ETHZilla approves $250m stock buyback, reveals $489M in Ethereum holdings

New Ethereum treasury firm ETHZilla hopes to boost its share price with a major stock buyback.

- ETHZilla announced a $250M stock buyback to boost its share price

- Firm holds 102,237 ETH, worth about $489 million

- The company has $215 million in cash holdings

More firms are publicly embracing the crypto treasury strategy. On Monday, August 25, the recently rebranded ETHZilla approved a $250 million stock buyback in an effort to strengthen its share price. In addition, the firm revealed it has total holdings of 102,237 ETH, valued at about $489 million.

ETHZilla will repurchase stock until buying up to a maximum of $250 million, scheduled to be completed by June 30, 2026. The company will acquire shares either on the open market or through deals with institutional investors at market rates.

The company should not face issues funding these repurchases. In the same press release, ETHZilla disclosed it currently holds approximately $215 million in cash equivalents.

Why ETHZilla is repurchasing stocks

The move to repurchase the company’s stock does two things. It puts pressure on its stock price, as well as increasing the ETH per share metric for the firm. Both of these will likely help boost the company’s share price.

“At ETHZilla, we continue to deploy capital to accelerate our Ethereum treasury strategy with discipline and record speed,” said McAndrew Rudisill, Executive Chairman of the Company. “As we continue to scale our ETH reserves and pursue differentiated yield opportunities, we believe an aggressive stock repurchase program at the current stock price underscores our commitment to maximizing value for shareholders.”

Formerly 180 Life Sciences, the company completed a rebrand to ETHZilla on August 18 to pursue an Ethereum treasury strategy and an acquisition of $419 million in ETH. Almost immediately, the shift paid off, with its stock advancing as much as 70% following the announcement.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

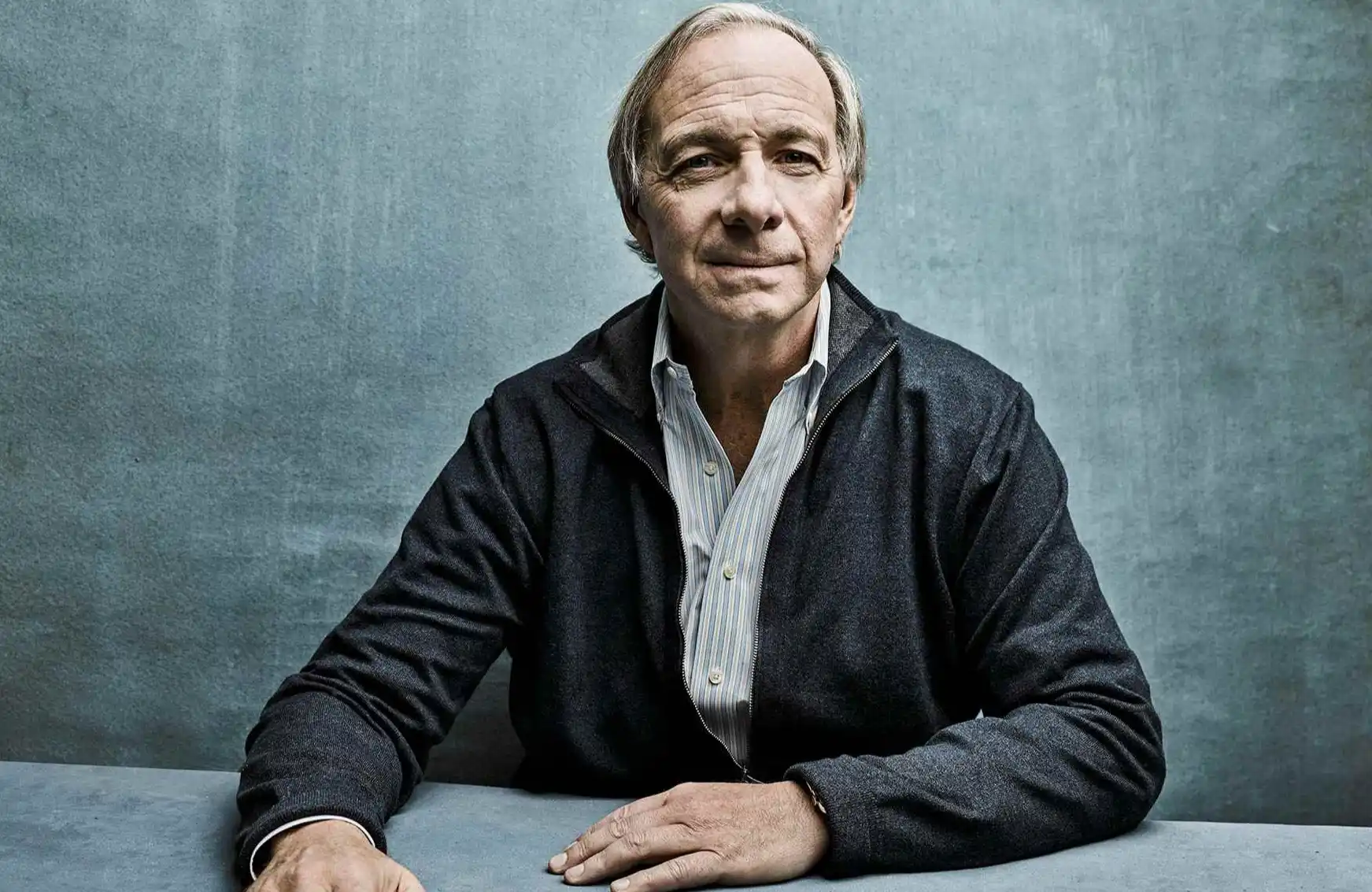

Conversation with Ray Dalio: From Asset Allocation to Wealth Inheritance, 10 Financial Principles for Chinese Friends

In the long run, cash is a very poor investment.

What exactly is the Ethereum meme that even Tom Lee is paying attention to?

Will there be a meme trend based on the Tom Lee concept?

[Long English Thread] Ethereum's New Journey: Towards 10,000 TPS and the Ultimate Vision of "ZK Everything"