News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 16)|Crypto market sees $508 million in long liquidations over 24 hours; Hassett faces opposition from Trump-aligned senior figures in Fed chair contest2Bitget US Stock Morning Report | US Stocks Fluctuate and Retreat, Tesla Hits New High for the Year, Fed Shows Strong Economic Confidence, Non-farm Payrolls to be Released Tonight, Commodity Prices Fluctuate Violently3Bitcoin sees ‘pure manipulation’ as US sell-off liquidates $200M in an hour

Fhenix Showcases Encrypted-by-Default Payments With Privacy Stages and Private x402 Transactions

BlockchainReporter·2025/12/16 14:27

Visa launches stablecoin settlement in US via Circle's USDC on Solana

The Block·2025/12/16 14:15

Cloud Mining Platforms 2025: A Guide to Hardware-Free Bitcoin Mining Services

CryptoNinjas·2025/12/16 14:12

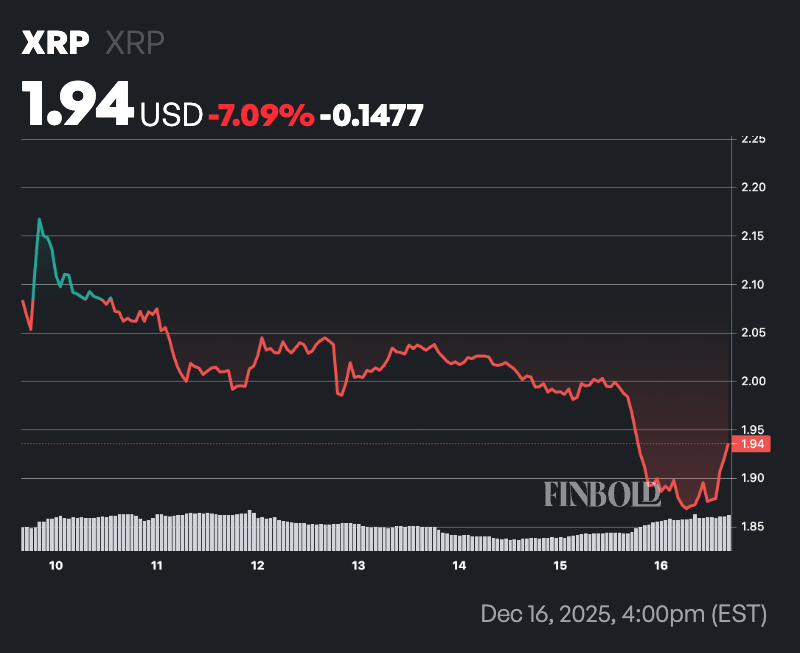

Artificial intelligence predicts XRP price for Q1 2026

币界网·2025/12/16 14:05

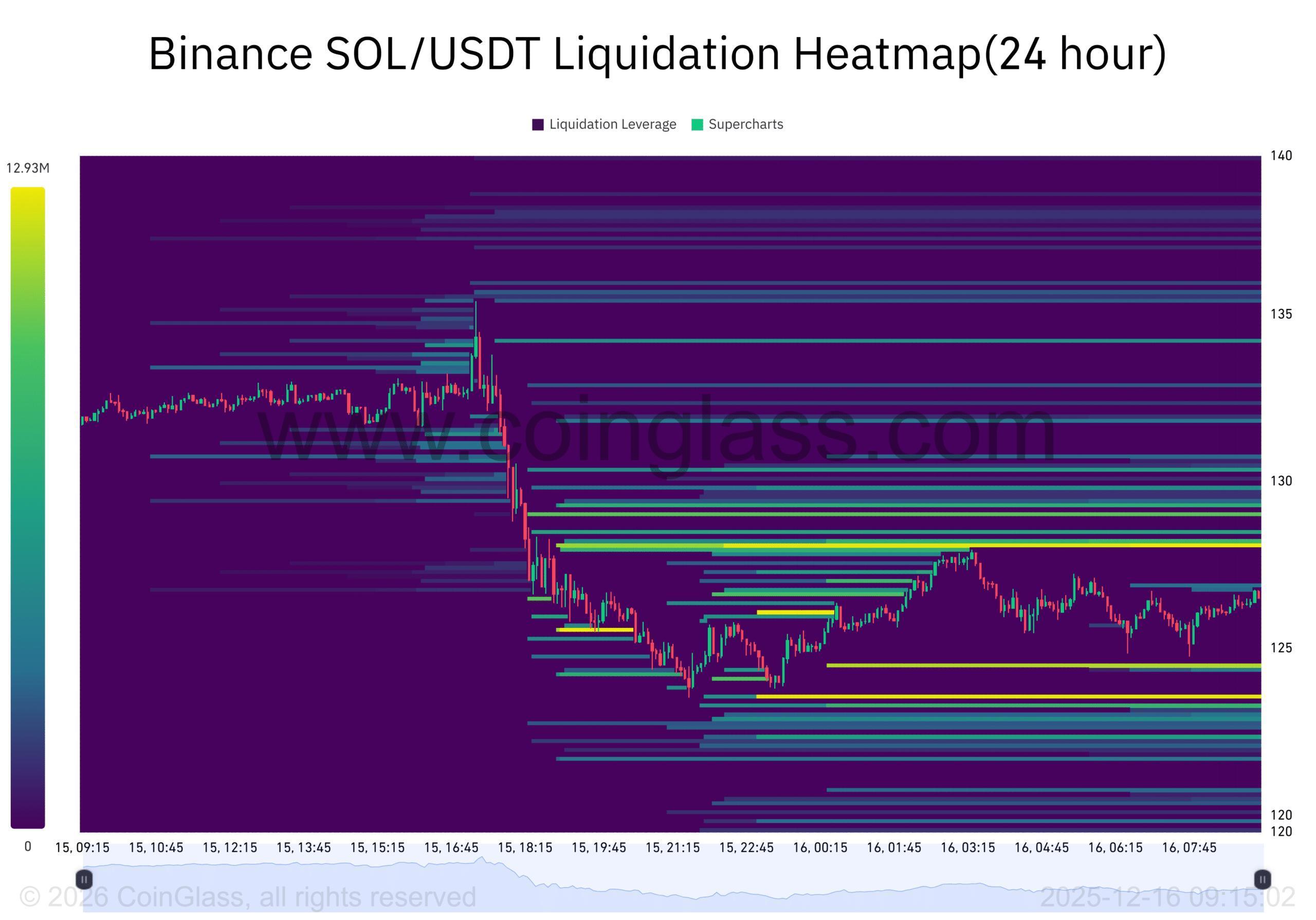

Solana’s sell pressure intensifies – How deep will SOL’s pullback go?

BlockBeats·2025/12/16 14:03

RedotPay raises $107 million Series B to expand stablecoin payments platform

The Block·2025/12/16 14:00

Stunning 64K Non-Farm Payrolls Surge Beats Forecasts: What It Means for Your Money

Bitcoinworld·2025/12/16 13:57

Flash

- 14:21Hashett: Trump Believes Interest Rates Can Go Lower, Plenty of Room for Rate CutsBlockBeats News, December 16th, American National Economic Council Director Hassett was interviewed by CNBC, where he discussed the Federal Reserve and stated that President Trump believes interest rates can be lower, which is correct according to Trump. He mentioned that there is a lot of room for rate cuts and that it is possible to achieve 3% growth and 1% inflation again.

- 14:19Hassett: If I were the Chairman of the Federal Reserve, I would negotiate with the committee on interest rate cuts.ChainCatcher News, according to Golden Ten Data, Hassett, Director of the White House National Economic Council, stated that if he were the Chairman of the Federal Reserve, he would have to negotiate with other committee members on the issue of interest rate cuts.

- 14:16Unemployment rate unexpectedly rises in November, US Treasury yields generally fallChainCatcher News, according to Golden Ten Data, John Briggs, Head of US Rate Strategy at Natixis North America, stated that the unemployment rate rose to 4.6% in November, the highest level since 2021. This has strengthened market expectations that the Federal Reserve will further cut interest rates in 2026, leading to a slight increase in US Treasury prices and a general decline in yields across all maturities. The two-year yield once fell by 5 basis points to 3.45%, hitting a new low since October 24, while the ten-year yield dropped by 4 basis points to 4.14%. The market estimates the probability of a rate cut in January next year at about 20%.

News