Undervalued Altcoins with Explosive ROI Potential in 2025: Contrarian Crypto Strategies in a Maturing Bull Cycle

- 2025 crypto market shifts as contrarians target undervalued L1 blockchains (Cardano, Polkadot) and AI-driven DeFi projects amid AI speculation peaks. - Cardano's $0.35 price (~$1.50 potential) and Polkadot's $3.83 valuation ($15 2027 target) reflect institutional inflows and technical upgrades. - MAGACOIN FINANCE ($12.8M raised) and Unilabs Finance ($30M AUM) offer asymmetric upside through presale traction and AI-powered DeFi tools. - Contrarian strategies emphasize DCA into infrastructure projects whil

The 2025 crypto market is at a pivotal inflection point . As the AI-driven speculative frenzy peaks and institutional capital begins to reallocate, contrarian investors are turning to undervalued layer-1 (L1) blockchains and early-stage AI-driven projects. These assets, often overlooked in the rush for AI-native tokens, offer asymmetric risk-reward setups that align with the maturing bull cycle. Cardano (ADA), Polkadot (DOT), and emerging projects like MAGACOIN FINANCE, alongside AI-driven DeFi platforms such as Unilabs Finance, represent compelling opportunities for those willing to bet against the crowd.

Cardano (ADA): Technical Upgrades and Institutional Inflows

Cardano's 2025 roadmap has been nothing short of transformative. The Plomin hard fork and Hydra scaling solutions have elevated ADA's throughput to 1,000+ transactions per second, positioning it as a viable infrastructure for AI-powered decentralized applications (dApps). Projects like SunContract, which leverages Cardano's energy-efficient proof-of-stake mechanism for AI-driven energy trading, underscore its real-world utility.

Institutional adoption is another tailwind. Over $73 million in inflows in 2025 alone, coupled with Polymarket's 81% probability of a U.S. spot ETF approval, has bolstered ADA's institutional appeal. Technical indicators suggest ADA could retest $1.00 and potentially surge to $1.50 by year-end. For contrarians, the key is timing: ADA's current price (~$0.35) trades at a discount to its fundamentals, making it a high-conviction play for those betting on infrastructure-driven value.

Polkadot (DOT): Cross-Chain Infrastructure and Elastic Scaling

Polkadot's undervaluation is striking. At $3.83 in 2025, DOT trades far below its 2021 all-time high of $55, despite foundational upgrades like Polkadot 2.0's elastic scaling. This innovation allows the network to dynamically adjust to demand, making it a critical player in the decentralized AI ecosystem.

The return of co-founder Gavin Wood to a leadership role has further solidified investor confidence. Machine learning models project DOT could reach $7.17 by year-end and $15 by 2027 as its parachain technology matures. While short-term volatility persists, the long-term narrative is robust: DOT's cross-chain interoperability positions it to capture value as blockchain adoption accelerates.

MAGACOIN FINANCE (MAGA): Market Traction and Whale-Driven Liquidity

MAGACOIN FINANCE has emerged as a speculative moonshot in 2025. By August 2025, the project had raised significant funding, with a 420% month-over-month growth rate. Whale activity, including a $132,000 ETH deposit in July 2025, signals institutional-grade confidence.

The deflationary model—burning 12% of tokens during transactions—has reduced the circulating supply to 88 billion by Q3 2025. Analysts project strong returns by Q4 2025, driven by anticipated listings on major exchanges.

Unilabs Finance (UNIL): AI-Driven DeFi and Asymmetric Upside

Unilabs Finance represents the next frontier in DeFi. By integrating AI into portfolio management and asset allocation, the platform offers institutional-grade tools to retail investors. With a 122% staking APY and a 30% fee redistribution model, UNIL's tokenomics are designed to incentivize long-term participation.

The project has raised $13.5 million in early-stage funding and managed $30 million in assets under management (AUM). Analysts project a 2,200% gain by 2026, assuming successful execution of its AI-driven roadmap. Unlike traditional altcoins, UNIL's utility is tied to real-world applications, making it a high-conviction satellite play in the DeFi space.

Contrarian Strategies: Timing, Technical Upgrades, and Macro Rotation

The key to capitalizing on these opportunities lies in timing and risk management. Dollar-cost averaging (DCA) into ADA and DOT balances exposure. For AI-driven projects like UNIL, early entry maximizes upside potential.

Macro-driven capital rotation is also critical. As Bitcoin dominance plateaus, capital is shifting toward AI tokens and DeFi 2.0 protocols. Projects with verifiable traction, like Launchcoin (35x return in 2025), exemplify this trend. Traditional altcoins, meanwhile, remain underperforming due to fragmented market attention and liquidity bottlenecks.

Conclusion: Positioning for the Next Bull Cycle

In a maturing bull cycle, undervalued L1s and AI-driven projects offer asymmetric risk-reward setups. Cardano and Polkadot's technical upgrades, MAGACOIN FINANCE's whale-driven liquidity, and Unilabs Finance's AI utility all align with macro trends. For contrarians, the window to capture explosive ROI is narrowing.

Investors should adopt a barbell strategy: anchor portfolios in foundational infrastructure (e.g., Ethereum) while allocating to high-conviction plays. As the market shifts from speculative exuberance to selective optimism, those who bet against the crowd now may reap the rewards of the next bull run.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Price Prediction: Can SOL Break $215 and Surge Toward $300?

Bitcoin Price Back Above $112K As Positive BTC NEWS Hits

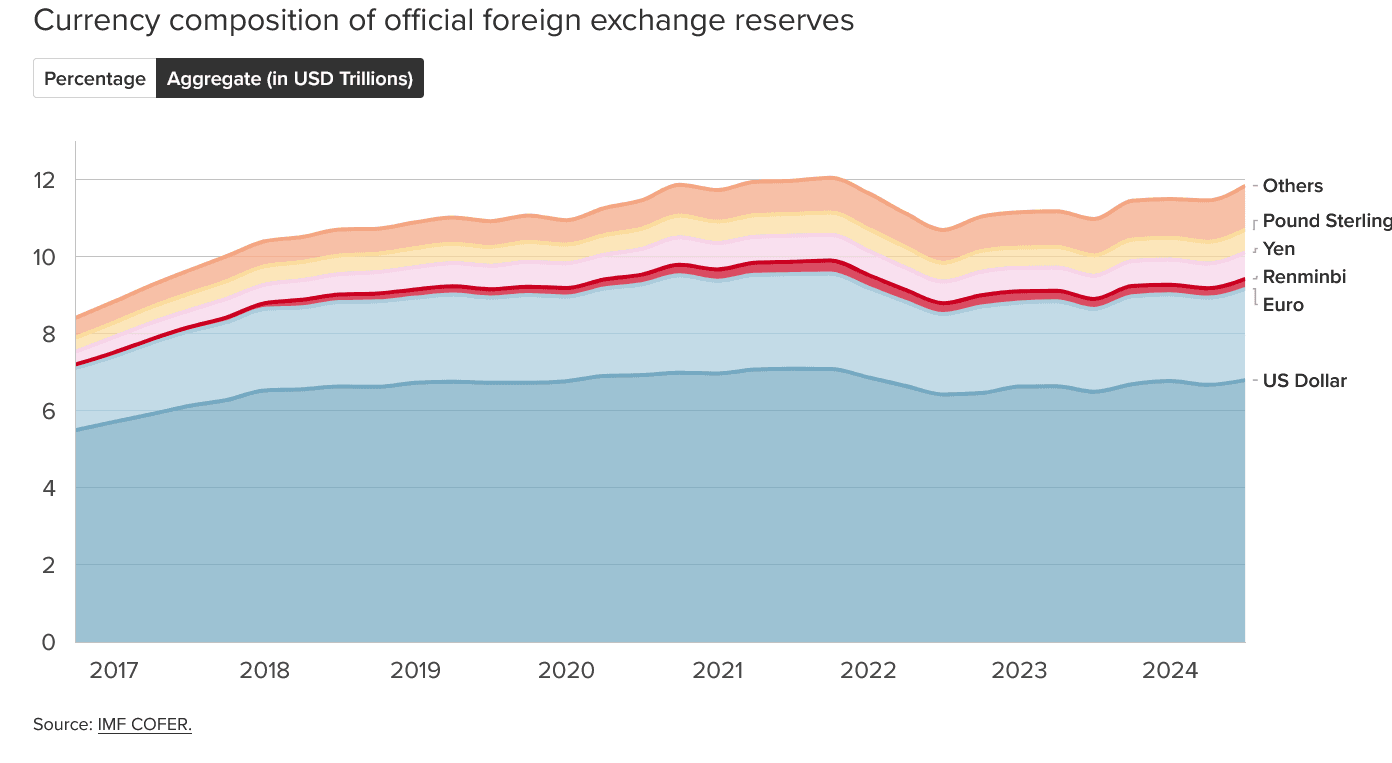

Crypto News: Dollar Weaponization Is Fueling the Next Crypto Boom?

The 2 Most Undervalued Altcoins Poised for Explosive Growth in Q4 2025

- Q3 2025 altcoin market shows optimism with institutional support and on-chain signals, highlighting Maxi Doge (MAXI) and HYPER as undervalued projects with disruptive potential. - Maxi Doge, an Ethereum-based meme coin with 1,000x leverage trading and 383% APY, raised $1.63M in presale, projecting 12.9x price growth by Q4 2025. - HYPER, a Bitcoin Layer 2 solution using ZK-rollups and SVM, aims to boost scalability and enable a $223B Bitcoin-native DeFi ecosystem, with $12.3M raised and 100x gain projecti