Nervos Network priceCKB

CKB/USD price calculator

Nervos Network market Info

Live Nervos Network price today in USD

The cryptocurrency market is buzzing on September 18, 2025, with a confluence of macroeconomic shifts, regulatory advancements, and significant on-chain movements fueling a broad-based rally. A key driver for today's optimism is the Federal Reserve's decision to cut its benchmark interest rate by 25 basis points, settling it in the 4.00%-4.25% range. This move has injected fresh confidence into risk assets, propelling the global crypto market capitalization to approximately $4.2 trillion.

Bitcoin (BTC) is leading the charge, trading robustly around the $117,000 to $118,000 mark. Analysts are now closely watching for a potential push towards $120,000, with some even forecasting a monumental surge to $200,000 by year-end, given the current monetary policy easing. Ethereum (ETH) is not far behind, with its price breaking past $4,600 and maintaining a strong position as institutional interest continues to flow into the ecosystem. This renewed enthusiasm follows a significant inflow of $646 million into Ethereum investment products last week. [1, 3, 4, 5, 6, 7, 9, 14]

Beyond the market leaders, altcoins are experiencing a vibrant day. Solana (SOL), XRP, Cardano (ADA), Dogecoin (DOGE), and Binance Coin (BNB) have all registered notable gains. BNB, in particular, has rallied past $900, nearing the $1,000 milestone, following a significant partnership with Franklin Templeton, underscoring growing institutional engagement with alternative digital assets. The meme coin sector also saw an impressive surge of over 5%, with 'Memecore' tokens emerging as top performers. This widespread rally across the altcoin space suggests that the long-anticipated 'altcoin season' may be on the horizon, characterized by diminishing Bitcoin dominance and an increasing altcoin market share. [1, 2, 3, 6, 7, 16, 20]

Regulatory developments are also painting a clearer picture for the future of digital assets. The U.S. Securities and Exchange Commission (SEC) has approved new listing rules for major exchanges, which is a pivotal step towards allowing more spot Exchange-Traded Funds (ETFs) beyond Bitcoin and Ethereum. This landmark decision has already paved the way for the launch of the first XRP and Dogecoin spot ETFs today, significantly expanding institutional access to a broader range of cryptocurrencies. Concurrently, the UK's Financial Conduct Authority (FCA) is adapting its regulatory framework, aiming to streamline rules for crypto firms while enhancing oversight on specific risks like cybersecurity. Bahrain’s Central Bank has also introduced a framework for stablecoins, emphasizing local incorporation and capital reserves, reflecting a global trend towards integrating digital assets within established financial structures. [1, 6, 8, 11, 12, 15, 16]

Ethereum's ecosystem is seeing dynamic activity, marked by a record $12 billion worth of ETH queued for unstaking, presenting potential selling pressure. However, this is largely counterbalanced by robust institutional demand, with ETF holdings and strategic reserves of ETH soaring by 116% since July. The staking entry queue has notably surpassed the exit queue, indicating strong investor confidence in Ethereum's long-term prospects, particularly as the network's staked capacity reaches an impressive 36 million ETH. The anticipation for ETH staking ETF approvals, potentially as early as October 2025, further contributes to this positive outlook. [13, 23, 26]

In the NFT landscape, while the broader market has experienced a cool-off, innovative projects continue to capture attention. Weekly sales volumes and unique buyer numbers saw a dip in early September, yet niche projects are flourishing. For instance, 'Doginal Dogs,' a pixel art collection on the Dogecoin blockchain, has surged from a free mint to a $5,000 floor price, drawing celebrity interest. Furthermore, American Express has launched Travel Stamp NFTs on the Ethereum Layer-2 network Base, integrating them into their mobile app. This initiative aims to onboard millions of cardholders onto blockchain experiences, highlighting a strategic move towards mainstream NFT adoption by traditional finance giants. [18, 19, 25]

Real-world asset (RWA) tokenization platforms are also gaining significant traction, with protocols like Centrifuge (CFG) demonstrating substantial growth and being eyed as top performers in the evolving RWA sector. Whale activity provides further insights into market sentiment, with notable withdrawals of Ethereum from exchanges and aggressive accumulation of Solana by institutional players like FalconX, signaling conviction in these assets' long-term value. [20, 21]

Today's crypto market is characterized by a powerful synergy of supportive monetary policy, advancing regulatory clarity, and continued technological innovation. These elements are collectively fostering an environment ripe for growth and increased institutional and retail participation across the digital asset spectrum.

Do you think the price of Nervos Network will rise or fall today?

Now that you know the price of Nervos Network today, here's what else you can explore:

How to buy Nervos Network (CKB)?How to sell Nervos Network (CKB)?What is Nervos Network (CKB)What would have happened if you had bought Nervos Network (CKB)?What is the Nervos Network (CKB) price prediction for this year, 2030, and 2050?Where can I download Nervos Network (CKB) historical price data?What are the prices of similar cryptocurrencies today?Want to get cryptocurrencies instantly?

Buy cryptocurrencies directly with a credit card.Trade various cryptocurrencies on the spot platform for arbitrage.Nervos Network price prediction

When is a good time to buy CKB? Should I buy or sell CKB now?

About Nervos Network (CKB)

What Is Nervos Network?

Nervos Network is an open-source blockchain platform, founded in 2018, designed to address the challenges of scalability and interoperability in the blockchain ecosystem. It employs a unique layered architecture, consisting of both Layer 1 and Layer 2 blockchains, to optimize different functionalities within the network. The foundational layer, known as the Common Knowledge Base (CKB), serves as the consensus engine and smart custodian, utilizing a proof-of-work consensus model and prioritizing security and decentralization. This layer is also the platform’s base layer, providing a store of value and executing smart contracts, with its native utility token called CKB.

Nervos Network's layered structure is akin to the human nervous system, with each layer serving a distinct purpose, enabling the creation of universal applications that can operate across various chains in the ecosystem. This innovative approach aims to foster a truly peer-to-peer crypto-economy network, allowing developers to build decentralized applications (DApps) that can interact seamlessly with other blockchains, thus eliminating the frustrations of multiple wallets, exchanges, and seed phrases.

Resources

Whitepaper: https://github.com/nervosnetwork/rfcs/blob/master/rfcs/0002-ckb/0002-ckb.md

Official Website: https://www.nervos.org/

How Does Nervos Network Work?

Nervos Network operates on a dual-layered blockchain. The first layer, the Common Knowledge Base (CKB), is a general-purpose proof-of-work blockchain that acts as the network's security and validation mechanism. It is designed to be stateful and features a Turing Complete virtual machine that supports application processing requirements using smart contracts. This layer is optimized to verify and settle transactions, acting as a trust anchor and providing additional security to the upper layers.

The second layer is the computation layer, responsible for off-chain processing of transactions and generation of new states of the blockchain. It hosts several DApps and is designed for high-performance transactions and privacy protection, allowing developers to execute the functions of their DApps efficiently. This layered approach enables parallel processing of transactions and application activities, achieving scalability without compromising network security. It also allows various Layer 2 blockchains to leverage the storage and processing capabilities of the mainnet, enhancing interoperability and flexibility within the network.

Nervos Network also features a unique economic model designed to incentivize all participants, including users, developers, and node operators, to contribute to the platform's success while maximizing the utility of blockchain technology. This model allows the platform to scale and grow organically, ensuring the sustainable value of CKB tokens and protecting them from secondary issuance dilution.

What Is CKB Token?

The CKB token, or Common Knowledge Byte coin, is the native token of the Nervos Network. It represents state storage units within the network, allowing token holders to purchase space on the blockchain. For instance, a holder with 1,000 CKB tokens can create a 1,000-byte cell or have multiple cells all adding up to 1,000 bytes on the Nervos blockchain. This unique approach prevents low-quality DApps from occupying unnecessary space and causing congestion on the chain, addressing the issues of high gas fees and scalability.

CKB tokens are also used to reward miners with block rewards and transaction fees, and they play a crucial role in executing smart contracts and enabling the entire ecosystem's flexibility. The tokenomics of CKB are meticulously designed, with a limited amount of tokens offered during the main issuance and a secondary issuance aimed at operational support of the project, including rewarding miners and depositors.

Nervos Network's Impact on Finance

Nervos Network is poised to make a significant impact on the financial sector by addressing the critical issues of interoperability and scalability that plague many existing blockchain networks. Its innovative layered design and unique economic model offer a scalable, secure, and interoperable blockchain solution, enabling the development of universal applications that can run on any blockchain network.

By solving the problems of interoperability and scalability, Nervos Network facilitates the mass adoption of blockchain technology, allowing users and developers to fully harness the benefits of decentralized finance (DeFi). Its approach to using tokens to “hold space” on the blockchain is a first-of-its-kind innovation with positive ramifications for blockchain infrastructure, potentially revolutionizing the way decentralized applications are built and interact with one another.

What Determines Nervos Network's Price?

The price of Nervos Network's native token, CKB, is influenced by a myriad of factors, much like other assets in the cryptocurrency market. Cryptocurrency price predictions for CKB are often derived from meticulous cryptocurrency analysis and examination of cryptocurrency charts, reflecting the token's historical performance, supply and demand dynamics, and prevailing market conditions. The cryptocurrency news also plays a pivotal role in shaping the perceptions and sentiments of cryptocurrency enthusiasts, experts, and the broader crypto community, potentially impacting the token's price movements. Developments in cryptocurrency regulation can also have significant repercussions, as regulatory clarity or uncertainties can either foster or hinder cryptocurrency adoption, respectively.

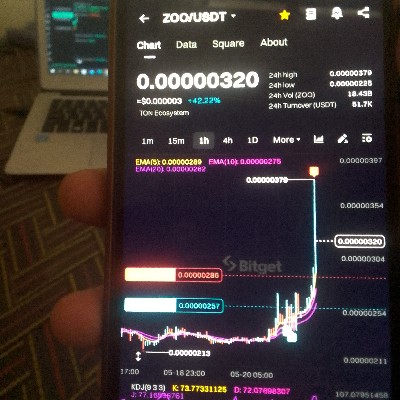

Market trends and cryptocurrency trading strategies adopted by investors and traders can also sway the price of CKB. The cryptocurrency market is renowned for its inherent volatility, and sudden price fluctuations can be triggered by speculative trading, macroeconomic factors, and changes in investor sentiment. Cryptocurrency risks, including security vulnerabilities and the potential for cryptocurrency scams, can also affect investor confidence and, subsequently, the token's value. Additionally, buying and selling activities on leading exchanges such as Bitget can influence the token's liquidity and price.

Looking ahead to 2023 and beyond, the trajectory of CKB's price will likely be shaped by ongoing developments within the Nervos Network, broader trends in the cryptocurrency market, and the evolving landscape of blockchain technology. As the network continues to innovate and foster a conducive environment for the development of decentralized applications, it could potentially become one of the best crypto investments for 2023. However, prospective investors are advised to conduct thorough research, consider cryptocurrency security aspects, and employ prudent crypto portfolio management practices before making investment decisions.

Bitget Insights

CKB/USD price calculator

CKB resources

Tags:

What can you do with cryptos like Nervos Network (CKB)?

Deposit easily and withdraw quicklyBuy to grow, sell to profitTrade spot for arbitrageTrade futures for high risk and high returnEarn passive income with stable interest ratesTransfer assets with your Web3 walletWhat is Nervos Network and how does Nervos Network work?

Global Nervos Network prices

Buy more

FAQ

What is the current price of Nervos Network?

What is the 24 hour trading volume of Nervos Network?

What is the all-time high of Nervos Network?

Can I buy Nervos Network on Bitget?

Can I get a steady income from investing in Nervos Network?

Where can I buy Nervos Network with the lowest fee?

Related cryptocurrency prices

Prices of newly listed coins on Bitget

Hot promotions

Where can I buy Nervos Network (CKB)?

Video section — quick verification, quick trading