Aave Bets on RWA: Will Horizon Be the Next Growth Engine?

After resolving disputes, Aave Labs has launched the Ethereum RWA market, Horizon.

After resolving disputes, Aave Labs has launched the Ethereum RWA market Horizon.

Written by: ChandlerZ, Foresight News

On August 28, Aave Labs officially announced the launch of the Ethereum RWA market Horizon. Institutions and qualified users can borrow stablecoins by collateralizing RWAs, supporting collateral from Circle, Superstate, and Centrifuge. Partner institutions include Ant Digital Technologies, Chainlink, Ethena, KAIO, OpenEden, Ripple, Securitize, VanEck, and WisdomTree.

The proposal for this project was first put forward in March. The company stated that it hopes to create new revenue streams for Aave DAO and enhance the utility of GHO in DeFi.

However, the proposal page also shows that if a new token is created, Aave DAO may receive a 15% allocation and revenue-sharing arrangement. Many opposing users believe that a new token could dilute the value of the existing AAVE token and undermine AAVE’s status as the sole governance and utility token. After heated discussions, Aave founder Stani Kulechov ultimately stated that no new token would be created for the Horizon product proposed by Aave.

What is Horizon? Can it bring new growth to Aave?

What is Horizon?

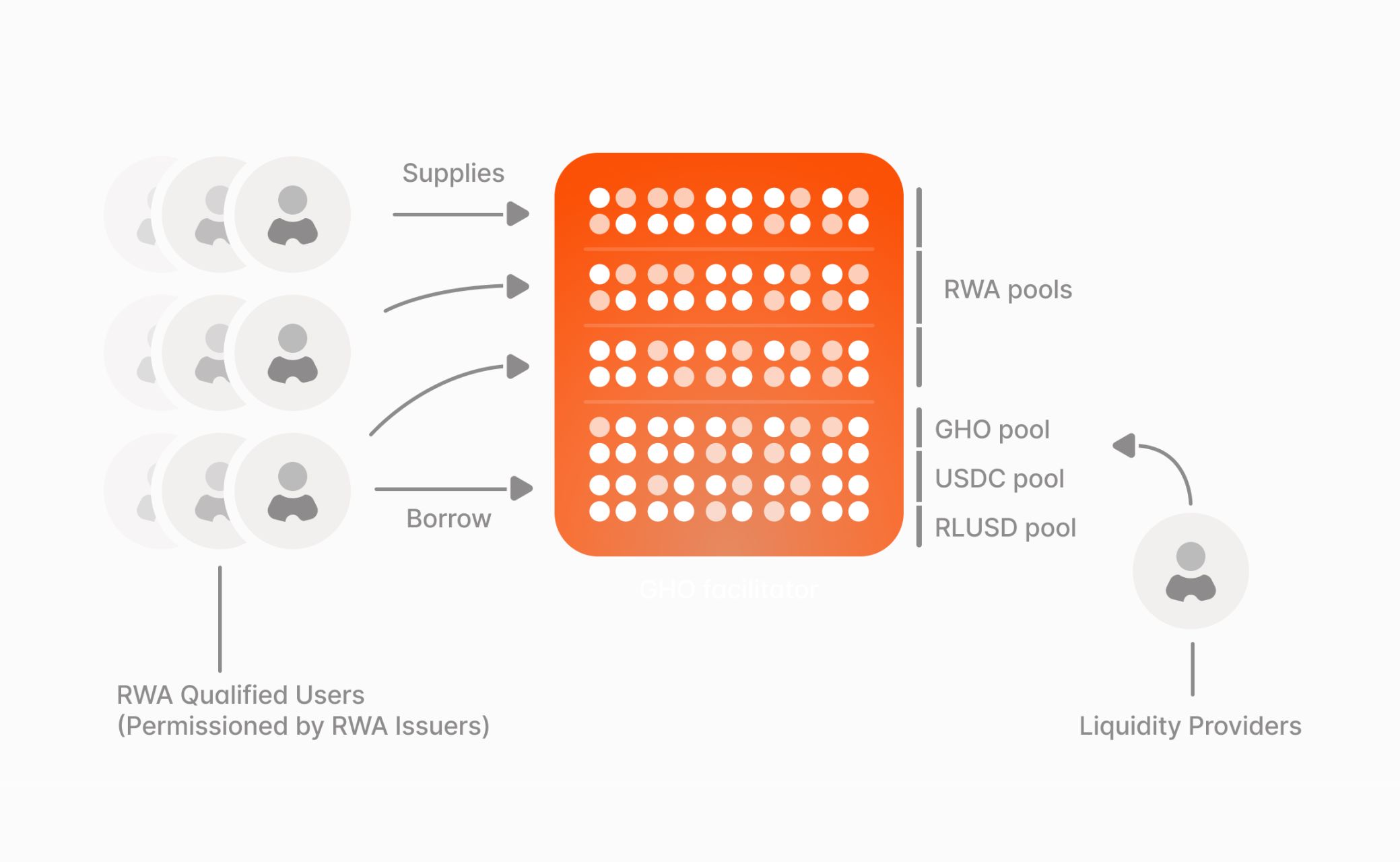

According to Aave Labs, Horizon is a lending market dedicated to RWAs. Institutional investors can collateralize tokenized US Treasuries, money market funds, or even AAA-rated loan debt, and then borrow stablecoins to maintain liquidity. Regular users can participate without barriers by depositing stablecoins to earn interest.

Technically, Horizon is still built on Aave Protocol v3.3, maintaining a non-custodial, automated architecture. Chainlink’s NAVLink provides the net asset value of collateral, while Llama Risk and Chaos Labs handle risk assessment. It sounds institution-friendly but retains DeFi’s transparency and automated execution.

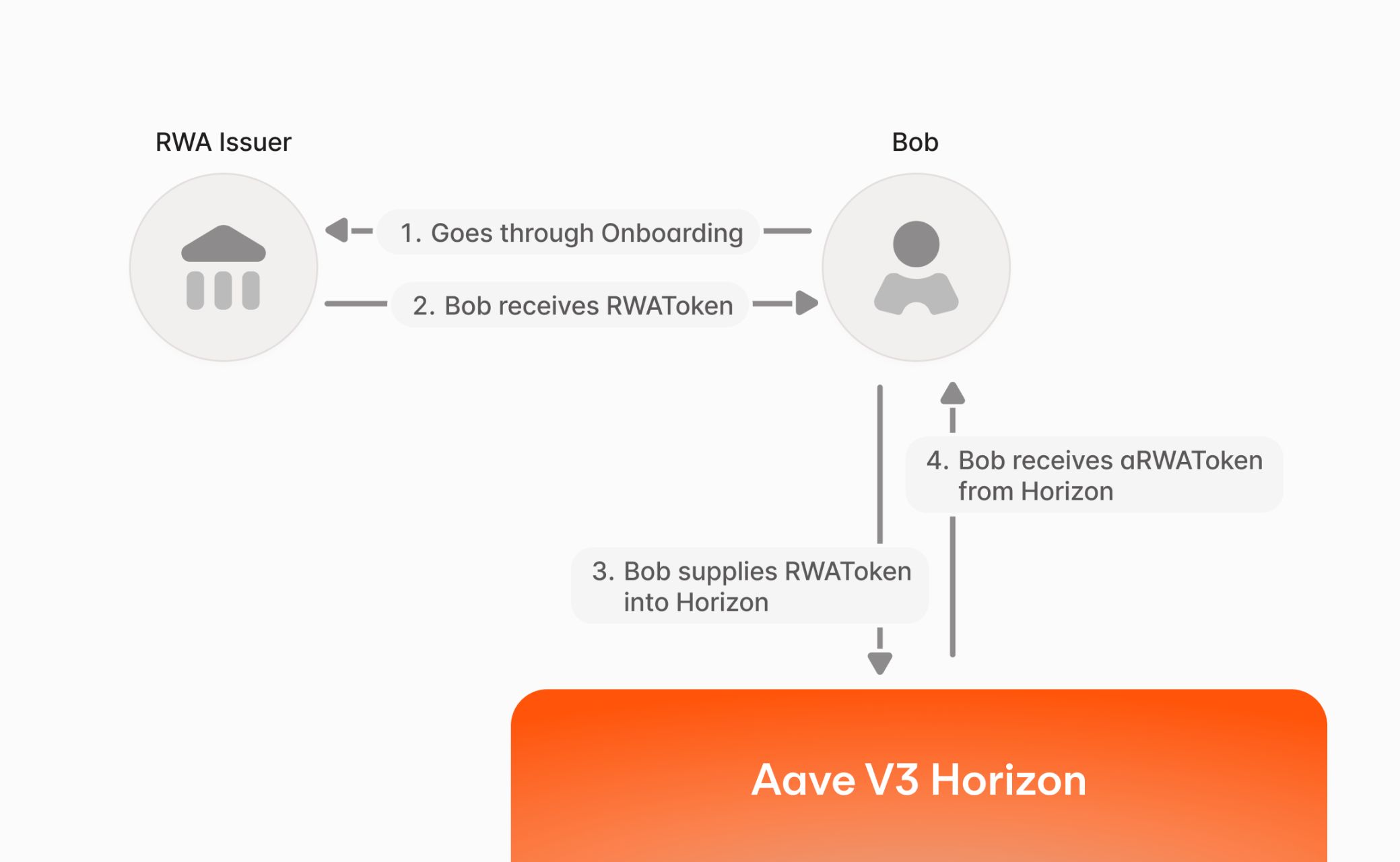

Qualified investors who meet the requirements of RWA issuers can deposit RWAs as collateral on Horizon. Each issuing institution is responsible for setting its own requirements and managing token access permissions.

When RWA tokens are supplied, Horizon issues a non-transferable aToken representing the collateral position. Users can borrow stablecoins up to a certain percentage of their collateral value, with each collateral type having its own loan-to-value (LTV) parameter.

Providing stablecoins to Horizon requires no permission. Anyone can supply RLUSD, USDC, or GHO to institutions for lending. Users who supply their chosen stablecoin to the market receive an aToken representing their deposit. aTokens earn yield and can be withdrawn at any time.

Launch Partners and Assets

The project attracted many partners from the start. At launch, Horizon offered RWA collateral options from Superstate (USTB and USCC) and Centrifuge (JRTSY and JAAA). Circle’s USYC will also be available soon. Stablecoin lending institutions can provide GHO, RLUSD, and USDC.

- Circle’s USYC offers the opportunity to earn dollar-denominated yield by investing in a diversified portfolio of high-quality short-term US Treasuries.

- Superstate’s USTB and USCC offer the opportunity to earn yield through short-term US government securities and crypto arbitrage strategies.

- Centrifuge’s JRTSY and JAAA offer the opportunity to earn yield by tokenizing investments in US Treasuries and AAA-rated mortgage debt.

Other institutions in the Horizon network include Ant Digital Technologies, Ethena, KAIO (formerly Libre), OpenEden, Securitize, VanEck, and WisdomTree.

Why is Aave doing this?

Over the past few years, Aave has been one of the leaders in DeFi lending, but a real issue is that the growth of the crypto-native market has reached a bottleneck. Lending volumes for old friends like ETH, USDC, and DAI have stabilized, and while there are many long-tail assets, they are riskier and cannot support new growth.

Meanwhile, RWAs have become the new trend in the industry. The scale of tokenized Treasuries has multiplied several times in two years, with traditional giants like BlackRock and Franklin Templeton entering the space. Aave believes that there are now over $25 billion of RWA assets on-chain, but most are scattered across traditional infrastructure. Horizon allows these assets to serve as real-time collateral for stablecoin loans, unlocking greater utility. For Aave, this is an opportunity not to be missed. If RWAs can be brought in, it can attract new capital and provide a stronger use case for its stablecoin GHO.

When Aave first announced the Horizon plan in March, the original intention was to bring RWAs into DeFi and provide institutions with a compliant entry point for collateralized lending. However, a design element in the proposal quickly sparked internal DAO controversy: whether to issue a brand-new token for Horizon.

According to the initial plan, if Horizon launched an independent token, AaveDAO would receive about 15% of the allocation and enjoy certain revenue-sharing rights. But this plan was immediately met with strong opposition. Many community members worried that a new token would dilute the value of AAVE and undermine AAVE’s status as the sole governance and utility token. Marc Zeller of Aave Chan Initiative publicly stated that he would not support such a proposal.

As discussions heated up, Aave founder Stani Kulechov personally clarified in mid-March that no new token would be created for Horizon, and the development team would respect the DAO’s consensus, stating, “The overall consensus is that the DAO has no interest in introducing a new token, and this consensus will be respected. AaveDAO is a true DAO.” This statement relieved some community members, who saw it as a protection of AAVE’s value and governance system. The tokenization controversy around Horizon was finally resolved.

The launch of Horizon means that Aave has moved from a crypto-native lending protocol to a more ambitious direction. Of course, challenges remain. Horizon is not the first attempt at RWAs, but it brings Aave into this increasingly competitive race.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The DOGE ETF Revolution: How Institutional Adoption and Meme Stock Momentum Are Reshaping Retail-Driven Crypto Assets

- Dogecoin (DOGE) transitions from meme coin to institutional asset in 2025, driven by $500M+ allocations and CFTC commodity reclassification. - Institutional infrastructure matures with green energy mining, custody platforms, and ESG-aligned solutions addressing volatility concerns. - Retail momentum fuels DOGE's rise via 11.2B social views and whale accumulations, while 3,000+ businesses adopt it for low-cost transactions. - 21Shares' DOGE ETF (0.25% fee) faces 80% approval odds by 2026, potentially unlo

Ethereum's Road to $10,000: A Strategic Buy Opportunity in 2025

- Ethereum’s $10,000 price target in 2025 is driven by blockchain adoption and macroeconomic tailwinds, including institutional ETF inflows and dovish central bank policies. - Dominance in DeFi ($78.1B TVL), NFTs ($5.8B Q1 2025 trading), and enterprise adoption by firms like BlackRock and Deutsche Bank solidify its infrastructure role. - Regulatory clarity (GENIUS Act, MiCAR) and the Pectra upgrade enhance legitimacy, while stablecoin settlement ($102B USDT/USDC) underscores its financial utility. - Growin

The Total2 Breakout: A Technical and Sentimental Prelude to Altcoin Dominance

- Total2, crypto market cap excluding Bitcoin, breaks 4-year $1.59T resistance with bullish Cup & Handle pattern and RSI/MACD confluence. - Total2/BTC ratio flips 3-year downtrend to support, signaling altcoins trading independently of Bitcoin for first time since 2021. - Ethereum's $4,955 ATH and Solana's growth, combined with Fed rate cut expectations, drive institutional/retail adoption of utility-driven blockchains. - $1.43T retest could trigger self-reinforcing altcoin adoption cycle, but $1.28T suppo

Decoding DeFi's Governance Goldmine: How Market Signals and Incentives Drive User Retention

- DeFi market to hit $78.49B by 2030, driven by Solana and Bitcoin restaking. - DAOs and token incentives boost governance but face concentration risks in voting power. - TVL transparency and cross-chain integration enhance user retention through seamless asset movement. - Mobile-first design and community engagement drive growth in APAC/Africa, reducing acquisition costs.