News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The cryptocurrency market remains cautiously optimistic ahead of the Federal Reserve's interest rate decision, with bitcoin prices experiencing narrow fluctuations. The market is closely watching the extent of the Fed's rate cuts and Powell's speech, while developments in the AI and metaverse industries may drive the performance of related tokens. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

This helps to isolate transaction fees from the crypto market fluctuations that could impact the price of volatile gas tokens, and provides a fee smoothing algorithm that maintains low dollar costs even during periods of network congestion.

"Charge-to-mine"—a Web3 application based on real-world assets has been validated in the South Korean market.

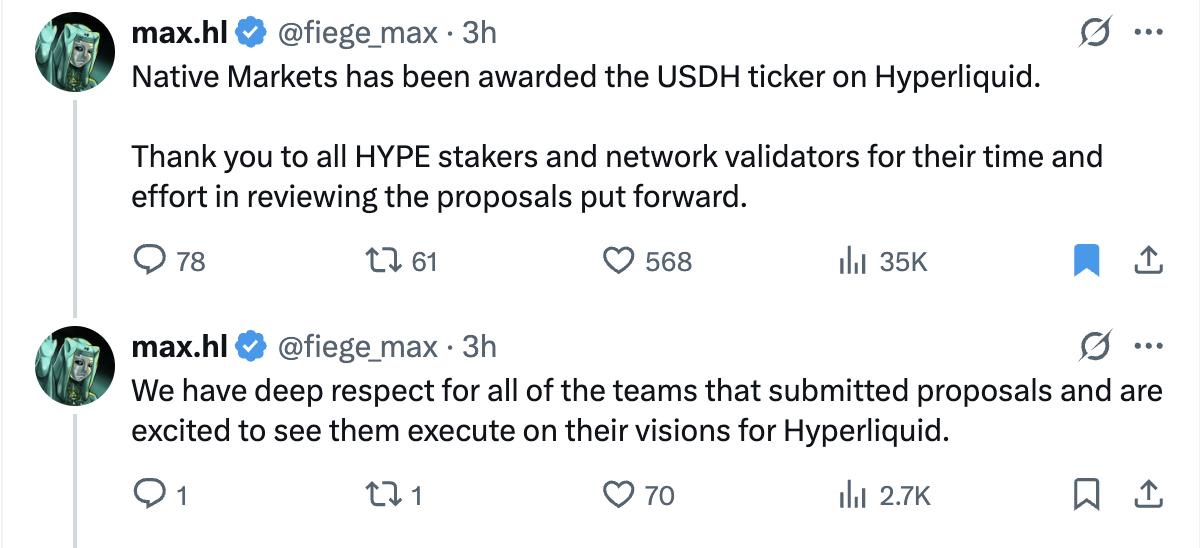

Native Markets secures USDH ticker on Hyperliquid and plans USDH HIP-1 and ERC-20 token rollout.What’s Coming: USDH HIP-1 and ERC-20 LaunchWhy It Matters for DeFi

Pakistan invites crypto companies to operate legally under its new national licensing regime.A Strategic Move Towards Fintech GrowthWhat This Means for Global Crypto Players

Bitcoin is just 0.5% away from marking its best September performance ever.What’s Fueling the Rally?Why It Matters for Investors

In 2010, websites gave away 5 Bitcoin per visitor. That’s worth over $579K today!From Freebies to FortunesThe Lesson: Never Underestimate Innovation

- 03:47Ethereum spot ETFs saw a net inflow of $638 million last week, with Fidelity FETH leading at $381 million.ChainCatcher news, according to SoSoValue data, last week the Ethereum spot ETF had a net inflow of $638 million during the trading week, with no net outflows. The Ethereum spot ETF with the largest net outflow last week was Fidelity FETH, with a weekly net inflow of $381 million. Currently, FETH's historical total net inflow has reached $2.86 billion; next is BlackRock ETF ETHA, with a weekly net outflow of $74.13 million. Currently, ETHA's historical total net inflow has reached $12.89 billion. As of press time, the total net asset value of Ethereum spot ETFs is $30.35 billion, with an ETF net asset ratio of 5.38%, and the historical cumulative net inflow has reached $13.36 billion.

- 03:47Matrixport: Market Index Fund has obtained Marketing registration from the UK Financial Conduct Authority (FCA)ChainCatcher news, according to the official announcement, Matrixport announced that its Market Index Fund has successfully obtained Marketing registration from the UK Financial Conduct Authority (FCA). The fund can now be compliantly distributed to professional and institutional clients in the UK.

- 03:36Arbitrum, Tac, and Base ranked as the top three cross-chain bridges by net capital inflow in the past 7 daysAccording to Jinse Finance, data from DefiLlama shows that in the past 7 days, Arbitrum's cross-chain bridge saw a net inflow of $466 million, ranking first among all public chains. Next are Tac and Base, with net inflows of $214 million and $48.68 million, respectively. Solana, Zkconsensys, and Linea saw net outflows of $69.81 million, $44.89 million, and $28.04 million, respectively.