Bitcoin Struggles at $110,000 as Traders Pull Back Across Markets

Bitcoin’s $110,000 support is under pressure as futures and spot traders lean bearish. Without renewed demand, BTC risks sliding to $107,557.

Bitcoin is trading 10% below its all-time high, pressured by heavy profit-taking that has wiped out some of its value since August 14.

The leading cryptocurrency now trades around the $110,000 level, with on-chain signals suggesting a deeper correction could be imminent.

BTC Futures Traders Retreat as Selloffs Continue

On-chain data shows that sell-side pressure continues to mount, threatening to push BTC below the psychological $110,000 threshold.

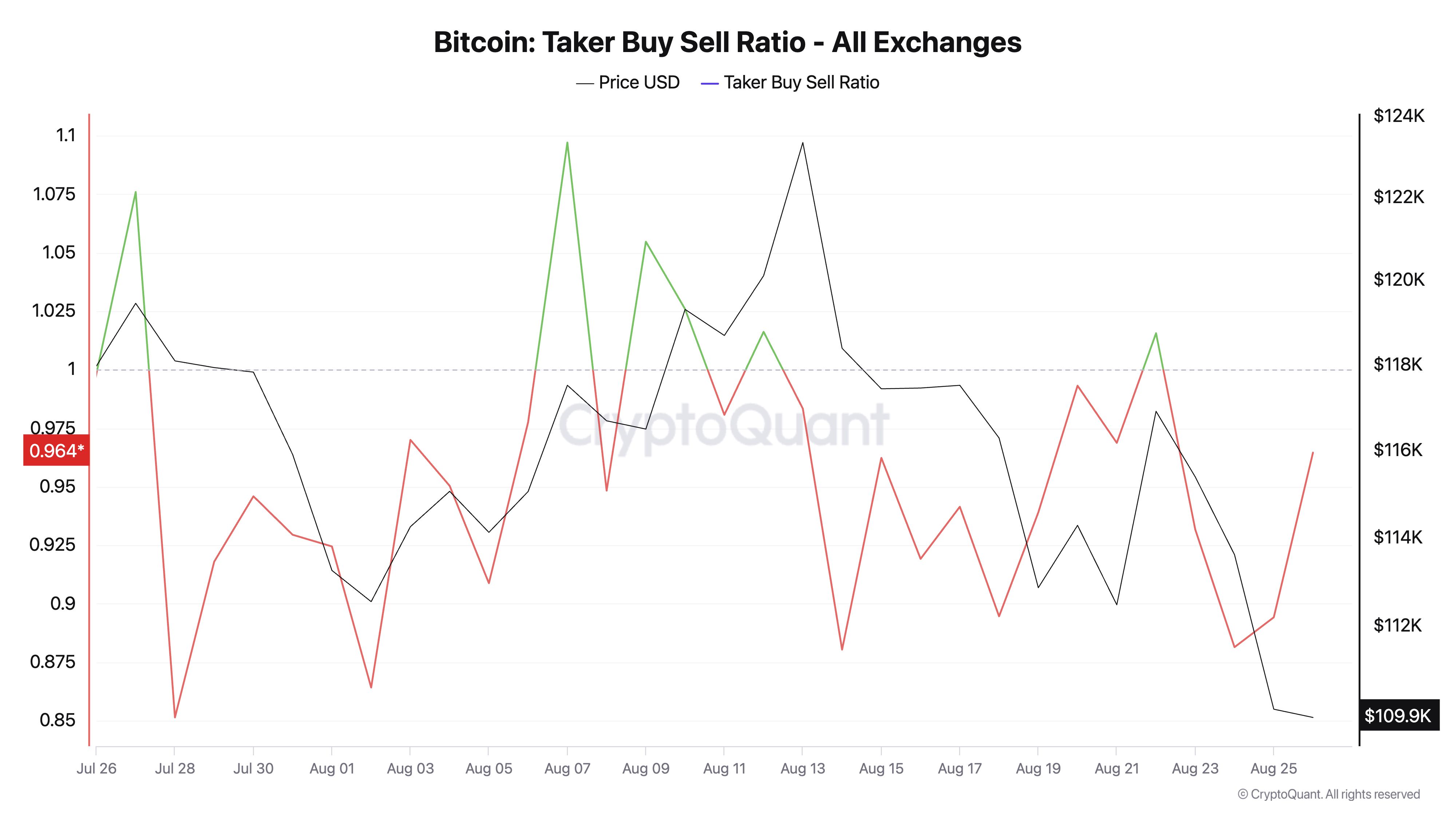

One of the most telling signs is BTC’s Taker-Buy Sell Ratio, which has been predominantly negative since July. At press time, it stands at 0.96 per CryptoQuant, indicating that sell orders dominate buy orders across the coin’s futures market.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

BTC Taker Buy Sell Ratio. Source:

CryptoQuant

BTC Taker Buy Sell Ratio. Source:

CryptoQuant

An asset’s taker buy-sell ratio measures the ratio between the buy and sell volumes in its futures market. Values above one indicate more buy than sell volume, while values below one suggest that more futures traders are selling their holdings.

For BTC, this trend indicates that its futures traders are pulling back from aggressive bullish bets, adding to the pressure already weighing on the market. It shows a lack of conviction among derivatives traders that the king coin could see a notable near-term recovery.

Bitcoin Spot Traders Turn Sellers

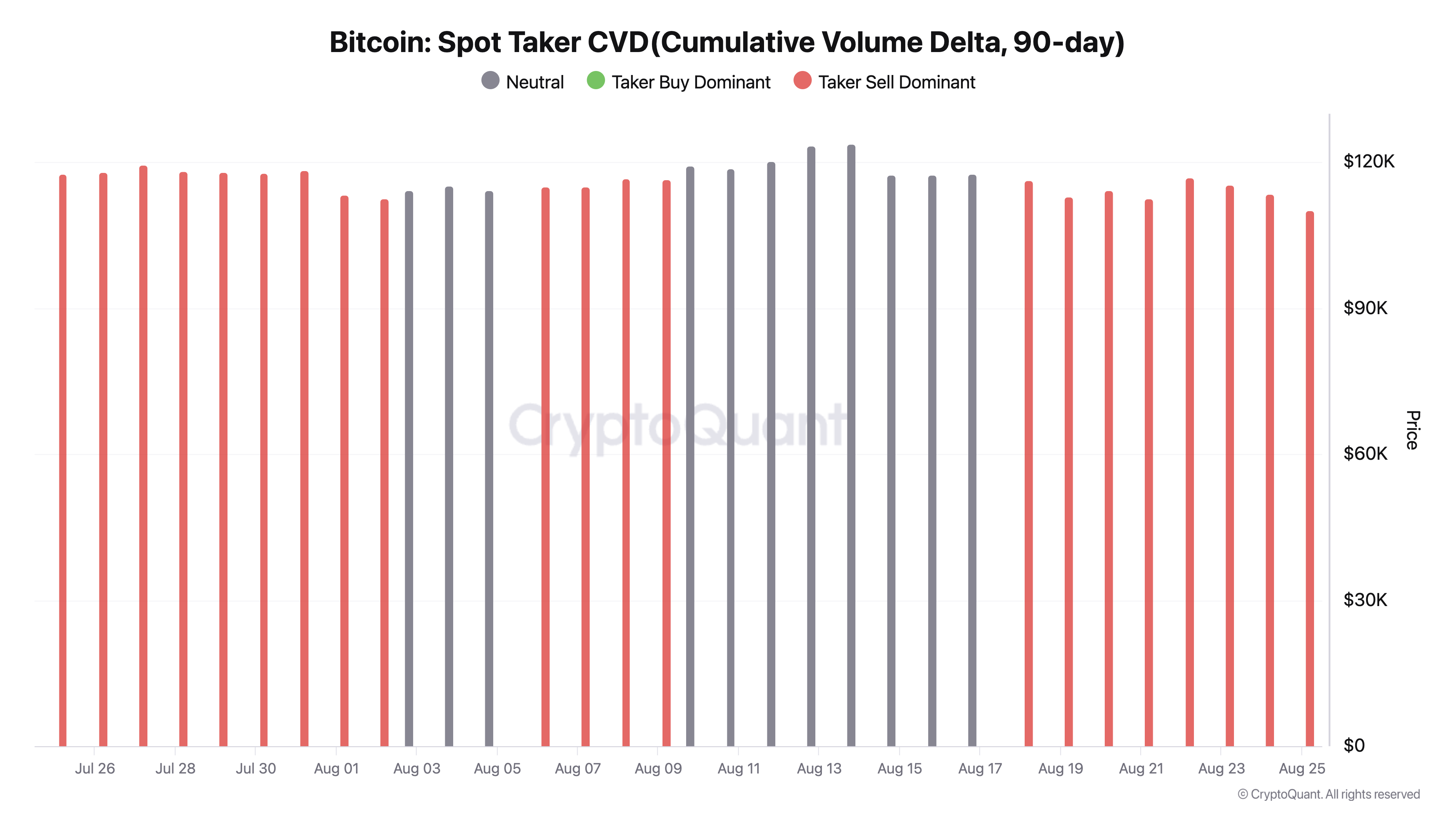

The trend is no different among spot market participants. Per CryptoQuant’s data, Bitcoin’s Spot Taker CVD (Cumulative Volume Delta, 90-day), which tracks net buying and selling activity in the spot market over a 90-day period, flipped from “neutral” on August 18.

Since then, it has consistently posted red bars, signaling that sellers are dominating spot market activity.

BTC Spot CVD. Source:

CryptoQuant

BTC Spot CVD. Source:

CryptoQuant

This shift into a taker-sell dominant phase for BTC reflects fading demand and weaker buy-side absorption of increasing supply. With spot traders increasingly offloading rather than accumulating, the imbalance heightens the risk of further downside.

$110,000 Support Under Siege Amid Fading Demand

As demand thins across both spot and futures markets, leading coin BTC risks plunging below $110,000. In this scenario, the coin’s price could fall to $107,557, its next major support level.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

However, if buyers regain dominance and drive a rally, they could drive BTC’s price to $111,961. A breach of this wall could trigger a move to $115 892.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cold Wallet's $6.8M Raise: A Paradigm Shift in Payment Crypto Adoption

- Cold Wallet raises $6.8M in presale, surpassing Litecoin and Dogecoin in utility and institutional appeal. - Its cashback rewards system incentivizes on-chain activity, creating a flywheel effect with tokenomics capping supply at 10B. - Security audits and Plus Wallet acquisition boost institutional credibility, contrasting with Litecoin/Dogecoin's lack of infrastructure. - Strategic tokenomics lock 90% presale tokens for three months, aligning incentives vs. infinite/limited supplies of Dogecoin/Litecoi

South Korean Lawmakers' Crypto Holdings Signal Institutional Confidence in Digital Assets

- South Korean lawmakers increasingly hold Bitcoin, XRP, and meme coins, signaling institutional confidence in crypto as personal investments influence policy. - 2025 regulatory reforms include leverage caps, stablecoin capital requirements, and alignment with EU MiCA to balance innovation and stability. - FSC plans KRW-backed stablecoins and Bitcoin ETFs by late 2025, aiming to attract institutional capital and reduce reliance on offshore tokens. - Risks persist from regulatory delays, fragmented infrastr

Critical Price Levels and Market Sentiment in XRP, Bitcoin, and Ethereum: A Pathway to Strategic Entry or Exit

- XRP forms a symmetrical triangle near $3.00, with $25M daily institutional flows supporting potential breakout above $3.04 or retest of $2.89 support. - Bitcoin shows bullish EMA divergence and Fed-driven macro tailwinds, but faces critical resistance at $123,000 and risk of bearish pressure below $110,000. - Ethereum exhibits mixed signals: long-term bullish EMAs contrast with bearish MACD and RSI below 50, requiring $4,676 breakout confirmation for renewed upward momentum. - Strategic implications emph

Kanye West Memecoin YZY Causes 74% of Investors to Lose Millions