Monad (MON) Price Prediction 2025–2030: How High Can MON Go After Mainnet Launch?

In the crowded world of Layer-1 blockchains, performance is everything — and Monad (MON) is stepping in to challenge the status quo. Officially launched on November 24, 2025, Monad promises to solve one of Ethereum’s most persistent problems: low throughput. By combining full EVM compatibility with high-speed parallel execution capable of processing up to 10,000 transactions per second, Monad aims to deliver Solana-level performance without sacrificing Ethereum’s developer tooling. The project arrives with serious backing — from Paradigm, Coinbase Ventures, and a team of ex-Jump Trading engineers — and a bold claim: scalability without compromise.

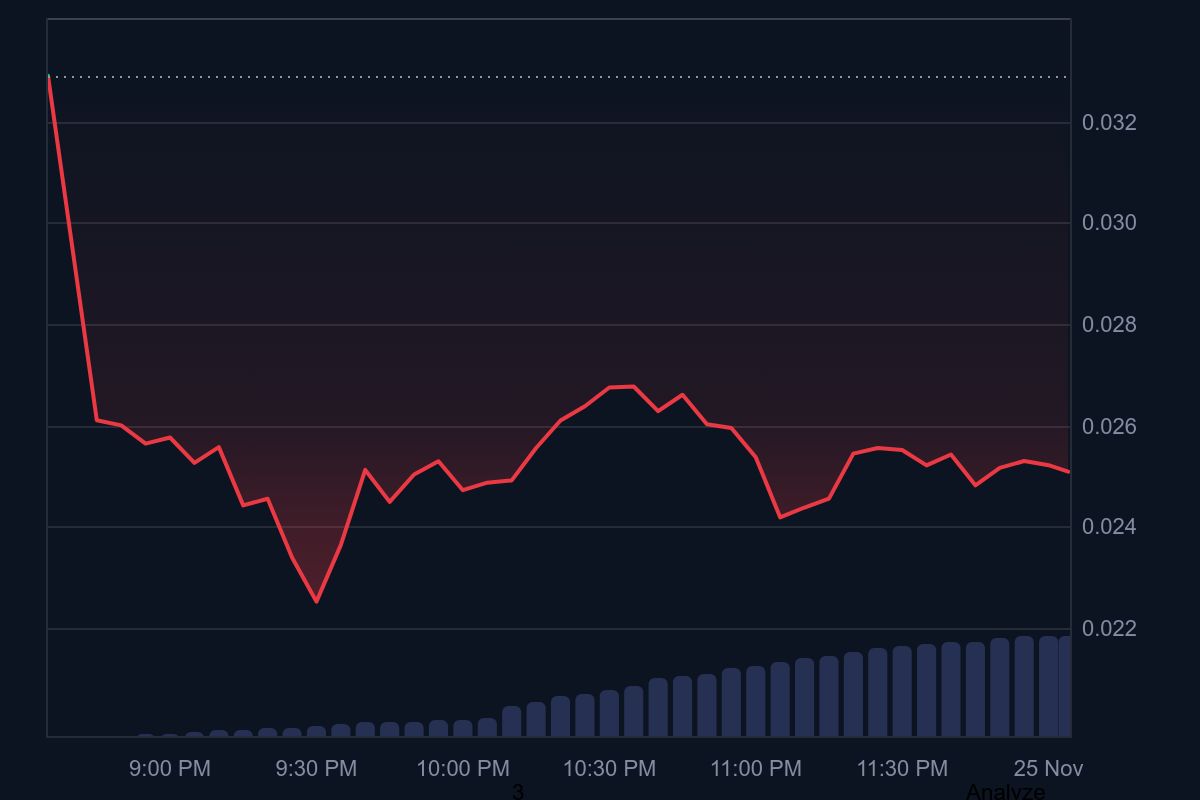

But even the most promising chains must navigate the realities of tokenomics and market appetite. MON debuted around $0.025 with listings on major exchanges like Bitget , yet its price dipped ~15% shortly after launch — a reflection of cautious investor sentiment amid concerns over its 100 billion token supply and limited initial liquidity. As hype cools and fundamentals take center stage, the big question looms: how high can MON go? In this article, we break down its long-term outlook with price predictions through 2030, exploring bullish, neutral, and bearish scenarios — and the key factors that could drive (or derail) its future growth.

What Is Monad (MON)?

Monad is a high-performance Layer-1 blockchain designed to bring massive scalability to Ethereum-compatible applications. Unlike traditional EVM chains that process transactions sequentially, Monad uses a parallel execution engine to handle many transactions at once — boosting throughput up to 10,000 transactions per second. This innovation aims to solve one of Ethereum’s biggest pain points: network congestion and high gas fees during peak demand.

At its core, Monad offers developers the best of both worlds: it supports Ethereum’s existing tools and smart contracts while delivering significantly faster execution and near-instant finality. Built by a team of former Jump Trading engineers, Monad uses a custom consensus mechanism called MonadBFT and targets block times under one second. With strong institutional backing and a developer-first focus, the project positions itself as a next-generation alternative for DeFi, gaming, and beyond — all without forcing users to abandon familiar EVM infrastructure.

2025 Price Prediction

Monad (MON) Price

Source: CoinMarketCap

Monad’s mainnet launch in late 2025 sets the stage for a volatile first year, as early investor sentiment, exchange liquidity, and ecosystem traction all begin to shape the token’s price behavior. With MON currently trading around $0.025 as of this writing, the year ahead could offer sharp upside — or continued pressure — depending on how the market responds to Monad’s technical promises.

● Bullish Scenario ($0.05–$0.07): If the network delivers on its 10,000 TPS target and key dApps begin deploying, MON could double or more from its current price. Major listings on exchanges combined with rising daily volume and early ecosystem TVL, would support a rally toward $0.07.

● Neutral Scenario ($0.035–$0.045): A steady climb is possible if adoption builds at a moderate pace. In this case, MON stabilizes above its ICO price, trading in the $0.035–$0.045 range as infrastructure develops but hype remains contained.

● Bearish Scenario ($0.025–$0.03): If momentum fades or large token holders take profits, MON could hover just above its launch level. Low liquidity, delayed integrations, or market-wide risk-off conditions might keep the price pinned near $0.025 through year-end.

2026 Price Prediction

By 2026, Monad will be under pressure to prove real-world traction beyond testnet stats and launch excitement. Investors will expect meaningful dApp activity, rising Total Value Locked (TVL), and growing user engagement to justify any significant price appreciation. This is the year Monad must shift from potential to performance.

● Bullish Scenario ($0.10–$0.15): If Monad gains visible adoption in DeFi, NFT, or gaming sectors and hits key ecosystem milestones, MON could 4–6× from its current levels. A strong developer pipeline, increased staking participation, and over $500M in TVL could help justify a price range in the $0.10–$0.15 zone.

● Neutral Scenario ($0.07–$0.10): With consistent growth but no breakout moments, MON could trend higher at a steady pace. Moderate exchange activity and gradual inflows into its ecosystem might push the token toward the $0.07–$0.10 range, sustaining investor interest without igniting major FOMO.

● Bearish Scenario ($0.04–$0.06): Slower-than-expected adoption, combined with sell-offs from early investors as lockups expire, could weigh on price action. In this case, MON could remain under pressure, struggling to sustain gains above $0.06 without major ecosystem wins.

2027 Price Prediction

Heading into 2027, Monad’s position in the Layer-1 ecosystem should be clearer. By this point, sustained growth — or lack thereof — will be reflected in developer adoption, user activity, and protocol revenue. The market will be looking for proof that Monad isn’t just fast, but useful.

● Bullish Scenario ($0.20–$0.30): If Monad establishes itself as a credible alternative to Ethereum or Solana for high-throughput applications, MON could accelerate significantly. A strong DeFi ecosystem, robust cross-chain integrations, and recognition as a leading EVM-compatible L1 could lift the price toward $0.30.

● Neutral Scenario ($0.10–$0.15): Continued ecosystem development and healthy market conditions could see MON maintain a stable uptrend. A balanced mix of developer activity and moderate token issuance might keep the price comfortably within this range.

● Bearish Scenario ($0.05–$0.08): If competing blockchains continue to dominate developer mindshare or if Monad fails to retain users, MON could lag behind expectations. The token may hover around or just above its initial range, especially if network usage remains light.

2028–2029 Price Prediction

By 2028 and 2029, Monad’s trajectory will likely be driven less by speculation and more by measurable outcomes: ecosystem size, developer retention, real transaction volumes, and protocol-level monetization. These two years could define whether MON matures into a top-tier Layer-1 asset — or fades into obscurity.

● Bullish Scenario ($0.30–$0.40+): If Monad captures meaningful Layer-1 market share and becomes a hub for high-throughput DeFi, gaming, or enterprise use cases, MON could break above $0.30. Deep liquidity, institutional partnerships, and global developer conferences showcasing Monad could push the token toward $0.40 or higher.

● Neutral Scenario ($0.15–$0.20): Steady but unspectacular growth would likely keep MON in a slow upward channel. If adoption improves year over year but remains modest, the token may consolidate within the $0.15–$0.20 range, driven by moderate use and sustained community support.

● Bearish Scenario ($0.08–$0.10): If Monad fails to meaningfully differentiate itself or gets outpaced by faster-moving rivals, MON could stagnate. The token might remain range-bound near $0.10 as liquidity thins and user activity plateaus, especially in a saturated Layer-1 market.

2030 Price Prediction

By 2030, Monad will either have cemented its role in the blockchain landscape or risk being remembered as a short-lived experiment. This year marks a critical endpoint for most vesting schedules and long-term investor horizons — making it a key inflection point for MON’s valuation.

● Bullish Scenario ($0.40–$0.50): In a best-case outcome, Monad becomes a foundational layer for decentralized apps requiring high throughput and EVM compatibility. If it captures even a small percentage of the global smart contract market, MON could trade between $0.40 and $0.50 — representing a ~16x to 20x return from its launch price.

● Neutral Scenario ($0.20–$0.30): A measured long-term climb could place MON in the $0.20–$0.30 range. This scenario assumes solid ecosystem retention, moderate but sustained adoption, and a stable crypto macro environment, delivering healthy but not explosive returns.

● Bearish Scenario ($0.10–$0.15): In the event Monad underdelivers on network growth or becomes overshadowed by more dominant blockchains, MON might trade closer to $0.10–$0.15. Regulatory friction, limited differentiation, or internal setbacks could all contribute to a muted long-term valuation.

Key Factors Influencing MON's Future Price

Several core variables will shape how Monad (MON) performs over the next five years. While its technology is promising, actual price movement will hinge on execution, adoption, and broader market forces.

● Network Utility and Ecosystem Growth: Monad’s ability to attract developers and users will be the most direct driver of price. If dApps launch successfully and Total Value Locked (TVL) increases, demand for MON as a gas and governance token should rise. Key metrics to watch include daily active addresses, on-chain volume, and smart contract deployments.

● Tokenomics and Supply Dynamics: With a total supply of 100 billion MON — and over half of it allocated to the team and investors — how and when these tokens unlock will significantly affect market price. While lockups limit immediate dilution, future vesting events could create selling pressure unless offset by strong demand.

● Competitive Positioning: Monad enters a field already dominated by Ethereum, Solana, and Avalanche. To justify its market share, Monad must not only be faster — it must also foster a thriving developer community and offer real incentives to switch chains.

● Macro Conditions and Crypto Market Cycles: Like all digital assets, MON will rise and fall with broader market sentiment. Bullish crypto cycles could amplify gains, while bearish periods could suppress even strong fundamentals. Regulatory developments and global monetary policy will also weigh heavily on risk asset performance.

Conclusion

Monad’s mainnet debut may have been modest in market response, but its technical ambition and heavyweight backers make it one of the more intriguing Layer-1 launches in recent memory. With a scalable, Ethereum-compatible architecture and a roadmap focused on high throughput and ecosystem growth, MON has the building blocks for long-term relevance — but success is far from guaranteed.

From 2025 to 2030, MON’s price could travel very different paths depending on how well it executes. Bullish projections put MON as high as $0.50, while bearish views suggest it may struggle to stay above its initial offering price. As with any emerging crypto asset, investors should weigh both the upside potential and the risks — including token distribution, competition, and market volatility. Whether Monad becomes a cornerstone of next-generation decentralized infrastructure or fades into the Layer-1 crowd will depend on the decisions, adoption, and momentum it builds in the years ahead.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.