Metaplanet announced a new fundraising plan, hoping to extend its BTC purchases in September and October. The company aims for nearly $900M to be raised on international stock markets.

Metaplanet announced plans to raise funds on international stock markets, to extend the BTC purchase program through September and October. The company’s board announced it would issue a new international offering of shares, planning to raise around $881M.

The fundraising will happen on international markets outside Japan, with US-based selling restricted to accredited investors. The pricing of the offering is expected between September 9 and September 11. The entire international offering is expected to add 555M shares to the Japanese firm’s balance.

As a result, Metaplanet will carry over 1.2B shares to its balance, a significant increase following the smaller raises from previous sales.

The new international offering follows the suspension of the exercise of Stock Acquisition Rights by the Evo Fund, one of the main MTPLF buyers.

The new fundraising wave follows Metaplanet’s recent BTC purchase , with another 775 coins added to the treasury as of August 18, and another 103 BTC on August 25. It now holds BTC at an average price of $102,712 after the latest treasury additions.

Metaplanet may slow down communications around its fundraising

CEO Simon Gerovich announced the company’s fundraising efforts may be constrained due to international market conditions and requirements. The company will not offer additional information on its offering and its progress until the raise is completed.

To date, the company owns 18,991 BTC, nearly double its target for 2025. Metaplanet managed to buy BTC weekly, based on strong demand for its shares on the domestic market.

MTPLF shares are now spread across 128K shareholders as of July 2025, while Metaplanet aims to offer a balanced ratio of debt and assets, as well as a strong relationship with its supporters.

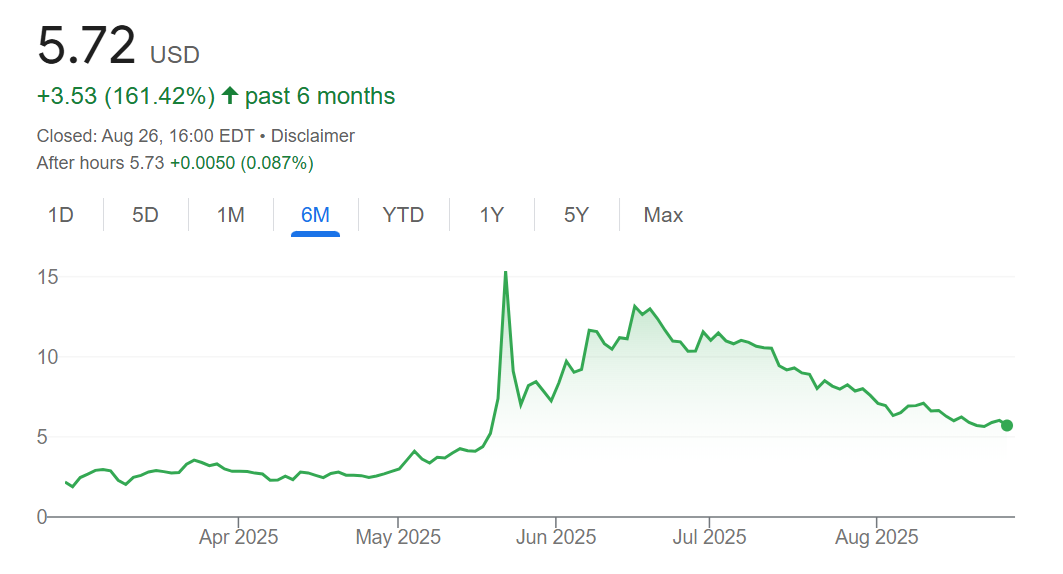

MTPLF is slowly deflating, though Metaplanet aims to extend its BTC purchases into September and October. | Source: Google Finance

MTPLF is slowly deflating, though Metaplanet aims to extend its BTC purchases into September and October. | Source: Google Finance

MTPLF shares still took a step back in the past month, trading down to $5.72. Despite regular purchases, MTPLF has been deflating slowly since June, as BTC peaked at $124,000. Metaplanet still shows long-term confidence in BTC, declaring its intention to buy based on international buying interest.

Treasury firms buys more cautiously

Metaplanet has exited the stage where its shares climbed relentlessly, allowing for rapid, large-scale purchases. The latest buying periods show a slower acquisition pace.

Metaplanet is now closely watched for eventually “buying the dip” during short-term BTC downturns. In a bull market scenario, the firm may continue to buy BTC, even at a slower pace, retaining its position as one of the top BTC holders.

In recent weeks, Metaplanet and Strategy have been the only big-time buyers, with other minor acquisitions from smaller companies. Despite the slower pace of buying, smaller companies are still raising the bar on BTC ownership.

Within days, the bar for entering the top 100 of treasury holders has gone from 40 BTC to 50 BTC, with Mogo, Inc. making the cut-off at position 100.

Treasury companies are still not creating a supply crunch, but they still absorb BTC even without complex fundraising programs.