Bitcoin News Today: GOAT Network Stakes 34 BTC to Fuel Bitcoin’s Future

- GOAT Network allocates 34 BTC to its Pilot Fund, the first Bitcoin Layer-2 project to use native BTC for ecosystem growth. - Over 2 BTC has been deployed, with Artemis Finance offering 7%+ BTC yield via a dual-reward mechanism. - The fund’s strategy emphasizes infrastructure over short-term gains, aligning with Bitcoin’s core principles. - Partners like Avalon Finance praise the approach, as the network aims to expand partnerships and yield products.

GOAT Network, a Bitcoin (BTC/USD)-native zero-knowledge (zk) Rollup, has announced the allocation of 34 BTC to a newly established Pilot Fund aimed at enhancing liquidity incentives and fostering community growth within its ecosystem. This marks the first instance in which a Bitcoin Layer-2 project has committed a native BTC treasury to support its ecosystem development. The fund, accumulated over the past year, will be used to distribute rewards to users, provide liquidity to pools, and incentivize developers and contributors to the GOAT Network platform [1].

To date, over 2 BTC has already been deployed from the Pilot Fund, with allocations going toward user rewards and liquidity pools. The Artemis Finance protocol, built on the GOAT Network infrastructure, is currently offering an annual percentage rate (APR) of over 7% in BTC yield, with a combined total APR of 87% when including additional incentives. This dual-reward mechanism allows users to stake Bitcoin and earn yield while also earning points eligible for future airdrops. The deployment of actual Bitcoin as a reward mechanism aligns with the broader ethos of the Bitcoin community, which emphasizes the use of native assets rather than inflationary tokens [1].

The Pilot Fund is positioned as the first phase of GOAT Network's broader treasury strategy. The company has outlined plans for a larger Ecosystem Development Fund set to launch in Q4 2025, which will provide additional support through grants, milestone-based funding, and long-term builder incentives. This approach reflects a commitment to infrastructure development over short-term gains, a strategy that aligns with the network’s vision of building a sustainable and scalable Bitcoin ecosystem [1].

In terms of adoption metrics, the GOAT Network has recorded 51,000 daily transactions, placing it among the top-performing Bitcoin Layer-2 solutions in terms of volume. This growth has been supported by liquidity programs, community engagement initiatives, and the recent launch of the BitVM2 Beta Testnet, which introduced sub-three-second real-time proving across five provers. These technical advancements enhance the network’s scalability and efficiency, making it more attractive to developers and users alike [1].

The deployment of a Bitcoin-based treasury underscores a strategic shift in how Bitcoin Layer-2 networks approach incentive structures. Unlike traditional blockchain ecosystems that rely on the issuance of inflationary tokens to reward liquidity providers and developers, GOAT Network is using actual Bitcoin to generate yield. This not only provides a more sustainable reward mechanism but also ensures that the incentives are directly aligned with the value of Bitcoin itself [1].

The broader ecosystem has responded positively to the initiative. Avalon Finance, an ecosystem partner, praised the approach as a new standard for how Bitcoin-based networks can support builders and communities while maintaining alignment with the core principles of the Bitcoin network. Kevin Liu, a core contributor to GOAT Network, described the treasury commitment as a “war chest” for ecosystem growth, emphasizing the long-term vision of infrastructure-first development rather than short-term hype [1].

Going forward, GOAT Network expects to accelerate growth through expanded ecosystem partnerships, the development of new Bitcoin-native yield products, and the full implementation of BitVM-based security features. With the Pilot Fund now active, the network is positioning itself as a key player in the evolving Bitcoin Layer-2 landscape, leveraging real Bitcoin value to drive liquidity, developer engagement, and long-term network sustainability [1].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decentralized Governance and the Rise of Bitcoin Treasuries: A New Paradigm for Institutional Investors

- Institutional investors increasingly adopt Bitcoin as strategic asset via decentralized governance models, mirroring industrial firms' operational agility. - Decentralized BTC-TCs empower mid-level managers for real-time decisions, using metrics like mNAV and leverage ratios to align with long-term goals. - Regulatory clarity (CLARITY Act, spot ETFs) and innovation (stablecoins, lending) normalize Bitcoin as diversification tool alongside traditional assets. - Investors prioritize transparent governance

NMR +253.64% in 24 Hours Amid Strong Momentum

- NMR surged 253.64% in 24 hours to $13.36, with 14,666.67% and 15,324.83% gains over the past week and month. - On-chain data shows reduced small-holdings and <10% circulating supply, reinforcing scarcity and upward pressure. - Technical indicators confirm key resistance breaks and strong momentum, with RSI in overbought territory but no bearish divergences. - A backtesting strategy using momentum and volume could capture NMR’s recent rally, aligning with its bullish on-chain and technical signals.

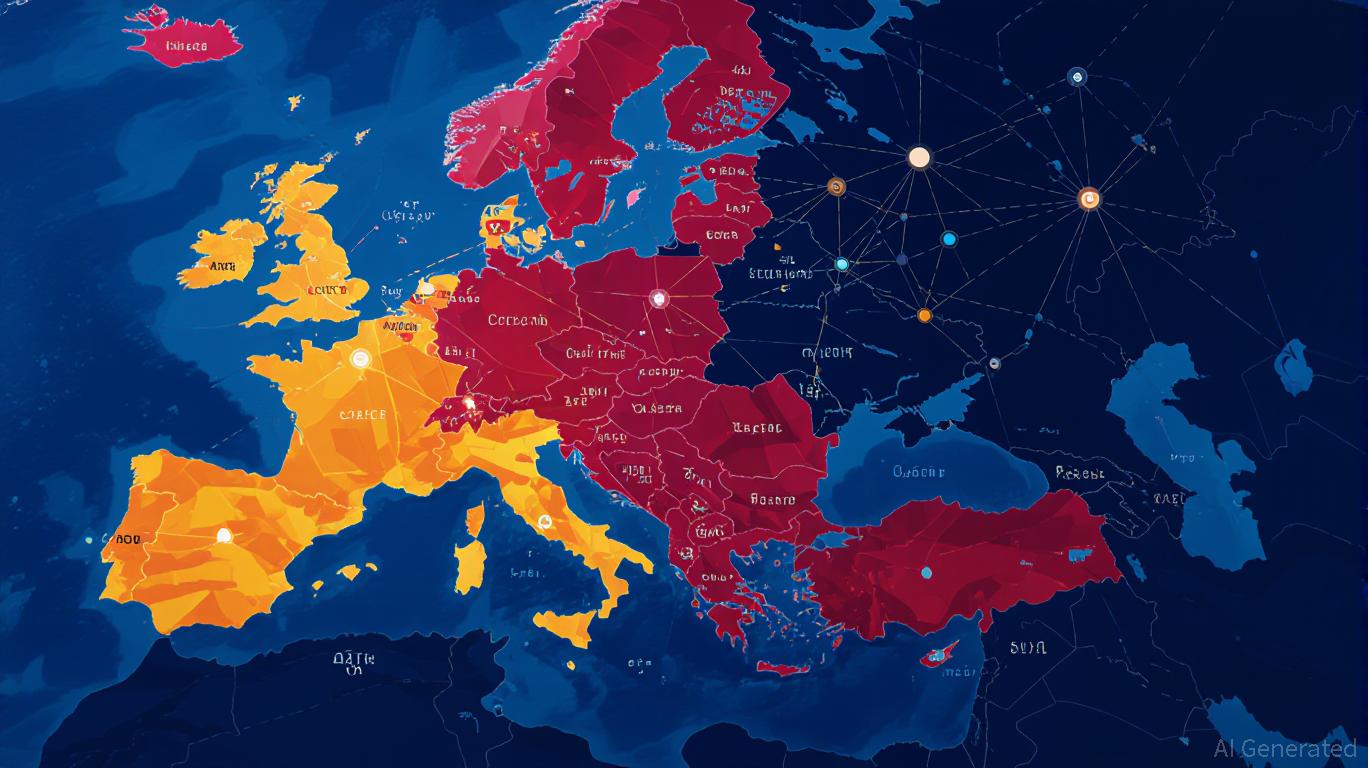

Navigating the Shifting Crypto Media Landscape in Eastern Europe: Strategic Opportunities Amid Traffic Declines

- Eastern European crypto media saw 18.3% Q2 2025 traffic decline, with 17 outlets capturing 80.71% of regional traffic amid regulatory and algorithmic shifts. - Tier-3 platforms (10,000–99,999 visits) retained 17.33% traffic through localized relevance and AI-optimized content in markets like Poland and Czech Republic. - AI-driven discovery tools and regional partnerships (e.g., Kriptoworld.hu) are reshaping distribution, with 20.6% of outlets reporting traffic from platforms like Perplexity. - Investors

Is This the Final Dip Before Altseason?

- Crypto market signals suggest altcoins may outperform Bitcoin amid waning dominance and bullish technical indicators. - Ethereum's 54% August surge and rising ETH/BTC ratio historically precede altcoin growth cycles. - Dovish Fed policy and $3B Ethereum ETF inflows create favorable conditions for altcoin capital rotation. - Institutional confidence in Bitcoin indirectly supports altcoin momentum through liquidity and risk-on appetite. - Strategic entry points for high-conviction investors include Ethereu