News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 16)|Crypto market sees $508 million in long liquidations over 24 hours; Hassett faces opposition from Trump-aligned senior figures in Fed chair contest2Bitget US Stock Morning Report | US Stocks Fluctuate and Retreat, Tesla Hits New High for the Year, Fed Shows Strong Economic Confidence, Non-farm Payrolls to be Released Tonight, Commodity Prices Fluctuate Violently3Bitcoin sees ‘pure manipulation’ as US sell-off liquidates $200M in an hour

Visa launches stablecoin settlement in US via Circle's USDC on Solana

The Block·2025/12/16 14:15

Cloud Mining Platforms 2025: A Guide to Hardware-Free Bitcoin Mining Services

CryptoNinjas·2025/12/16 14:12

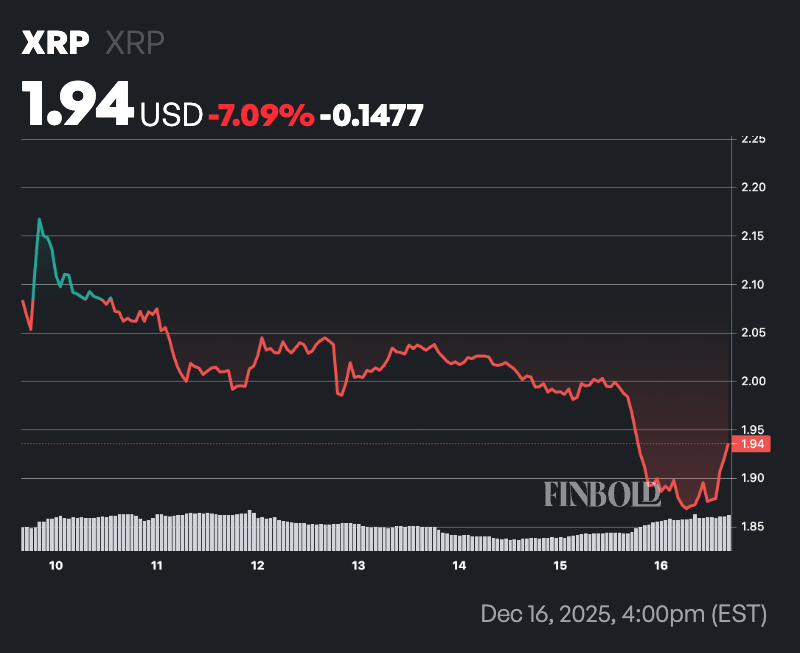

Artificial intelligence predicts XRP price for Q1 2026

币界网·2025/12/16 14:05

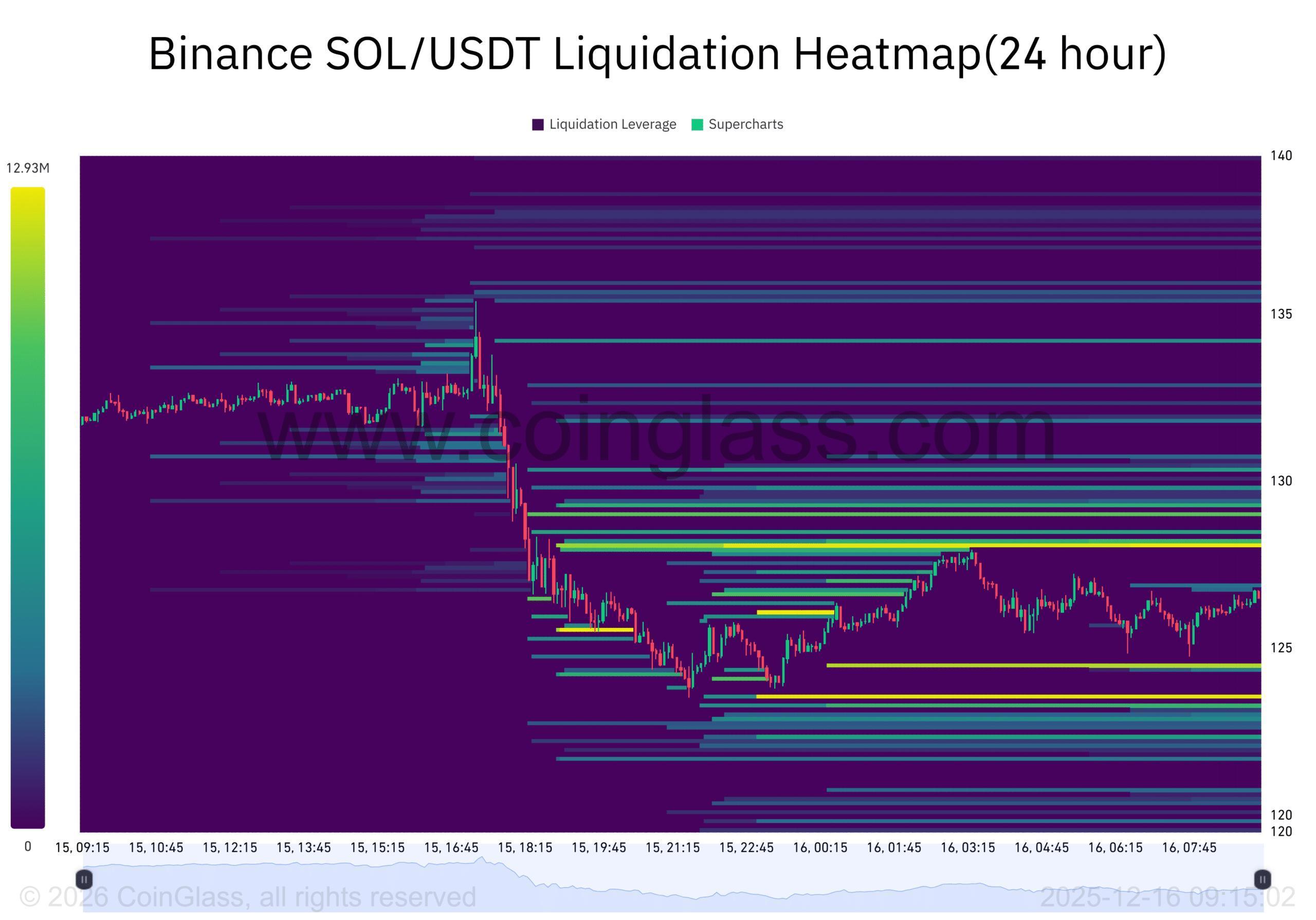

Solana’s sell pressure intensifies – How deep will SOL’s pullback go?

BlockBeats·2025/12/16 14:03

RedotPay raises $107 million Series B to expand stablecoin payments platform

The Block·2025/12/16 14:00

Stunning 64K Non-Farm Payrolls Surge Beats Forecasts: What It Means for Your Money

Bitcoinworld·2025/12/16 13:57

Circle Acquires Interop Labs to Accelerate Cross-Chain Blockchain Infrastructure

DeFi Planet·2025/12/16 13:24

PIPPIN Climbs to $0.51 Record High, Marks 4-Week Bullish Run

Cryptotale·2025/12/16 13:15

Flash

- 14:09An early Ethereum whale deposited 3,000 ETH into an exchange, worth $8.79 million.According to ChainCatcher, as monitored by Onchain Lens, an early Ethereum whale has deposited 3,000 ETH into an exchange, valued at $8.79 million. It is reported that this whale is likely Richard Heart.

- 14:07Strategist: The Federal Reserve's action in December depends on non-farm payroll and retail data, with wage growth slowing downUS interest rate strategist Ira Jersey stated that although the overall data is hardly strong, the muted reaction in the interest rate market is not surprising. Ira Jersey is more focused on wage growth, noting that the year-on-year wage growth rate has slowed to 3.5%, the lowest level in this cycle. The Federal Reserve may still take action, but it will need to see the December non-farm payroll and retail sales data before determining whether to act in December. Given the current lack of a clear trend shift in the data, long-term interest rates will continue to fluctuate within a range.

- 14:06Analyst: December Nonfarm Payroll and Retail Data Are Key to the Federal Reserve's ActionsAccording to Odaily, U.S. interest rate strategist Ira Jersey stated that although it is difficult to describe the overall data performance as strong, the muted reaction from the interest rate market is not surprising. We are more focused on wage growth—which has slowed to a year-over-year rate of 3.5%, the lowest level in this cycle. Therefore, the Federal Reserve may still take action, but it will need to see the December nonfarm payroll and retail sales data before determining whether it will act in December. Given the current lack of a clear trend shift in the data, we believe long-term interest rates will continue to fluctuate within a range.

News