News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

When a platform's profits are built on the widespread losses of its participants, such a model is destined to be nothing more than a fleeting speculative frenzy.

Genuine firsthand experience always comes from those who are actively driving industry transformation.

Is it a "madman's" blueprint, or a precise map leading to the future?

After nine years of waiting, MetaMask only released a stablecoin?

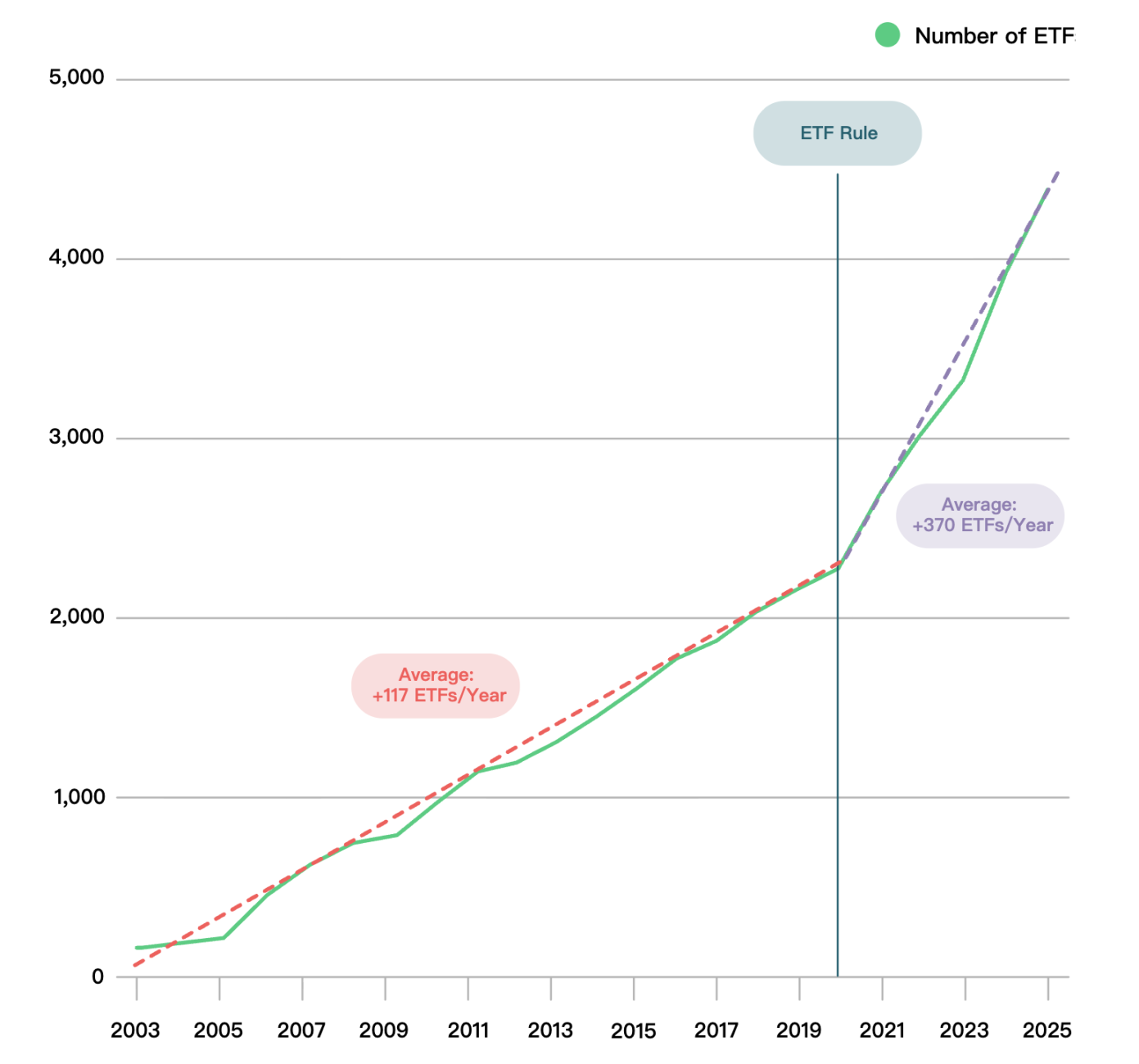

The universal listing standards could be approved as early as October, and their adoption may lead to a large influx of new crypto ETPs.

A $1 million prize pool, lasting for one month. Today, everyone's progress is reset to zero, and all participants are back to the same starting line.

- 14:54CleanCore increases holdings by 100 million Dogecoin, total holdings surpass 600 millionChainCatcher reported that NYSE American-listed company CleanCore Solutions (ZONE) has once again purchased 100 millions Dogecoin (DOGE), bringing its total holdings to over 600 millions. Earlier this month, CleanCore launched a $175 million Dogecoin reserve plan, aiming to increase its holdings to 1 billion within 30 days and to acquire 5% of DOGE's circulating supply in the long term. This plan is supported by the Dogecoin Foundation and House of Doge, and aims to promote DOGE as a reserve asset, as well as its application in payments, tokenization, remittances, and staking-like products. Since the launch of this plan, the price of DOGE has risen by more than 25%.

- 14:05Stablecoin solution provider Stablecore completes $20 million financing, led by NorwestJinse Finance reported that stablecoin solutions provider Stablecore has announced the completion of a $20 million funding round, led by Norwest, with participation from an exchange, Curql, BankTech Ventures, Bank of Utah, EJF Ventures, and Bankers Helping Bankers Fund. Stablecore is a platform that supports community and regional banks and credit unions in offering stablecoins, tokenized deposits, and digital asset products. It can be integrated with existing bank core and digital banking services, enabling financial institutions to provide digital asset products without changing their technological infrastructure.

- 13:52The US Dollar Index (DXY) falls to its lowest level since July 4.Jinse Finance reported that the US Dollar Index (DXY) fell to its lowest level since July 4, with an intraday decline of nearly 0.5%, currently at 96.89.