News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 28)|S. today. Trump nominates Michael Selig as CFTC Chairman. Stablecoin USD1 enters partnership with Enso.2Research Report|In-Depth Analysis and Market Cap of Common Protocol (COMMON)3Is Monero (XMR) Gearing Up for a Bullish Breakout? This Key Pattern Formation Suggest So!

BNB faces pullback risk after 10% drop as charts signal overbought levels

Coinjournal·2025/10/14 14:00

BTC price forecast: Bitcoin stays below $112k ahead of Powell speech

Coinjournal·2025/10/14 14:00

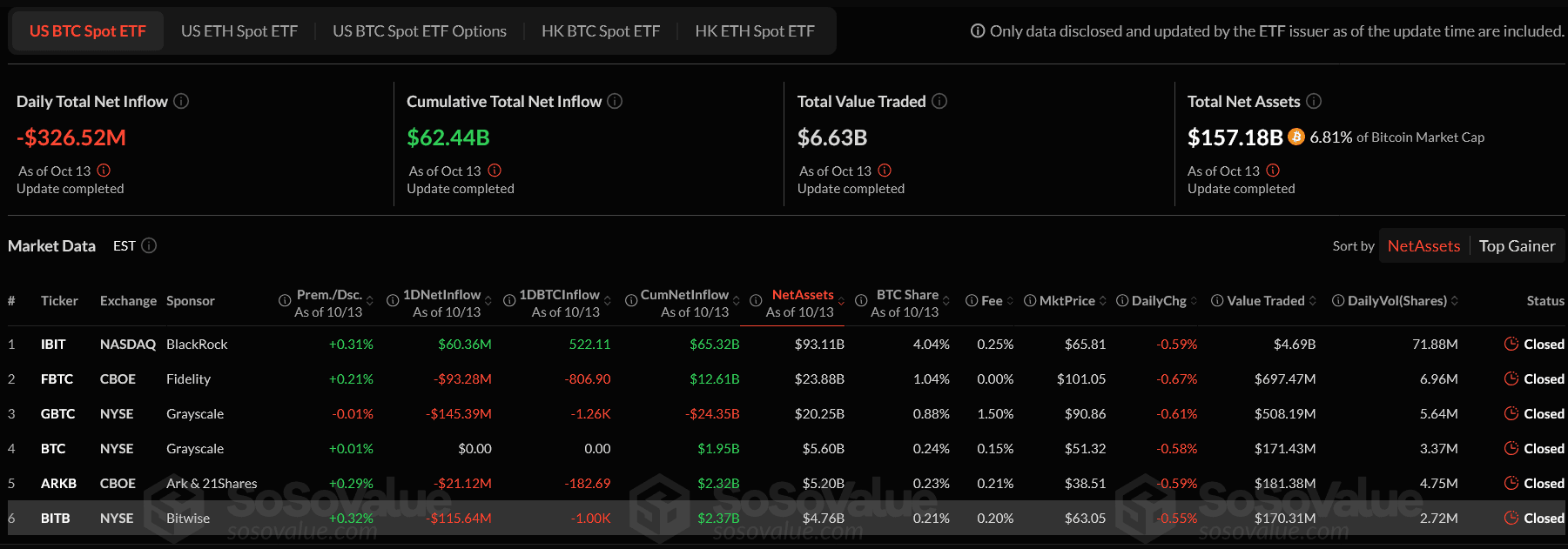

Bitcoin and Ethereum ETFs Crash with $755M Outflow

Cryptoticker·2025/10/14 13:54

Monad has opened the MON token airdrop, ending on November 3

PANews·2025/10/14 13:45

UK politics attempts to copy £5B Trump crypto script, without his levers or power

CryptoSlate·2025/10/14 13:35

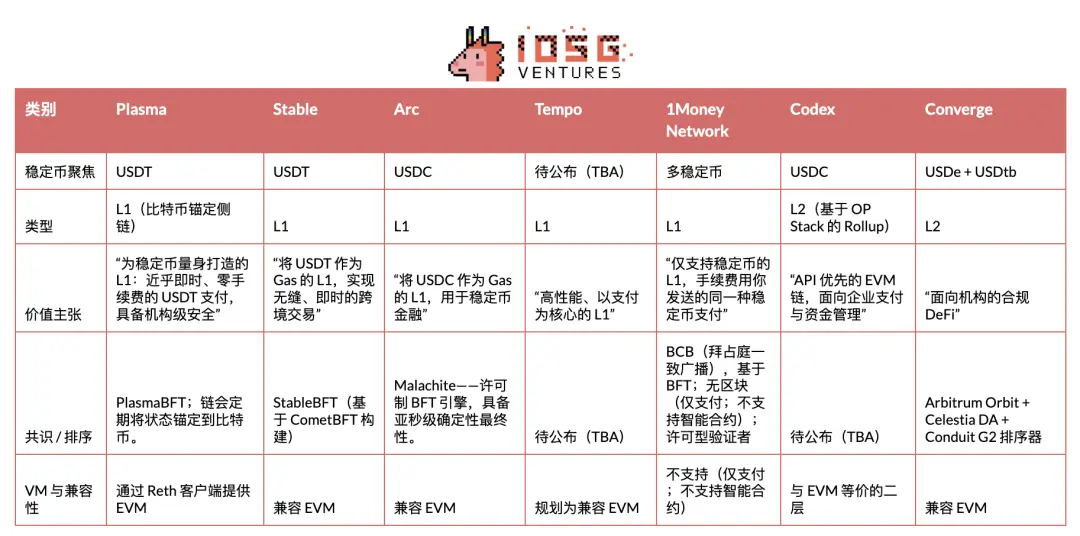

IOSG | In-depth Analysis of Stablecoin Public Chains: Plasma, Stable, and Arc

A deep dive into the issuers behind it, market dynamics, and other participants.

深潮·2025/10/14 13:31

Japan Could Make a Major Change To Crypto Trading Rules

Japan’s financial regulators are preparing a pivotal legal change to treat crypto as a financial product, giving the FSA broader authority to tackle insider trading and tighten oversight of Web3 markets.

BeInCrypto·2025/10/14 13:23

Whale Activity Boosts WLFI Price Amidst Stablecoin Growth

Coinlineup·2025/10/14 13:09

DekaBank Partners with Börse Stuttgart for Retail Crypto Expansion

Coinlineup·2025/10/14 13:09

Vaulta continues to expand its institutional-grade service offering and launches the all-new financial management platform, Omnitrove.

Omnitrove is committed to bridging native crypto assets with the real-world financial infrastructure, providing a unified interface, AI smart tools, and real-time prediction capability to empower diverse digital asset management scenarios and applications.

BlockBeats·2025/10/14 13:06

Flash

- 15:21If Bitcoin surpasses $118,000, the total short liquidation intensity on major CEXs will reach $1.12 billion.BlockBeats News, October 28, according to Coinglass data, if bitcoin breaks through $118,000, the cumulative short liquidation intensity on major CEXs will reach $1.12 billions. Conversely, if bitcoin falls below $113,000, the cumulative long liquidation intensity on major CEXs will reach $1.112 billions. BlockBeats note: The liquidation chart does not display the exact number of contracts to be liquidated or the precise value of contracts being liquidated. The bars on the liquidation chart actually show the relative importance, or intensity, of each liquidation cluster compared to adjacent clusters. Therefore, the liquidation chart demonstrates the extent to which the underlying price reaching a certain level will be affected. A higher "liquidation bar" indicates that once the price reaches that level, there will be a stronger reaction due to a wave of liquidity.

- 15:21OpenAI completes restructuring, Microsoft becomes major shareholder with 27% stakeBlockBeats News, October 28, OpenAI announced on Tuesday that it has completed a capital restructuring, establishing its structure as a nonprofit institution holding a for-profit business. OpenAI stated that its nonprofit entity has now been renamed the OpenAI Foundation and holds equity worth approximately $130 billions in its for-profit division. OpenAI said that its for-profit division has now become a public benefit corporation, named OpenAI Group PBC. Under the new structure, the OpenAI Foundation will hold 26% of the for-profit division's shares, while current and former employees and investors collectively hold 47%. Microsoft has invested in OpenAI since 2019, with a cumulative investment exceeding $13 billions. Microsoft expressed support for this restructuring and stated that its investment in OpenAI Group PBC is now valued at approximately $135 billions, equivalent to 27% of the company's diluted shares.

- 15:20Tether discloses physical gold reserves totaling 375,572.297 troy ouncesChainCatcher news, according to official sources, Tether announced that the market capitalization of its tokenized gold product, Tether Gold (XAUT), has surpassed $2 billion. Tether's total physical gold reserves have reached 375,572.297 troy ounces, with the gold reserves stored in Switzerland and fully compliant with the London Good Delivery standard. The total circulating supply of XAUT tokens is 522,089.3.