB Digital Euro Acceleration