Analytics Firm Warns Against a Region in Bitcoin – “An Operation That Could Trigger Stops May Be Coming”

Cryptocurrency analytics firm Alphractal has released a striking report highlighting the risks inherent in leveraged trading. According to the report, 94% of traders have liquidated in the last three months.

The company said many investors are unaware of the critical areas where mass liquidations are taking place.

The report stated that Bitcoin's long and short positions, both low and medium leveraged, have been completely liquidated in the last 30 days, and market movements have not given traders the opportunity to close their positions even with small profits.

The situation was no different in Ethereum; while long and short positions have been heavily liquidated in the last month, it was stated that the large liquidity pool formed at $ 4,840 on the 22nd pushed the price up rapidly, but the price rebounded sharply with the reaccumulation of long positions.

Alphractal also noted that the most striking point for Bitcoin is the accumulation of heavy long positions in the $104,000-$107,000 range over the past three months. According to the company, this area represents a potential liquidation area, and market makers could use these levels to push the price higher, trigger stop-loss orders, and subsequently create selling pressure. However, Alphractal added that this isn't a hard and fast rule, simply a critical area to monitor closely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin futures demand rises even as BTC sells off: What gives?

Bitget Debuts First-Ever RWA Index Perpetuals Featuring Major Real-World Assets

Cap Labs attracts capital with EigenLayer-backed credit model

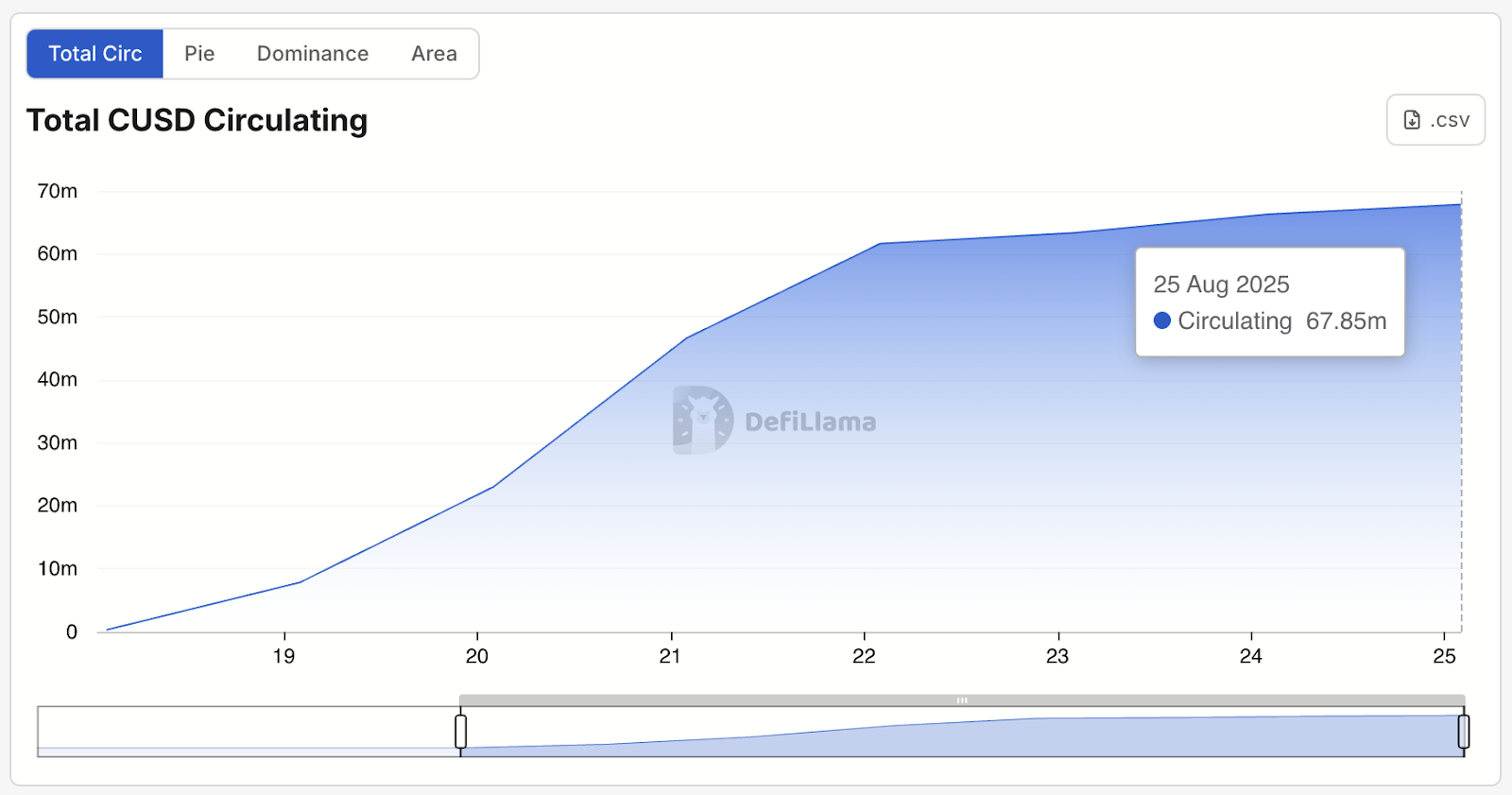

The GENIUS-compliant cUSD stablecoin surges past $67M in one week

Metaplanet Acquires 103 BTC, Strengthening Treasury Position