News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1US Stocks Surge as Crypto Reserve Companies Find Growth Hack2Eightco Secures $250M for $WLD Treasury Launch3Bitcoin Inches up to $112K as Stocks Hit Record Highs

Exciting ICON SODA Migration: Your Essential Guide to a Seamless

CryptoNewsNet·2025/09/09 23:45

Solana (SOL) Hits $200+ with $7B+ in Perp Open Interest, Funding Rates Calm

CryptoNewsNet·2025/09/09 23:45

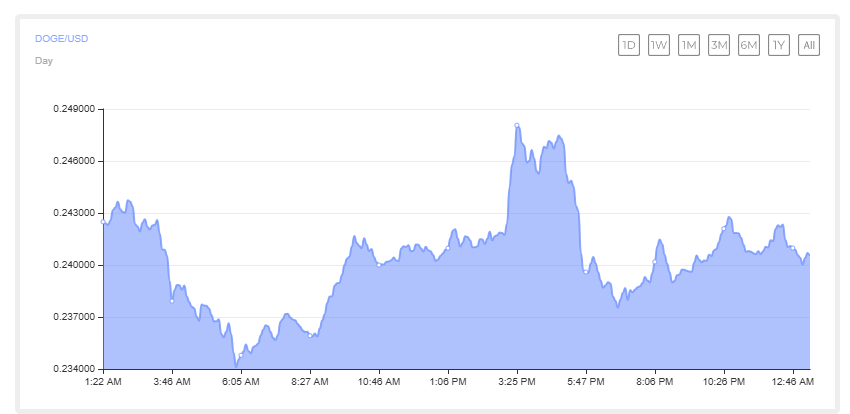

Dogecoin ETF Approval: Can DOGE Price Hit $0.50 and Surge Toward $1 Next?

CryptoNewsNet·2025/09/09 23:45

ICE Gains 14.1% Weekly as Diamond Bottom Pattern Anchors Price Near $0.005184

CryptoNewsNet·2025/09/09 23:45

Bitcoin, Ethereum slips amid US payrolls report

CryptoNewsNet·2025/09/09 23:45

Filecoin Holds $2.39 as Price Consolidates Between Support and $2.41 Resistance While Retesting Key Trendline

CryptoNewsNet·2025/09/09 23:45

TRON Forges Ahead with Mainnet v4.8.1 Upgrade

Bitcoininfonews·2025/09/09 23:42

Ripple Strikes Custody Deal with BBVA to Boost Crypto Services in Spain

DeFi Planet·2025/09/09 23:39

Historic Shift As French 10-Year Yields Surpass Italy’s

Cointribune·2025/09/09 23:39

OpenSea Opens $1M NFT Reserve With CryptoPunk Collection Buy

Cointribune·2025/09/09 23:39

Flash

- 23:48DuckDB confirms its Node.js and Wasm packages were compromised in an npm supply chain attackAccording to ChainCatcher, DuckDB's official Twitter account posted that DuckDB's Node.js and Wasm packages were injected with malware during a recent npm supply chain attack. The official team has investigated and deprecated the affected versions, and has released new versions. DuckDB stated that, according to npm data, no users have downloaded the affected packages. The team has issued a security advisory detailing the post-incident analysis and response measures.

- 23:25Data: Stablecoin companies accounted for about 25% of total crypto fundraising in Q3According to Jinse Finance, as disclosed by Cointelegraph, stablecoin companies accounted for approximately 25% of the total cryptocurrency financing in the third quarter.

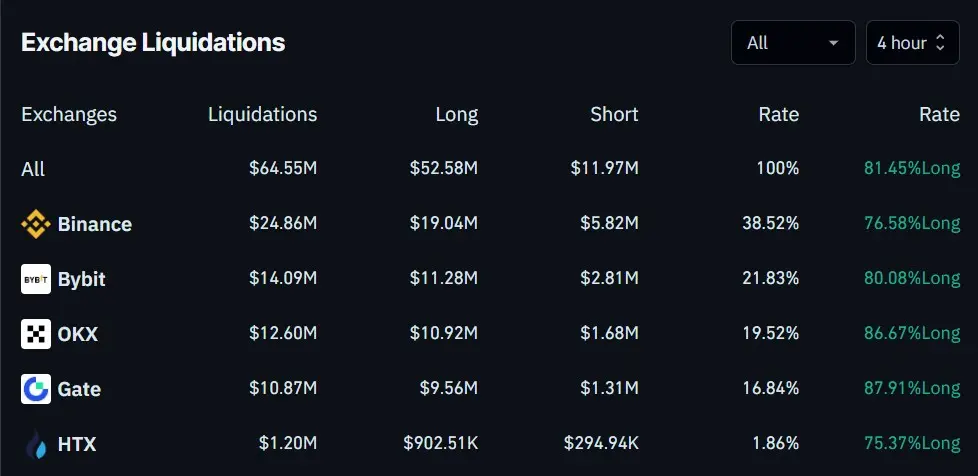

- 22:47Grayscale submits multiple filings to the US SEC seeking approval for BCH, Hedera, and LTC ETFsJinse Finance reported that Grayscale has submitted multiple filings to the US SEC, applying to launch ETFs tracking Bitcoin Cash, Hedera, and Litecoin. The plan is to convert existing related closed-end trusts, following the same process as the 2024 Bitcoin and Ethereum trust-to-ETF conversions, with the intention to list on NYSE Arca or Nasdaq. Meanwhile, the SEC has postponed its decision on the Grayscale Spot Hedera ETF and the Bitwise Spot Dogecoin ETF.