News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

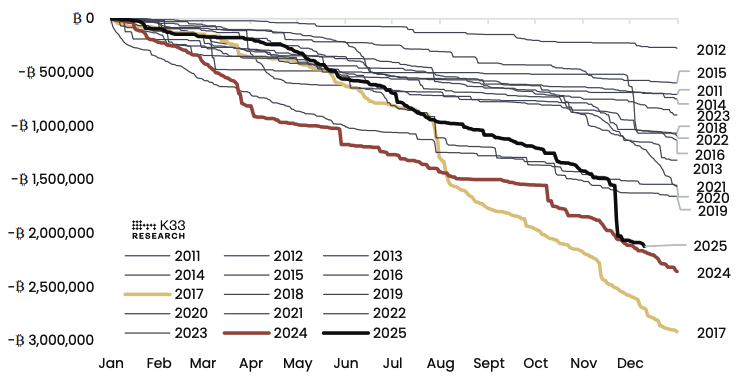

Sell-side pressure from long-term Bitcoin holders nears saturation: K33

The Block·2025/12/17 11:21

Unveiled: Infrared’s Token Generation Event Kicks Off on Berachain

Bitcoinworld·2025/12/17 11:12

IoTeX Publishes MiCA-Compliant Whitepaper to Expand EU Market Access for IOTX

DeFi Planet·2025/12/17 11:09

BlackRock moves 47K Ethereum in a day: But the real story isn’t a sell-off

AMBCrypto·2025/12/17 11:03

$110M XRP Moved from Australia’s Top Exchange. Here’s the Destination

TimesTabloid·2025/12/17 10:57

Space Announces Public Sale of its Native Token, $SPACE

BlockchainReporter·2025/12/17 10:42

The Fed "successor" reverses course: From "loyal dove" to "reformer"—has the market script changed?

Odaily星球日报·2025/12/17 10:41

Bitcoin at $1 million is not a price issue, but a denial of reality | Opinion

币界网·2025/12/17 10:36

Flash

11:30

Pantera 2025 Review: Flat Prices but Significant Structural Progress, Regulatory Shifts, ETFs, and RWAs Become Key VariablesAccording to TechFlow, on December 17, crypto investment firm Pantera Capital released its annual outlook report, "A Review of Structural Progress in the Crypto Industry in 2025." The report states that although the price performance of crypto assets in 2025 fell short of some market expectations, the year marked the most significant structural progress in the crypto industry. The report highlights clear improvements in the US regulatory environment (including changes in SEC leadership, the repeal of SAB 121, and the withdrawal of several crypto lawsuits), the advancement of stablecoin legislation, the inclusion of a certain exchange in the S&P 500, progress in Solana and XRP ETF, Robinhood's launch of tokenized stocks, as well as the accelerated development of RWA and prediction markets—all laying the foundation for the industry's long-term growth. Pantera believes that these institutional and infrastructure-level changes are opening up space for crypto development in 2026 and beyond.

11:22

Reuters: Investors Become More Cautious After Crypto Market Correction, New Strategies May Gain FavorBlockBeats News, December 17, according to Reuters, the recent sharp correction in the crypto market has made investors more cautious, with some high-leverage and high-valuation sectors being particularly affected. At the same time, this has also driven more attention to active risk management strategies. With the rapid expansion of investment tools, investors can participate in the market through various means such as direct coin holding, spot ETF, options and futures, mining companies and "bitcoin treasury companies", exchanges, and infrastructure companies. However, the risk exposures of different paths vary significantly. John D`Agostino, Head of Institutional Strategy at an exchange, stated that the key lies in how investors use leverage and whether they hedge. Since reaching a high of $126,223 on October 6, bitcoin once fell by 36% and is currently still down about 30% from its peak. "Bitcoin treasury companies" represented by Strategy have seen even larger declines, with Strategy's stock price down 54% from bitcoin's October high and 63% from mid-July. Japan's Metaplanet and a group of followers are also under pressure. Lyn Alden pointed out that a "localized bubble" had formed in related sectors, and investors are now reassessing premium risks. In terms of mining companies, IREN, CleanSpark, Riot, and MARA are experiencing growing pains as they transition to AI data centers. VanEck Onchain Economy ETF manager Matthew Sigel stated that these companies previously benefited from the strong performance of the "crypto + AI" dual theme, but under the changing macro environment, high debt, and ongoing financing needs, their profitability is being questioned, resulting in pressure on their stock prices.

11:21

Reuters: Cryptocurrency Market Sees Investor Caution After Pullback, New Strategies Gain FavorBlockBeats News, December 17th. According to Reuters, the recent sharp pullback in the cryptocurrency market has made investors more cautious. Sectors with high leverage and high valuations have been particularly impacted, driving more attention to active risk management strategies.

As investment tools rapidly expand, investors can participate in the market through various means such as direct holdings, spot ETFs, options and futures, mining companies and "Bitcoin Treasury Reserve Companies," an exchange, and infrastructure companies. However, the risk exposure varies significantly depending on the chosen path. John D'Agostino, Head of Institutional Strategy at an exchange, stated that the key is how investors utilize leverage and whether they hedge their positions.

Since hitting a high of $126,223 on October 6th, Bitcoin has experienced a 36% decline, currently down approximately 30% from the peak. "Bitcoin Treasury Reserve Companies" represented by Strategy have seen even greater declines, with Strategy's stock price falling 54% from the October Bitcoin peak and 63% from mid-July. Japan's Metaplanet and a group of followers are similarly under pressure. Lyn Alden pointed out that these sectors had previously formed a "local bubble," and investors are now reassessing the premium risk.

On the mining front, companies like IREN, CleanSpark, Riot, and MARA are facing challenges in transitioning to AI data centers. Matthew Sigel, manager of the VanEck Onchain Economy ETF, stated that these companies had previously benefited from the strong performance of the "crypto + AI" dual theme. However, amid macroeconomic changes, high debt levels, and ongoing financing needs, their profitability is being questioned, leading to downward pressure on stock prices.

News