News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | U.S. Shutdown Crisis Averted; Iran Tensions Boost Oil; Gold Rebounds Amid Microsoft Earnings Split (January 30, 2026)2Bitcoin Plunge Could Get Much Worse as Death Cross Gains Power3 Crypto Market Today Turns Red But LTH Data Signals Structural Stability

Why NetApp (NTAP) Shares Are Falling Today

101 finance·2026/01/20 16:36

Why Shares of Hims & Hers Health (HIMS) Are Falling Today

101 finance·2026/01/20 16:36

Nova (NVMI) Shares Are Rising, Here’s What You Should Be Aware Of

101 finance·2026/01/20 16:36

Estee Lauder sued by beauty tech startup for alleged theft

101 finance·2026/01/20 16:33

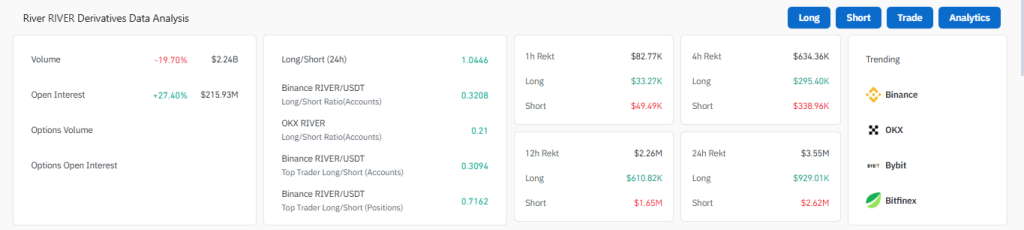

SUI Partners with River: Is RIVER Price Set to Exceed $45 or Enter a Cool-Off Period?

Coinpedia·2026/01/20 16:30

![Bitcoin 2026 [LIVE] Updates : Stock Market, Gold And Silver Price, Crypto News](https://img.bgstatic.com/spider-data/9f50dba99bcac8f0f4c5759f0f619d661768926610959.webp)

Bitcoin 2026 [LIVE] Updates : Stock Market, Gold And Silver Price, Crypto News

Coinpedia·2026/01/20 16:30

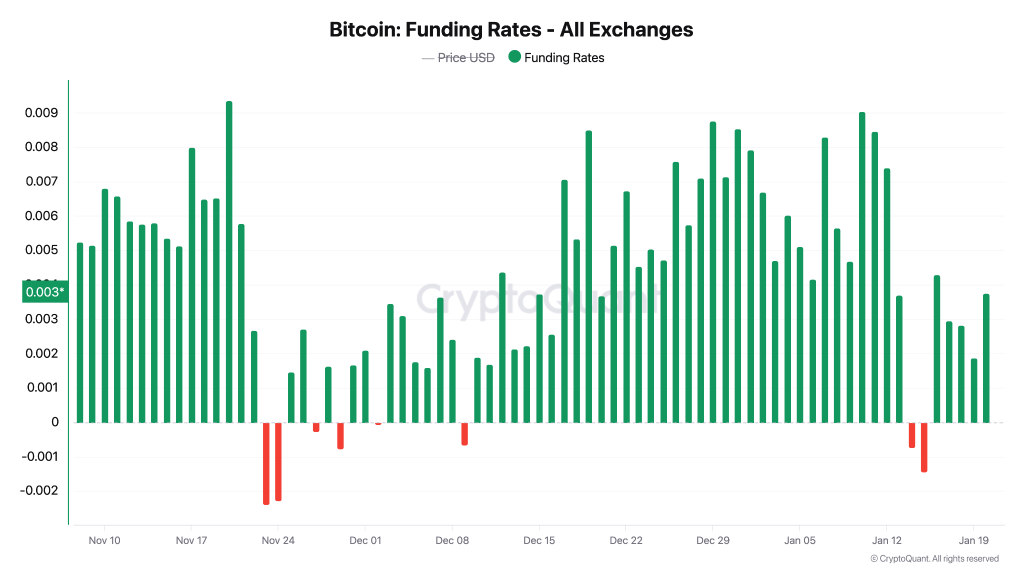

Bitcoin (BTC) Price Slides Below $91K as Open Interest Rises—Is a Deeper Correction Ahead?

Coinpedia·2026/01/20 16:30

Bitcoin Price Outlook Turns Bearish: Worst-Case Scenario Targets Revealed

Coinpedia·2026/01/20 16:30

Netflix boosts £62bn proposal for Warner Bros amid Hollywood takeover contest

101 finance·2026/01/20 16:30

Bitcoin to $62K? Peter Brandt Weighs In—Here’s What the BTC Price Charts Suggest

Coinpedia·2026/01/20 16:30

Flash

13:12

Ondo's DeBorde says the New York Stock Exchange's around-the-clock plan could address key issues with stock tokens.According to a report by Bijie Network: Based on data from RWA.xyz, Ondo Finance's tokenized equity platform, Ondo Global Markets, has surpassed $500 million in total value locked and reached $7 billion in trading volume since its launch in September 2025, becoming the largest provider of tokenized stocks. President Ian de Bode told CoinDesk that stocks and ETFs, with their clear pricing and high liquidity, are ideal scenarios for tokenization and can serve as convenient collateral. The platform supports instant minting and burning of tokens backed by real stocks, enabling global investors and crypto-native investors to conduct large-volume, low-slippage trades. The main challenge currently faced remains the liquidity mismatch between the 24/7 crypto market and traditional trading hours.

13:11

Step Finance hacked, approximately $30 million in SOL transferred to unknown addressesPANews reported on January 31 that Step Finance posted on the X platform stating that several treasury and fee wallets have been compromised and that an investigation into the attack is underway. According to on-chain data, during the incident, approximately 261,854 SOL tokens were unstaked and transferred, with a total value of about $30 million.

12:54

IronWallet launches a new generation multi-chain crypto wallet, supporting gas-free transactions and privacy-first security features.According to a report by Bijie Network: IronWallet has announced an upgrade to its non-custodial wallet platform, focusing on multi-chain support, gasless transactions, and enhanced privacy protection. The platform currently supports over 10,000 tokens on major networks such as Bitcoin, Ethereum, and Solana. Its gasless mode allows transaction fees to be paid directly from the transferred token itself, eliminating the need to hold native gas tokens. As a non-custodial wallet, it requires no KYC verification and offers a physical NFC backup card to secure mnemonic phrases.

News