News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 24)|Ethereum achieves real-time L1 block proof; Solmate surges 40% after $300M financing; Stable’s $825M pre-deposit raises insider concerns2Bitcoin falls below $115,000—is this a delayed reaction to the sale of 80,000 BTC?3Research Report|In-Depth Analysis and Market Cap of aPriori (APR)

Revolut Secures MiCA License in Cyprus, Expanding Regulated Crypto Services Across EU

CryptoNewsNet·2025/10/23 10:39

OpenAI Launches ChatGPT Atlas, a Browser With Integrated AI

Cointribune·2025/10/23 10:39

Aave formalizes a massive annual buyback plan financed by DeFi

Cointribune·2025/10/23 10:39

Hyperliquid (HYPE) To Surge Further? Key Harmonic Pattern Signals Potential Upside Move

CoinsProbe·2025/10/23 10:36

Solana Price Eyes Bullish Crossover as New Addresses Hit Monthly High

Solana’s network growth and bullish MACD signal hint at recovery potential. A breakout above $192 may send SOL toward $200, but losing $183 risks deeper losses.

BeInCrypto·2025/10/23 10:30

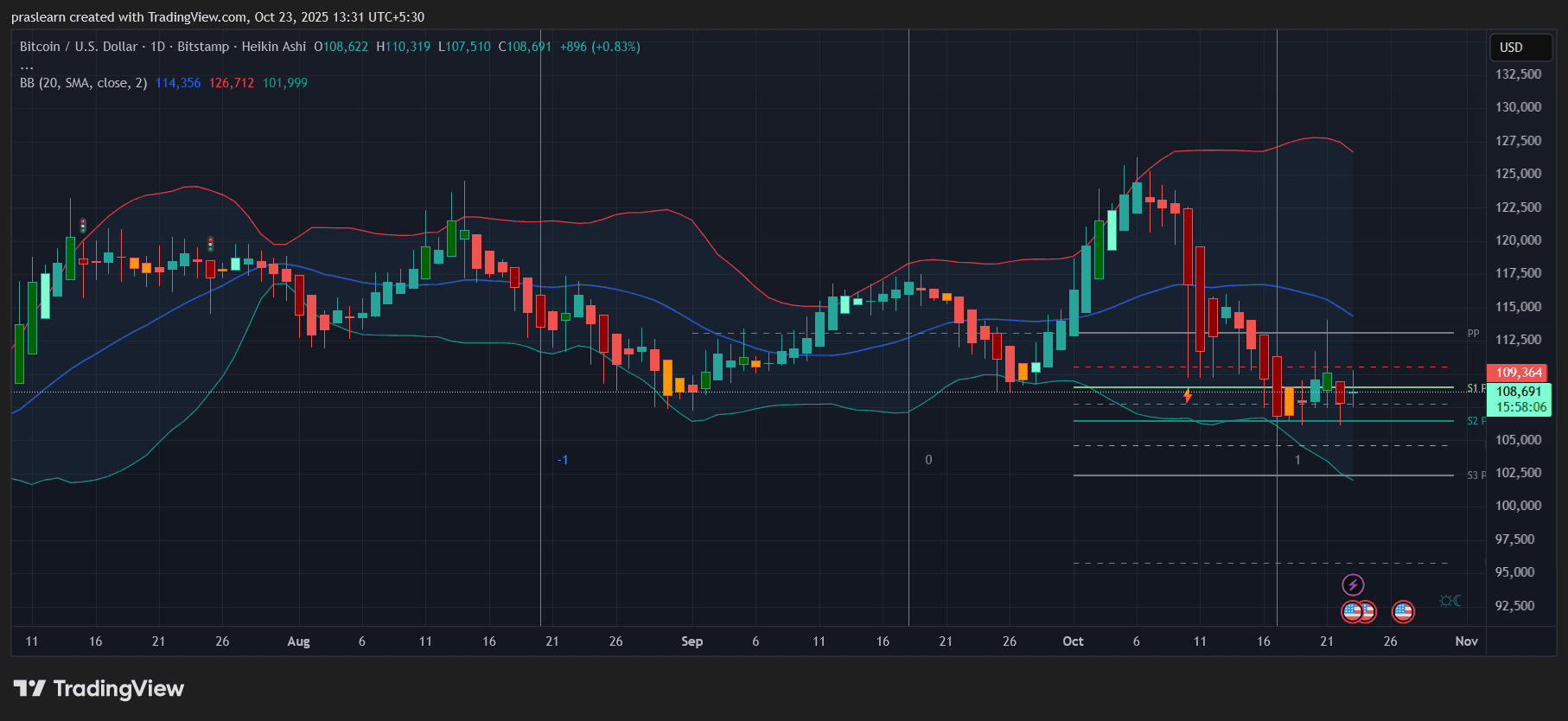

Bitcoin price prediction: BTC reclaims $109k as analysts predict dump

Coinjournal·2025/10/23 10:27

Something Big Is About to Happen to Bitcoin Price

Cryptoticker·2025/10/23 10:15

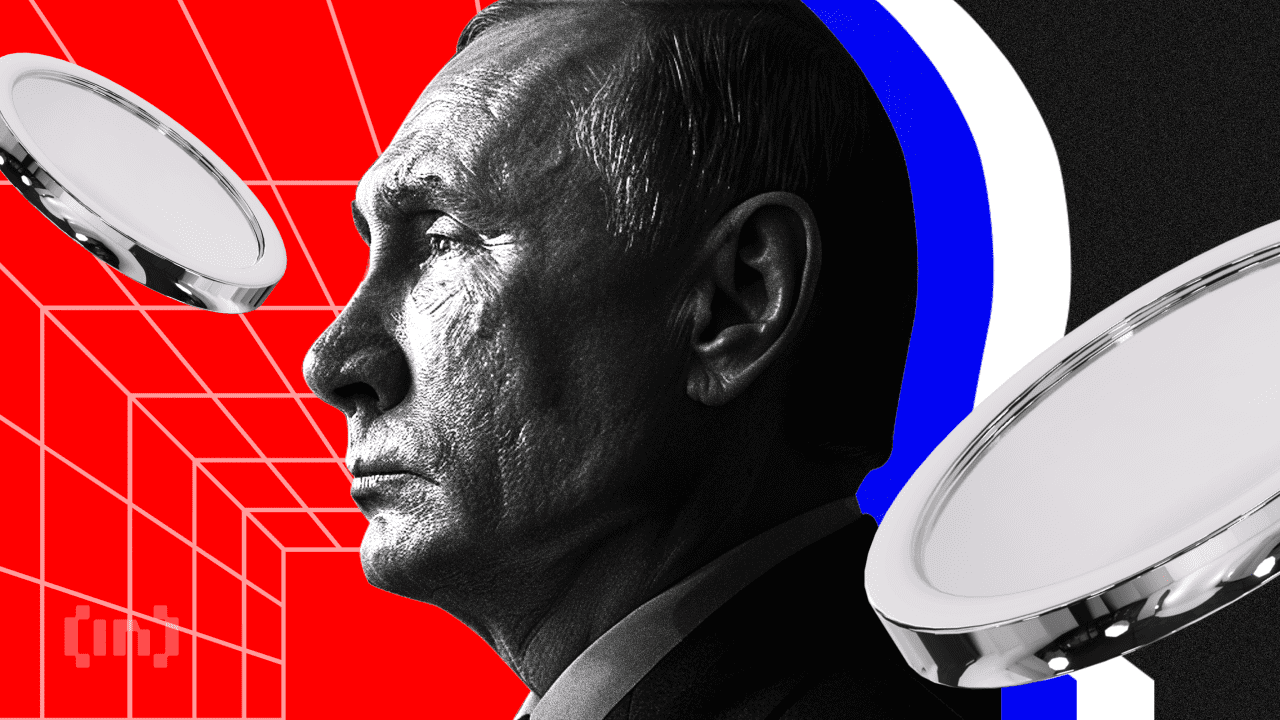

EU Bans Russia-Backed Stablecoin In First Crypto Sanction

Brussels sanctioned a ruble-backed stablecoin used to bypass SWIFT, marking its first crypto-specific penalty on Russia. The EU is now preparing a MiCA-compliant euro token to assert financial sovereignty and counter alternative payment networks.

BeInCrypto·2025/10/23 10:10

Can Google’s 13,000× “quantum echoes” put Bitcoin’s keys on a clock?

CryptoSlate·2025/10/23 10:00

a16z 2025 Report: $4 Trillion Market Cap Record, the First Year of Global Asset On-Chain

It is time to upgrade the financial system, rebuild global payment channels, and create the internet that the world deserves.

BlockBeats·2025/10/23 09:54

Flash

- 20:05All three major U.S. stock indexes closed higher, each reaching new record highs.Jinse Finance reported that all three major U.S. stock indexes closed higher, each reaching new record highs. The Nasdaq rose 1.15%, the Dow Jones increased by 1.01%, and the S&P 500 index gained 0.79%.

- 19:11US government "shutdown" enters its 24th day, over 500,000 federal employees fail to receive salariesJinse Finance reported that on October 24 local time, as the U.S. government shutdown entered its 24th day, more than 500,000 federal employees failed to receive their full paychecks on time this week. The Senate is currently in recess, and the shutdown is expected to continue until next Monday. Due to significant differences between the Republican and Democratic parties on core issues such as healthcare-related welfare spending, the Senate failed to pass a new temporary funding bill before the end of the last fiscal year on September 30, resulting in the federal government running out of funds to maintain normal operations and entering a "shutdown" starting October 1.

- 18:41Tether plans to launch the US-compliant stablecoin USAT in December, targeting 100 million US users.Jinse Finance reported that Tether CEO Paolo Ardoino stated the company plans to launch the US dollar stablecoin USAT, compliant with the GENIUS Act regulations and targeting the US market, in December. By leveraging platforms such as Rumble, Tether aims to expand its potential user base to 100 millions. USAT will be issued by a joint venture between Tether and the regulated crypto bank Anchorage Digital. Ardoino said the company will continue to invest in content platforms and social media to drive creator economy payment applications, competing for market share with rivals such as PayPal. Meanwhile, Tether's flagship stablecoin USDT supply has increased to 182 billions, maintaining its dominant position in the approximately 300 billions stablecoin market. The market value of XAUT, backed by physical gold, has surpassed 2.2 billions this year, more than tripling since the beginning of the year, mainly driven by retail demand.