The Ethereum price today is trading around $4,774, cooling slightly after a powerful rally that pushed ETH above $4,800 earlier this week. The surge came as ETH broke free from a multi-week descending channel, reclaiming critical trendline support near $4,400. Now, the market is at a key decision point: whether ETH can sustain momentum toward the psychological $5,000 level or face near-term consolidation.

What’s Happening With Ethereum’s Price?

ETH price dynamics (Source: TradingView)

On the 4-hour chart, Ethereum reversed sharply from $4,200, breaking out of a falling channel and reclaiming the rising trendline from early August. The recovery lifted ETH into the $4,750–$4,800 resistance zone, which has acted as both a liquidity cluster and a key rejection level in past cycles.

ETH price dynamics (Source: TradingView)

The weekly chart shows ETH testing the same supply zone that capped rallies in late 2021. A decisive close above $4,900 would confirm a structural breakout, potentially opening the path toward $5,200 and even $5,500. Until then, ETH faces overhead supply pressure that could keep price action choppy.

Why Is The Ethereum Price Going Up Today?

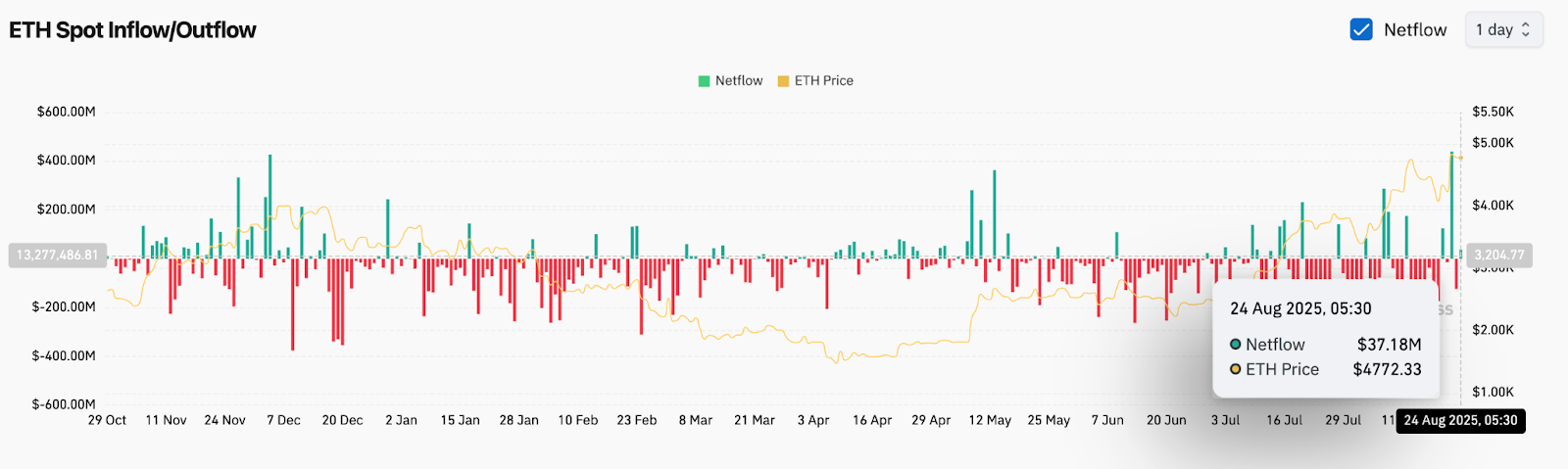

ETH Spot Inflow/Outflow (Source: Coinglass)

The rally in Ethereum price is being driven by both technical and flow dynamics. Spot inflow data on August 24 showed a net positive of $37.1M, reinforcing accumulation interest at higher levels. While inflows are smaller compared to Bitcoin’s flows, ETH’s rebound aligns with broader market risk appetite and signals renewed demand among institutions.

ETH price dynamics (Source: TradingView)

Momentum indicators confirm bullish strength. The Money Flow Index (MFI) stands elevated at 76, highlighting aggressive buying pressure, while the RSI on the 30-minute chart holds near 57 after easing from overbought readings. The Directional Movement Index (DMI) also supports a bullish bias, with +DI above -DI and ADX rising, confirming trend strength.

Indicators Signal Consolidation Before Breakout

ETH price dynamics (Source: TradingView)

Bollinger Bands on the 4-hour chart are expanding sharply, with ETH trading near the upper band around $5,020. This signals volatility expansion but also warns of near-term exhaustion. The EMA cluster (20/50/100/200) is tightly aligned below $4,600, reinforcing the $4,550–$4,600 zone as dynamic support.

On lower timeframes, Ethereum has formed a symmetrical triangle just above $4,750. A breakout from this structure could decide whether ETH tests $4,900–$5,000 in the next session. VWAP is sitting at $4,786, nearly flat with price, indicating balance before the next move.

The Supertrend indicator on the daily chart remains firmly bullish above $4,050, underscoring that the macro bias is intact as long as ETH holds above its trend base.

ETH Price Prediction: Short-Term Outlook (24H)

The immediate outlook depends on Ethereum’s ability to sustain above $4,750. A breakout from the current consolidation triangle would likely propel ETH toward $4,900 and then the $5,000 psychological level. A confirmed close above $5,000 could invite momentum-driven buyers, targeting $5,200–$5,500 in the coming week.

On the downside, if ETH loses $4,700 support, price may retest $4,600 and possibly the $4,400 breakout zone. As long as ETH remains above $4,400, the broader structure favors buyers.

With inflows supportive, indicators aligned bullish, and macro resistance in play, Ethereum price today appears primed for a volatility-driven breakout.

Ethereum Price Forecast Table: August 25, 2025

| Indicator/Zone | Level / Signal |

| Ethereum price today | $4,774 |

| Resistance 1 | $4,900 |

| Resistance 2 | $5,000–$5,200 |

| Support 1 | $4,700 |

| Support 2 | $4,600–$4,400 |

| RSI (30-min) | 57.3 (Neutral-Bullish) |

| MFI (14) | 76.2 (Strong Buying Pressure) |

| Bollinger Bands (4H) | Expanding, $5,020 upper band |

| EMA Cluster (20/50/100/200) | Bullish alignment, $4,600 base |

| VWAP (Session) | $4,786 (Neutral balance) |

| DMI (14) | +DI leads, ADX rising (Bullish) |

| Spot Inflows (Aug 24) | +$37.1M (Accumulation signal) |

| Chart Pattern | Symmetrical Triangle (Breakout Watch) |