Bitcoin Price Surges to Record $124,533 All-Time High

- Bitcoin reaches a new all-time high at $124,533.

- Institutional adoption intensifies, boosting prices.

- Federal Reserve decisions impact market dynamics.

Bitcoin’s price surged past $112,000, reaching a historic high of $124,533 amid growing institutional involvement, driven by macroeconomic factors and corporate interest.

The surge highlights increasing Bitcoin adoption, affects market dynamics, and signals potential price volatility, emphasizing institutional roles in cryptocurrency’s evolving landscape.

Bitcoin recently surged past $112,000, reaching a new all-time high of $124,533. This significant rise reflects intensified institutional adoption , macroeconomic factors such as Federal Reserve interest rate policies, and ongoing demand from corporate buyers.

The rally involved key figures like El Salvador’s President Nayib Bukele, who is actively accumulating Bitcoin. Additionally, major institutional players such as BlackRock’s iShares Bitcoin Trust are substantially expanding their holdings.

The immediate impact of this surge includes psychological support at current levels, as traders react to both international policies and institutional trading activities. This movement has significant implications for the crypto market’s overall sentiment.

Financial implications are noticeable, with Bitcoin ETFs recently experiencing selling pressures. Meanwhile, governmental strategies and interest rate signals continue to shape investor expectations, leading to market volatility.

Market participants watch closely as monetary policy decisions from the Federal Reserve further influence Bitcoin’s trajectory. Industry experts suggest cautious optimism, as uncertainties in macroeconomic conditions remain prevalent. Acknowledging the delicate balance, Ali, a crypto analyst, remarked:

Bitcoin is ‘hanging by a thread’ after slipping below the $112,000 support level.

Strategists anticipate shifts in regulatory frameworks and technological advancements that could influence future cryptocurrency dynamics . As historical trends show, such high volatility often leads to significant corrections or sustained rallies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin futures demand rises even as BTC sells off: What gives?

Bitget Debuts First-Ever RWA Index Perpetuals Featuring Major Real-World Assets

Cap Labs attracts capital with EigenLayer-backed credit model

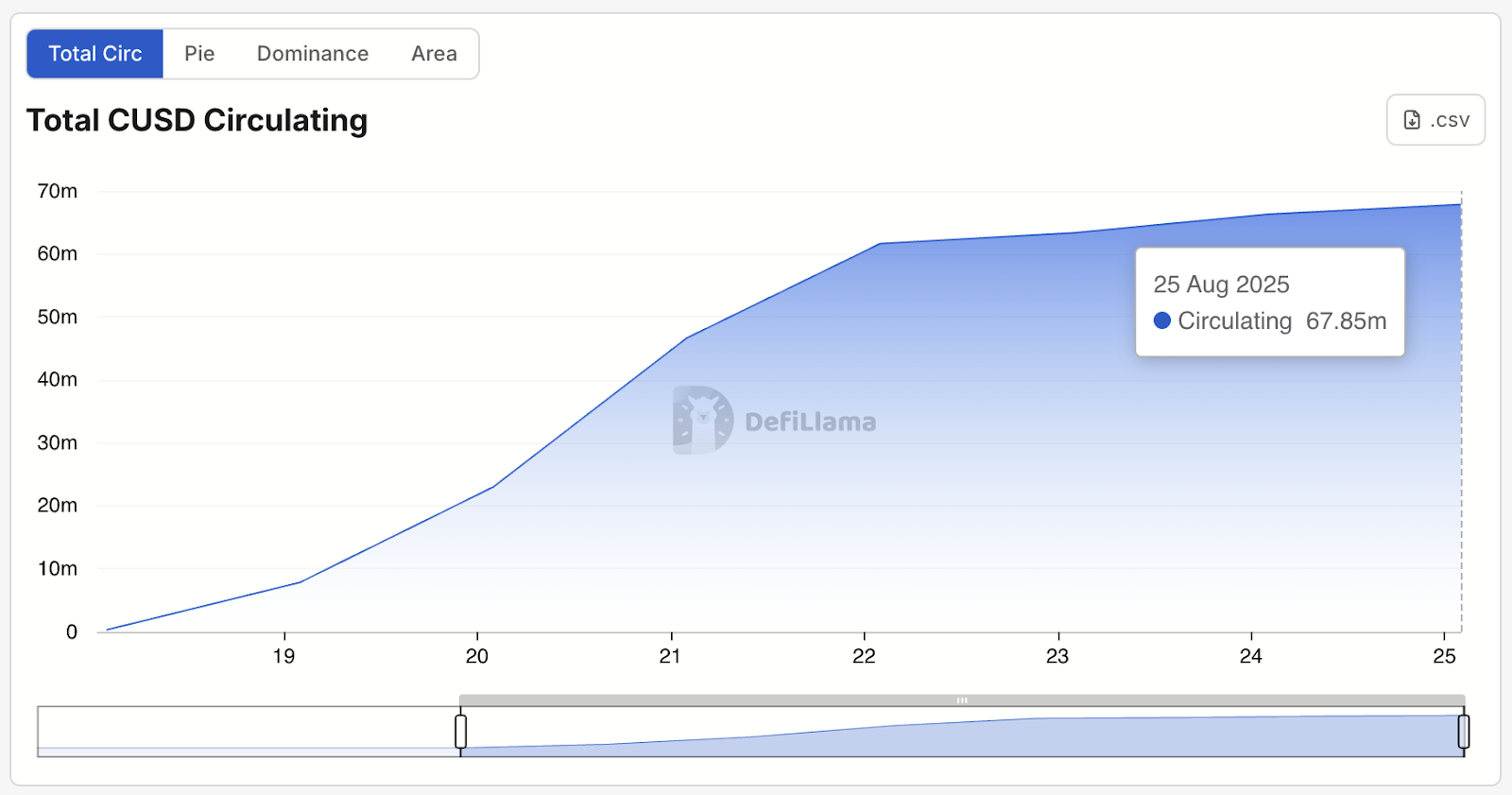

The GENIUS-compliant cUSD stablecoin surges past $67M in one week

Metaplanet Acquires 103 BTC, Strengthening Treasury Position