76% of Japanese banks target Chainlink-backed tokenized securities

- SBI and Chainlink Join Forces to Expand Tokenization in Japan

- 76% of financial institutions want to invest in tokenized securities

- Partnership focuses on stablecoins, funds, and secure international settlement

Japanese group SBI announced a strategic partnership with Chainlink to accelerate blockchain adoption and expand asset tokenization in Japan and across the Asia-Pacific region. The deal , unveiled on August 24, combines SBI's expertise in the financial sector with Chainlink's infrastructure, widely used for data, interoperability, and institutional-grade DeFi applications.

The initiative aims to expand the use of tokenized securities, regulated stablecoins, and digital funds, as well as explore real-world assets such as real estate. According to the SBI, Japan's mature financial system and growing digital asset landscape make the country fertile ground for large-scale experimentation.

As part of the collaboration, SBI and its network of financial partners will leverage Chainlink services such as the Cross-Chain Interoperability Protocol (CCIP), SmartData (NAV), and Proof of Reserve. These tools are expected to improve operational efficiency and unlock liquidity in the secondary market, making tokenized asset management more robust.

The partnership also seeks to create secure solutions for payment-versus-payment (PvP) settlement in foreign exchange markets and international transfers, areas where demand for efficiency and regulatory compliance is growing rapidly.

These efforts are supported by a study conducted by SBI Digital Asset Holdings, which surveyed more than 50 financial institutions in Japan. The results showed that 76% of them intend to invest in tokenized securities, citing gains in efficiency and diversification, although the lack of institutional infrastructure still poses a challenge to wider adoption.

For Yoshitaka Kitao, CEO of SBI Holdings, the collaboration with Chainlink represents a decisive step: "The partnership highlights our commitment to building compliance-focused digital asset frameworks." The executive also stated that the combination of SBI's reach and the security of Chainlink's systems will enable the development of international transactions powered by stablecoins.

This move builds on the previous agreement between SBI and Ripple to introduce the RLUSD stablecoin in Japan. Together, these initiatives reinforce the conglomerate's strategy of positioning itself as a key player in the evolution of tokenization and the growth of the digital asset market in Japan and Asia-Pacific.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin futures demand rises even as BTC sells off: What gives?

Bitget Debuts First-Ever RWA Index Perpetuals Featuring Major Real-World Assets

Cap Labs attracts capital with EigenLayer-backed credit model

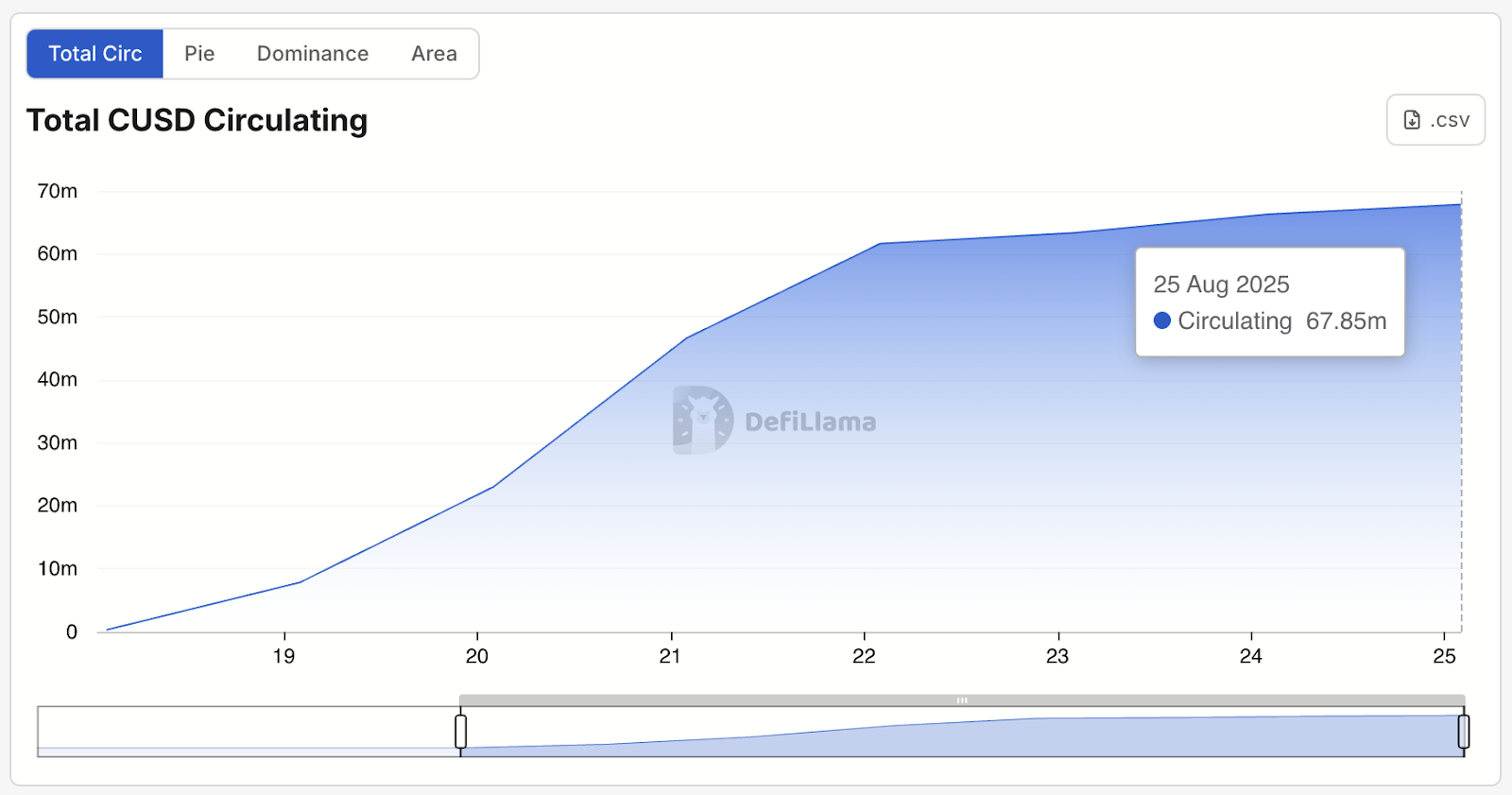

The GENIUS-compliant cUSD stablecoin surges past $67M in one week

Metaplanet Acquires 103 BTC, Strengthening Treasury Position