Interest Rate Cut Hints Spark Crypto Market Surge

- Federal Reserve hints at interest rate cuts affecting cryptocurrency market.

- Surge in institutional crypto investments recorded.

- Ethereum hits new all-time high during market rally.

Federal Reserve Chair Jerome Powell’s statements from Jackson Hole on potential September interest rate cuts have ignited institutional market activity, leading to a cryptocurrency spike, notably Ethereum reaching new heights.

The remarks suggest a favorable macroeconomic climate for digital assets, spurring investor interest and pushing altcoins like Ethereum to new records amidst shifting monetary policies.

Lede

Federal Reserve Chair Jerome Powell’s statements at Jackson Hole have led to significant movements in the cryptocurrency market. The announcement piqued investor interest, encouraging a shift towards risk-on assets, including cryptocurrencies.

Nut Graph

Crypto investments surged following speculation about potential interest rate cuts in September. Major players like DDC Enterprise and Ming Shing are increasing their Bitcoin holdings , while Verb Technology focuses on investing in TON.

Market Impact

The market impact is immediate, with Ethereum reaching new highs . Institutional activity has significantly increased, notably in altcoins such as Zora , Bio Protocol , and Aave . This activity reinforces a bullish sentiment.

“We could see cuts in September if data confirms current inflation path.” — Jerome Powell, Chair, Federal Reserve

The macroeconomic implications of the Federal Reserve’s position indicate a possible shift towards more favorable conditions for cryptocurrencies. This development attracts major investments, with Bitcoin and Ethereum leading the charge.

Analysts’ Insights

Analysts note comparisons to previous cycles, suggesting potential long-term bullish trends. These trends echo historical patterns observed in 2021, driven by institutional inflows and market expansions.

Should the Federal Reserve proceed with interest rate cuts, this may lead to sustained investment growth in the crypto market. Historical data supports such possibilities, further encouraged by ongoing treasury activity and elevated trading volumes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

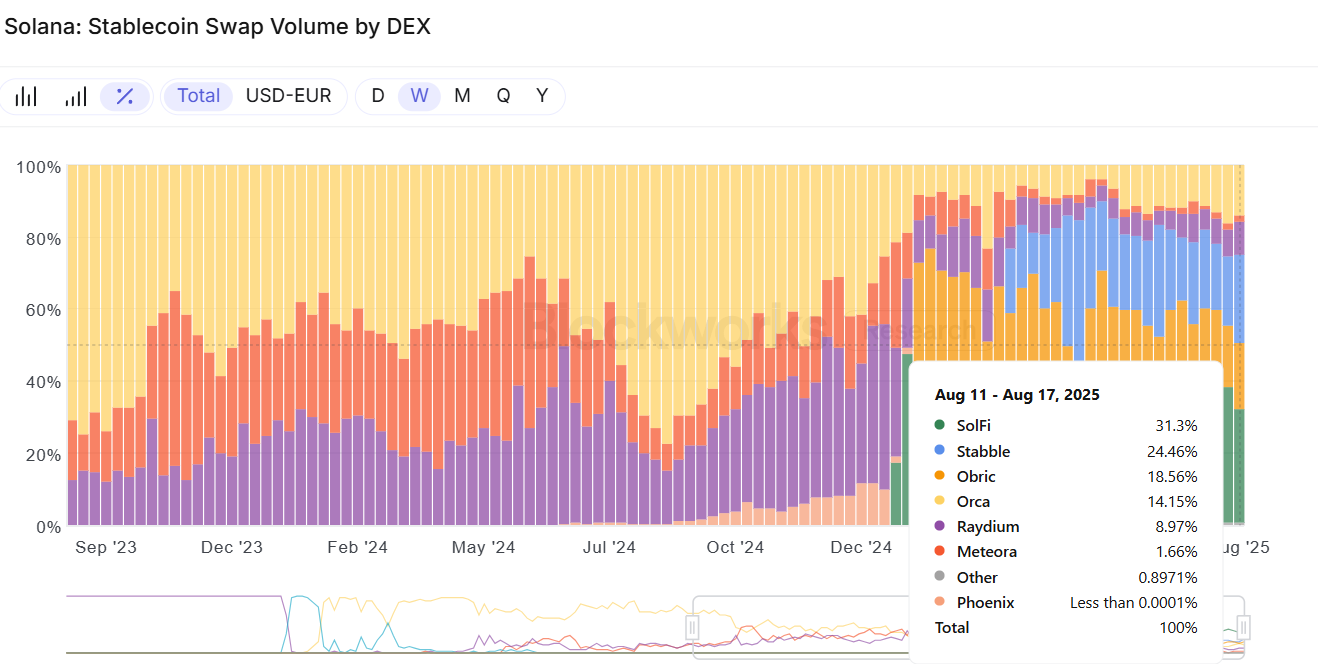

Solana’s proprietary AMMs are reshaping liquid asset markets for users

Prop AMMs like SolFi, HumidFi and Obric are taking over liquid capital markets

Pennsylvania Bill Proposes Jail for Crypto-Holding Officials

Federal Reserve Impact Sparks Crypto Market Surge

U.S. GENIUS Act Prompts ECB Digital Euro Acceleration