- Ethereum is mirroring its 2021 ATH behavior.

- A breakout or rejection could define the next ETH trend.

- Market sentiment and macro factors may influence ETH’s move.

Ethereum ($ ETH ) recently touched a new all-time high (ATH), only to retreat shortly after—a move that feels eerily similar to its behavior during the 2021 bull run. Back then, ETH hovered just below its previous ATH for several weeks, frustrating investors, before finally bursting into price discovery.

Many traders and analysts are now wondering: is Ethereum setting up for a similar breakout this cycle, or is the recent pullback a warning sign?

Could a Breakout Be on the Horizon?

In 2021, patience paid off. ETH lingered near resistance, consolidating and building momentum before eventually surging into uncharted territory. A similar consolidation phase appears to be happening now. If history repeats itself, we could see ETH explode past its recent highs after a few weeks of sideways action.

Market indicators also show increased institutional interest, Ethereum ETF discussions, and on-chain activity picking up—all of which could act as catalysts for another breakout.

Or Is Rejection More Likely This Time?

However, the macroeconomic landscape today is quite different from 2021. Uncertainty around interest rates, global regulation , and the broader crypto market sentiment could act as headwinds. A failure to reclaim the ATH soon might lead to investor fatigue and a deeper correction.

While past patterns offer clues, they don’t guarantee future outcomes. ETH’s next move will depend heavily on market momentum and investor confidence over the coming weeks.

Read Also :

- $170M in Cardano ADA Withdrawn from Exchanges

- Best Crypto To Invest in 2025? Arctic Pablo’s CEXpedition Prep Phase Turns $1,250 Into $32,608 as Peanut and Baby Dogecoin Heat Up

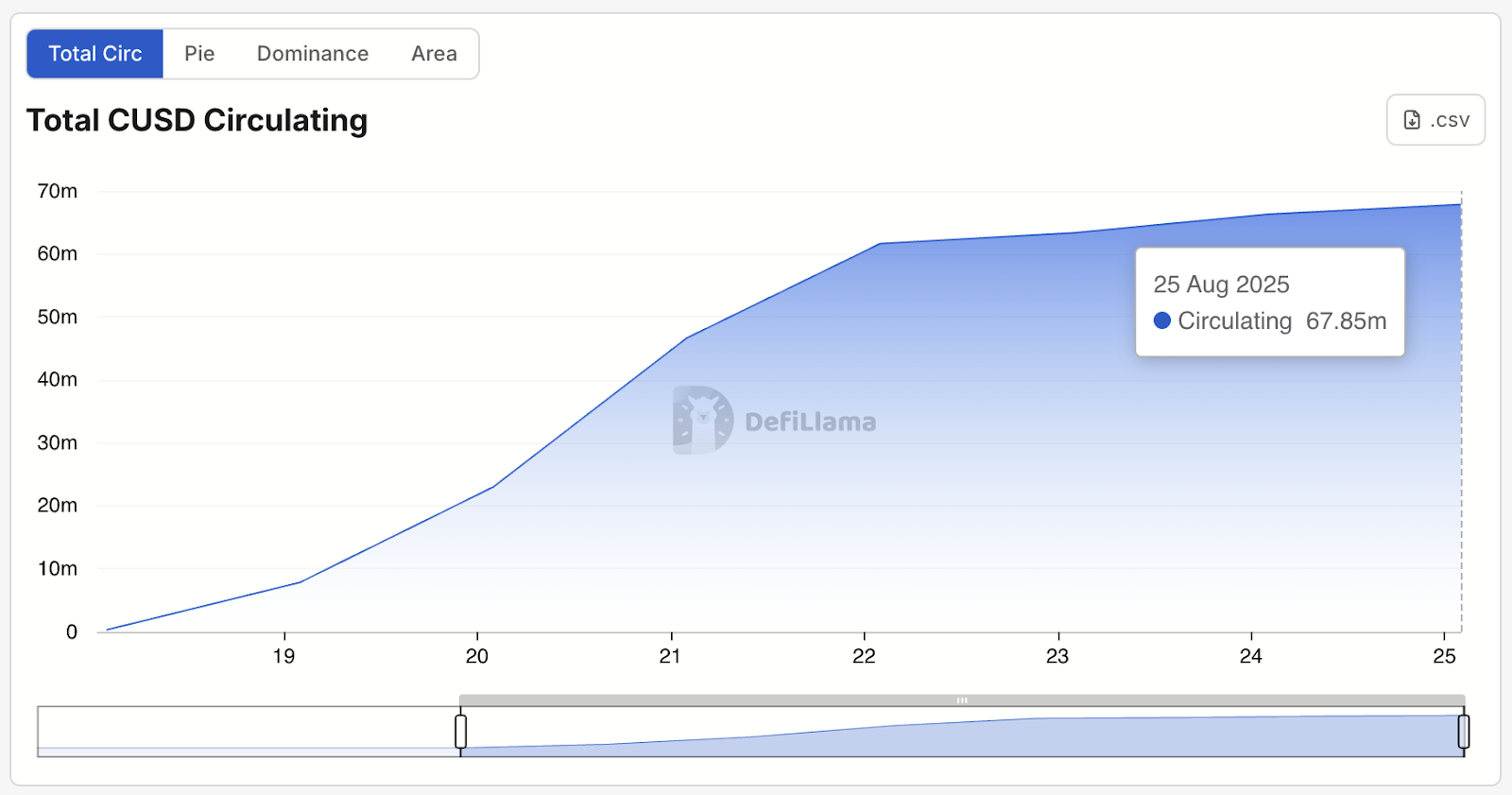

- Stablecoin Activity Hits All-Time Highs

- BlockDAG Raises $383M, ETH Slips Below $4K, HBAR Stalls at $0.24: Which Is the Top Decentralized Crypto of 2025?

- Digital Asset Funds See $1.43B in Outflows