Brevan Howard has become the biggest shareholder of the BlackRock spot Bitcoin exchange-traded fund (ETF). According to a recent Securities and Exchange Commission (SEC) filing, the hedge fund now owns around 37.5 million shares of IBIT.

This is worth around $2.3 billion and represents a sizable increase since Q1, when the firm had only 21.56 million shares. With the increase, it now tops a list that includes hundreds of institutional investors ranging from traditional financial institutions to tech companies.

Before now, Goldman Sachs was the biggest holder with 30.8 million shares as of the end of the first quarter 2025. At the time, it was valued at $1.4 billion and represented a 28% increase from its holdings at the end of 2024.

Interestingly, Goldman Sachs has yet to disclose its most recent holdings in IBIT. So, it is unclear whether it has increased its stake. It would not be a surprise if the firm does, given that it also has a stake in the Fidelity FBTC ETF.

Brevan Howard stake highlights the hedge fund’s interest in digital assets. The Jersey-based firm, which has around $40 billion in assets under management (AUM), is considered to be one of the biggest macro hedge funds. It has invested billions into digital assets and blockchain technology products and has a dedicated crypto assets division.

More Entities gain and increase exposure to IBIT

Meanwhile, Brevan Howard was not the only firm that increased its stake in IBIT during the second quarter of 2025. Based on SEC filings, Hong Kong-based Avenir owned 16.55 million IBIT shares worth over $1 billion as of June 30.

This marks an increase from the 14.76 million shares it held back in March. Interestingly, the firm also reported a new IBIT put position worth $12.2 million, but its FBTC position remained at $5.5 million.

However, not every firm increased its IBIT holdings. Abu Dhabi sovereign wealth fund Mubadala disclosed that its 8.726 million IBIT shares did not increase since the last filing in May.

On the other hand, Al Warda Investments, an investment fund that listed Abu Dhabi Investment Council as its manager, disclosed that it owned 2.41 million shares of IBIT worth $147.5 million on June 30. Mubadala owns the Abu Dhabi Investment Council.

Nevertheless, the biggest news of exposure to IBIT has been from the Ivy League, with Harvard disclosing that it now has over $117 million stake in IBIT. This is more than the University’s exposure to tech giants such as Google and Nvidia.

Several analysts believe it is a watershed moment for the Bitcoin ETFs. According to Macroscope on X, “It’s certainly one of the most important ownership disclosures since the inception of the Bitcoin ETFs. It will have an impact in the endowment space as well as the broader asset management sector.”

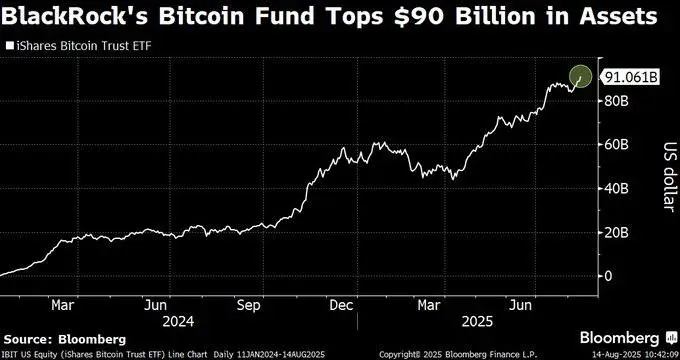

IBIT hits $90 billion in AUM

Meanwhile, the massive interest in IBIT from several institutional investors and sovereign wealth funds drove the BlackRock product to a new peak of over $90 billion AUM. This was enough to make IBIT the 20th largest ETF product out of over 4,400 ETFs in the US.

According to the ETF expert, Nate Geraci, this is a massive milestone for IBIT, particularly given that the product achieved this milestone in just 19 months of existence, making it the best-performing ETF by a large margin.

IBIT reaches $90 billion in AUM (Source: Nate Geraci)

IBIT reaches $90 billion in AUM (Source: Nate Geraci)

However, the recent decline in BTC prices, which has seen the flagship asset fall to $117,000 from as high as $123,000 on August 14, means that the AUM value might have dropped briefly. Still, there is a general sense of bullishness surrounding IBIT, which is evident in its minimal outflows compared to other Bitcoin ETFs.

Farside Investors’ data shows that the product only saw three days of outflows between July 28 and August 14, and Geraci expects the fund to reach $100 billion in AUM soon.

Get seen where it counts. Advertise in Cryptopolitan Research and reach crypto’s sharpest investors and builders.