Written by: San, Deep Tide TechFlow

On the evening of the 25th, AAVE founder Stani's post announcing the imminent launch of AAVE V4 quickly attracted a lot of attention and discussion. Meanwhile, the recent controversy between AAVE and WLFI regarding the 7% token allocation proposal has also been making waves in the market.

For a time, the market's focus converged on AAVE, this veteran lending protocol.

Although the dispute between AAVE and WLFI has not yet reached a final conclusion, behind this "farce" a different picture seems to emerge—"New tokens come and go, but AAVE stands firm."

With the emergence of more and more new tokens and the stimulation of on-chain fixed token lending demand, AAVE undoubtedly has a solid fundamental and catalyst.

This V4 update may allow us to see clearly AAVE's strong future competitiveness in the DeFi sector, as well as the root cause of its continuously rising business volume.

From Lending Protocol toDeFi Infrastructure

When we discuss AAVE V4, we first need to understand a key question: why is the market looking forward to this upgrade?

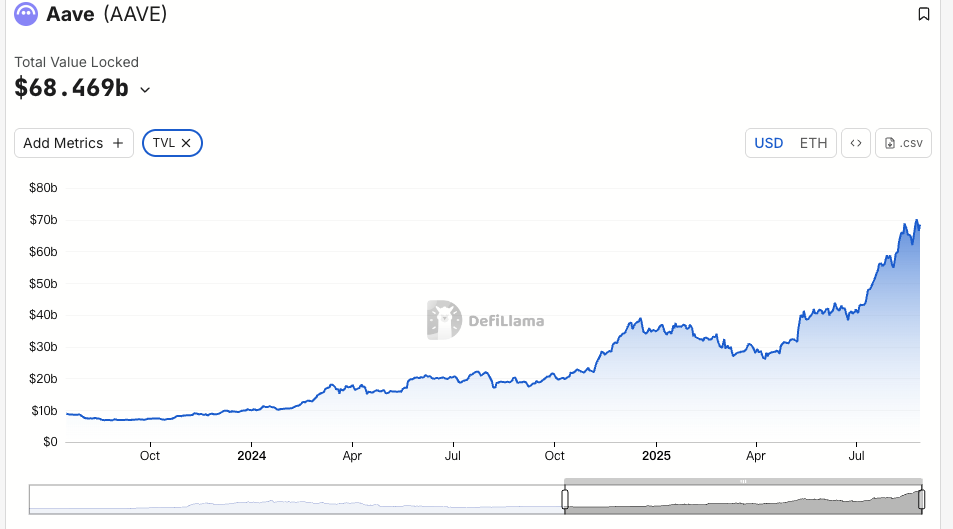

From 2017's ETHLend to today's DeFi giant with $38.6 billions in TVL, as a veteran protocol, every version update of AAVE has actually been an optimization, and has been able to impact on-chain asset liquidity and gameplay to varying degrees.

The history of AAVE versions is essentially the evolution history of DeFi lending.

At the beginning of 2020, when V1 was launched, the total value locked in DeFi was less than $1 billion. AAVE replaced the P2P model with liquidity pools, turning lending from "waiting for matching" into "instant transactions." This change helped AAVE quickly gain market share.

V2 was launched at the end of 2020, with core innovations such as flash loans and debt tokenization. Flash loans gave rise to arbitrage and liquidation ecosystems, becoming an important source of protocol revenue. Debt tokenization allowed positions to be transferred, paving the way for subsequent yield aggregators. In 2022, V3 focused on cross-chain interoperability, allowing more on-chain assets to enter AAVE and becoming a connector for multi-chain liquidity.

More importantly, AAVE has become a pricing benchmark. When designing interest rates, DeFi protocols refer to AAVE's supply and demand curve. New projects also benchmark AAVE's parameters when choosing collateral ratios.

However, despite being infrastructure, the limitations of the V3 architecture are becoming increasingly apparent.

The biggest problem is liquidity fragmentation. Currently, AAVE has $60 billions in TVL on Ethereum, only $4.4 billions on Arbitrum, and even less on Base. Each chain is an independent kingdom, and funds cannot flow efficiently. This not only reduces capital efficiency but also limits the development of smaller chains.

The second problem is the bottleneck of innovation. Any new feature needs to go through a complete governance process, from proposal to implementation often taking months. In the fast-iterating DeFi environment, this speed clearly cannot keep up with market demand.

The third problem is the inability to meet customization needs. RWA projects require KYC, GameFi needs NFT collateral, and institutions need isolated pools. But the unified architecture of V3 makes it difficult to meet these differentiated needs. Either support all, or support none—there is no middle ground.

This is the core problem that V4 aims to solve: how to transform AAVE from a powerful but rigid product into a flexible and open platform.

V4 Upgrade

According to publicly available information, the core improvement direction of V4 is the introduction of a "Unified Liquidity Layer," adopting a Hub-Spoke model to change the existing technical design and even business model.

Image source: @Eli5DeFi

Hub-Spoke: Solving the Dilemma of Wanting Both

Simply put, the Hub aggregates all liquidity, while Spokes are responsible for specific businesses. Users always interact through Spokes, and each Spoke can have its own rules and risk parameters.

What does this mean? It means AAVE no longer needs to use one set of rules to serve everyone, but can let different Spokes serve different needs.

For example, Frax Finance can create a dedicated Spoke that only accepts frxETH and FRAX as collateral and sets more aggressive parameters; meanwhile, an "institutional Spoke" may only accept BTC and ETH, require KYC, but offer lower interest rates.

The two Spokes share the same Hub liquidity but are isolated in terms of risk.

The subtlety of this architecture lies in its ability to solve the dilemma of "wanting both." Deep liquidity and risk isolation; unified management and flexible customization. In the past, these were contradictory within AAVE, but the Hub-Spoke model allows them to coexist.

Dynamic Risk Premium Mechanism

In addition to the Hub-Spoke architecture, V4 also introduces a dynamic risk premium mechanism, revolutionizing the way lending rates are set.

Unlike V3's unified interest rate model, V4 dynamically adjusts rates based on collateral quality and market liquidity. For example, highly liquid assets like WETH enjoy base rates, while more volatile assets like LINK must pay an additional premium. This mechanism is automatically executed by smart contracts, not only enhancing protocol security but also making borrowing costs fairer.

Smart Accounts

V4's smart account feature makes user operations more efficient. Previously, users needed to switch wallets between different chains or markets, making complex position management time-consuming and laborious. Now, smart accounts allow users to manage multi-chain assets and lending strategies through a single wallet, reducing operational steps.

A user can adjust WETH collateral on Ethereum and borrow on Aptos within the same interface, without manually transferring across chains. This simplified experience allows both small users and professional traders to participate in DeFi more easily.

Cross-chain and RWA: Expanding the Boundaries of DeFi

V4 achieves second-level cross-chain interaction through Chainlink CCIP, supporting non-EVM chains like Aptos, allowing more assets to seamlessly access AAVE. For example, a user can use assets on Polygon as collateral and borrow on Arbitrum, all completed in a single transaction. In addition, V4 integrates real-world assets (RWA), such as tokenized government bonds, opening new paths for institutional funds to enter DeFi. This not only expands AAVE's asset coverage but also makes the lending market more inclusive.

Market Response

Although AAVE experienced a sharp drop along with the overall crypto market this week, its rebound today was significantly stronger than other leading DeFi assets.

After the crypto market crash this week, AAVE's token saw a 24-hour trading volume of $18.72 million, far higher than Uni's $7.2 million and Ldo's $3.65 million, reflecting investors' positive response to protocol innovation, and the increased trading activity further enhanced liquidity.

TVL more intuitively reflects the market's recognition. Compared to early August, AAVE's TVL surged by 19% this month to a record high of nearly $70 billions, currently ranking first in TVL on the ETH chain. This growth far exceeds the DeFi market average, and the increase in TVL also validates the effectiveness of AAVE V4's multi-asset support strategy, perhaps hinting that institutional funds have quietly entered.

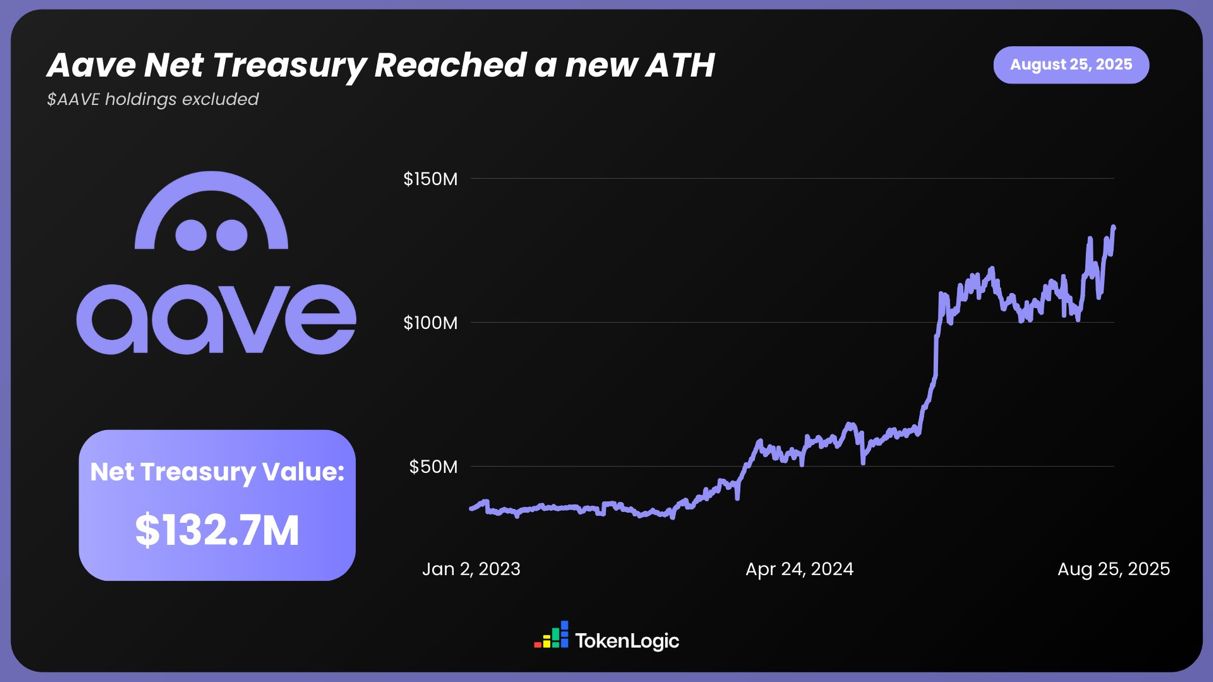

According to TokenLogic data, AAVE's net assets have reached a new high of $132.7 million (excluding AAVE token holdings), growing about 130% over the past year.

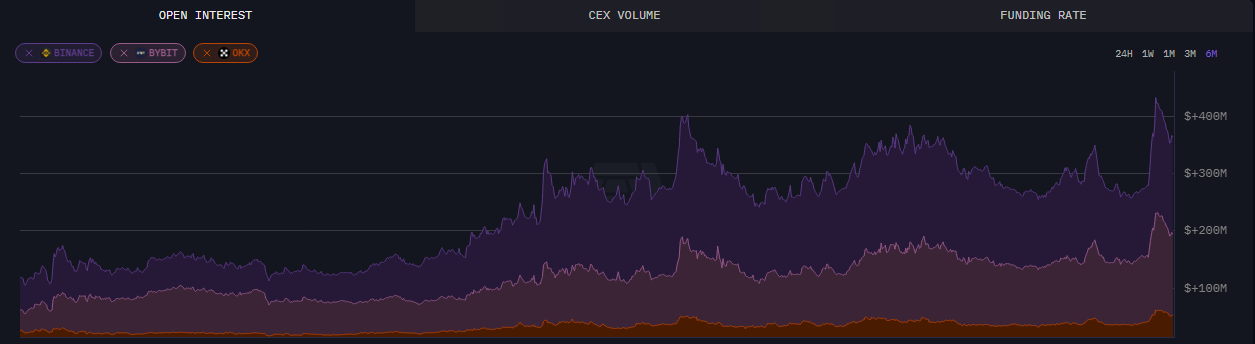

On-chain data shows that as of August 24, AAVE's open interest exceeded $430 million, hitting a new six-month high.

In addition to the intuitive data, this AAVE upgrade has also sparked widespread discussion in the community. The pre-released information about V4 has received a lot of support and recognition, especially in terms of capital utilization and composable DeFi, showing the market more possibilities and potential.

Make DeFi great again

Based on the disclosed update content, this AAVE upgrade is very likely to lead the DeFi market to a new level. The highlights of modular architecture, cross-chain expansion, and RWA integration have not only ignited market enthusiasm but also driven the rise in price and TVL.

Its founder Stani also seems very confident about the impact of the V4 upgrade on the DeFi sector.

Perhaps in the near future, AAVE will ride the "eastern wind" of liquidity brought by the crypto bull market and soar to new heights, opening up infinite possibilities.