News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 16)|Crypto market sees $508 million in long liquidations over 24 hours; Hassett faces opposition from Trump-aligned senior figures in Fed chair contest2Bitget US Stock Morning Report | US Stocks Fluctuate and Retreat, Tesla Hits New High for the Year, Fed Shows Strong Economic Confidence, Non-farm Payrolls to be Released Tonight, Commodity Prices Fluctuate Violently3Bitcoin sees ‘pure manipulation’ as US sell-off liquidates $200M in an hour

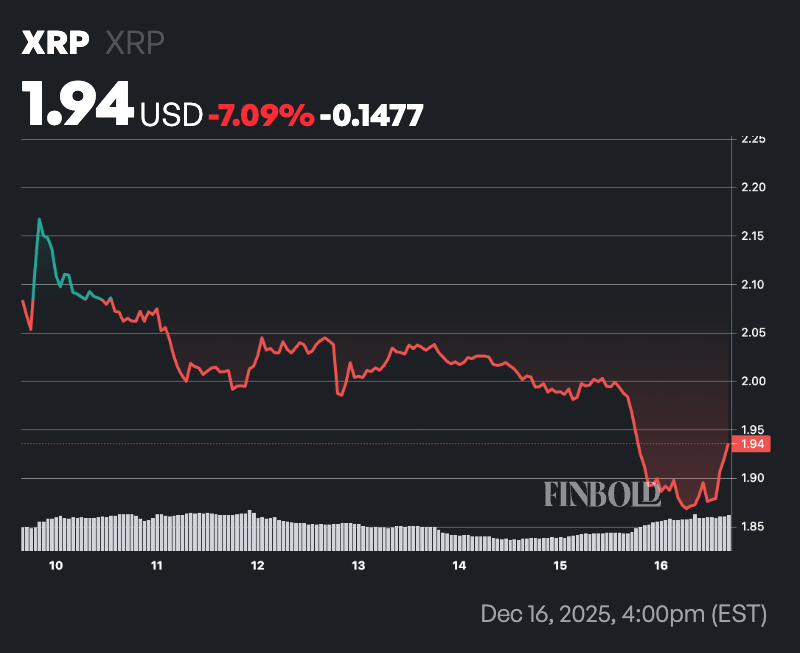

Analyst Warns XRP Investors: We May See a Drop to $1.56. Here’s why

·2025/12/16 14:33

Cloud Mining Industry Outlook 2026: Market Trends, Platforms, and Participation Models

CryptoNinjas·2025/12/16 14:33

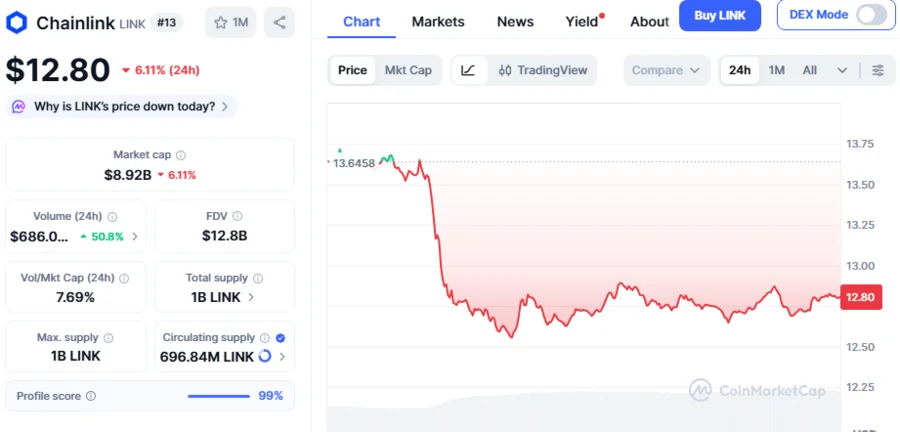

Chainlink Whales Accumulate 20.46M Tokens as LINK Consolidates at $12.69, Is Market Rally Coming?

BlockchainReporter·2025/12/16 14:31

Fhenix Showcases Encrypted-by-Default Payments With Privacy Stages and Private x402 Transactions

BlockchainReporter·2025/12/16 14:27

Visa launches stablecoin settlement in US via Circle's USDC on Solana

The Block·2025/12/16 14:15

Cloud Mining Platforms 2025: A Guide to Hardware-Free Bitcoin Mining Services

CryptoNinjas·2025/12/16 14:12

Artificial intelligence predicts XRP price for Q1 2026

币界网·2025/12/16 14:05

Flash

- 14:35Bitwise predicts a crypto bull market in 2026 and releases ten major forecastsJinse Finance reported that Bitwise believes 2026 will be a bull year for cryptocurrencies. From institutional adoption to regulatory progress, the current positive trends in crypto are too strong to be suppressed for long. Here are Bitwise's top ten predictions for the coming year. Prediction 1: Bitcoin will break the four-year cycle and reach a new all-time high. Prediction 2: Bitcoin's volatility will be lower than Nvidia's. Prediction 3: As institutional demand accelerates, ETFs will purchase more than 100% of the new supply of Bitcoin, Ethereum, and Solana. Prediction 4: Crypto stocks will outperform tech stocks. Prediction 5: Polymarket's open interest will reach a new all-time high, surpassing the level during the 2024 election. Prediction 6: Stablecoins will be blamed for undermining the stability of emerging market currencies. Prediction 7: On-chain treasuries (also known as "ETF 2.0") will double their assets under management. Prediction 8: Ethereum and Solana will reach new all-time highs (if the CLARITY Act is passed). Prediction 9: Half of Ivy League endowment funds will invest in cryptocurrencies. Prediction 10: The United States will launch more than 100 crypto-linked ETFs. Additional prediction: The correlation between Bitcoin and stocks will decrease.

- 14:34The three major U.S. stock indexes opened lower collectively.Jinse Finance reported that the three major U.S. stock indexes opened lower collectively. The Dow Jones Index fell by 0.04%, the S&P 500 Index dropped by 0.18%, and the Nasdaq Composite Index declined by 0.23%. The seven major tech giants mostly fell: Amazon rose by 0.25%, Tesla dropped by 0.70%, Apple fell by 0.13%, Meta declined by 0.48%, Google dropped by 1.30%, Microsoft fell by 0.41%, and Nvidia declined by 0.24%.

- 14:33U.S. stock market opens, Nasdaq drops over 52 pointsU.S. stocks opened lower, with the Dow Jones Industrial Average down 21 points, the Nasdaq down 52 points, and the S&P 500 Index down 0.18%.

News