News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 5) | 21Shares Launches 2x Leveraged SUI ETF on Nasdaq; U.S. Treasury Debt Surpasses $30 Trillion; JPMorgan: Strategy’s Resilience May Determine Bitcoin’s Short-Term Trend2Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?3The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

Unprecedented "burn rate"! Wall Street estimates: Before turning profitable, OpenAI will have accumulated losses of $140 billion.

According to data cited by Deutsche Bank, OpenAI may accumulate losses exceeding 140 billions USD before reaching profitability, with computing power expenses far surpassing revenue expectations.

ForesightNews·2025/12/05 09:22

Bitget·2025/12/05 09:00

Morning Brief | Ethereum completes Fusaka upgrade; Digital Asset raises $50 million; CZ's latest interview in Dubai

Overview of major market events on December 4.

Chaincatcher·2025/12/05 08:31

BitsLab gathers ecosystem partners in San Francisco to host the x402 Builders Meetup

San Francisco x402 Builders Meetup

Chaincatcher·2025/12/05 08:30

The trend of the United States embracing the crypto economy is now irreversible.

The K-shaped growth of the US economy, Wall Street's irreversible embrace of the crypto trend, and the stablecoin B-side becoming the main battleground.

Chaincatcher·2025/12/05 08:30

Will Trump become the most financially powerful president in U.S. history?

AICoin·2025/12/05 08:24

BTC mining faces short-term pressure, why does JPMorgan have a high target of $170,000?

AICoin·2025/12/05 08:24

The US CFTC officially approves cryptocurrency spot products, reshaping the regulatory landscape from the "crypto sprint" to 2025

US crypto regulation is gradually becoming clearer.

ForesightNews 速递·2025/12/05 08:22

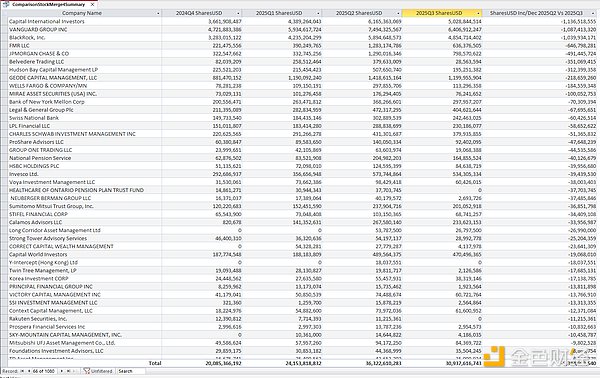

Controversial Strategy: The Dilemma of BTC Faith Stocks After a Sharp Decline

金色财经·2025/12/05 07:51

Previous Call King Murad: 116 Reasons Why This Bull Market Isn't Over

I do not subscribe to the view that the market cycle is solely four years long. I believe this cycle could extend to four and a half years or even five years, and may continue until 2026.

BlockBeats·2025/12/05 06:26

Flash

- 09:13Bunni attacker address deposits 2,295.8 ETH into TornadoCashJinse Finance reported that, according to monitoring by PeckShield, the address marked as the Bunni protocol attacker deposited 2,295.8 ETH, worth approximately $7.3 million, into Tornado Cash. Previously, on September 2, the Bunni protocol suffered an attack, resulting in a loss of about $8.4 million. The team announced its closure in October.

- 09:12Cloudflare control panel and Cloudflare API services are experiencing issuesJinse Finance reported that due to a large-scale service outage at Cloudflare, several major Solana protocols, including Jupiter, Raydium, and Meteora, are experiencing user interface downtime.

- 09:00CryptoQuant: The market has entered a structural adjustment phase, and the likelihood of continued decline remains high.Jinse Finance reported that CryptoQuant analyst @AxelAdlerJr, based on an analysis of bitcoin on-chain signal indicators, stated that the current market has entered a deep correction phase, which lasted for a year in the previous cycle. The current maximum drawdown of bitcoin from its historical high is -32%, placing it in the middle zone between a deep correction and a market bottom. If macroeconomic and on-chain signals do not improve, there is still a risk of continued decline in the market. In summary, the current combination of signals indicates that the market has entered a structural adjustment phase: the profit and loss score corresponds to the bear market area in history, and the -32% drawdown has already exceeded a typical cyclical correction. As long as there are no signs of improvement in on-chain and macro indicators, the possibility of a continued decline remains high. Recovery will take time and requires a shift in sentiment within the network's profit and loss structure.

News