News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 12)|World launches a “super app” featuring payments and chat; US initial jobless claims reach 236,000; Satoshi Nakamoto statue installed at the NYSE2Ether vs. Bitcoin: ETH price poised for 80% rally in 20263Prediction markets bet Bitcoin won’t reach $100K before year’s end

Cryptocurrency incubator Obex raises $37 million.

Cointime·2025/11/18 18:03

Revolut has integrated Polygon as a primary infrastructure for crypto payments.

Cointime·2025/11/18 18:03

Liquidity crisis: Are the bulls left with only a "death queue"?

The crypto market experienced another "bullish death spiral" in mid-November.

深潮·2025/11/18 18:03

Cryptocurrency Market Adjusts as Bitcoin Faces Significant Value Decline

In Brief Bitcoin's value drop triggers extensive market rebalancing. No significant shift towards altcoins observed amid major crypto declines. Blockchain activities do not indicate an impending altcoin season.

Cointurk·2025/11/18 17:33

Aave Rolls Out Retail Savings App Offering Up to 9% APY

Cointribune·2025/11/18 17:30

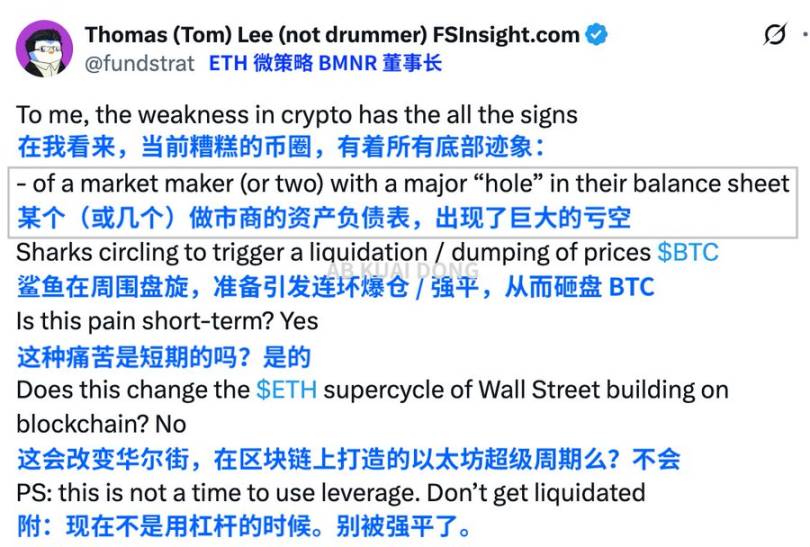

Ethereum May Be Entering a Bitcoin-Like ‘Supercycle,’ Says Tom Lee

Cointribune·2025/11/18 17:30

Bitcoin Slump Deepens as Small-Cap Cryptos Sink to Four-Year Lows

Cointribune·2025/11/18 17:30

SEC Leaves Crypto Out of Its 2026 Priorities

Cointribune·2025/11/18 17:30

SEC Drops Dedicated Crypto Section in 2026 Examination Priorities

DeFi Planet·2025/11/18 17:21

Cboe to Launch U.S.-Regulated Continuous Bitcoin and Ether Futures on December 15

DeFi Planet·2025/11/18 17:21

Flash

- 13:43Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchaseChainCatcher reported that Strategy founder Michael Saylor has once again released information related to the bitcoin Tracker. According to previous patterns, Strategy always discloses information about increasing its bitcoin holdings on the day after such announcements are made.

- 13:38The probability of a "25 basis point rate hike by the Bank of Japan in December" on Polymarket is currently reported at 98%.According to Jinse Finance, data from the relevant Polymarket page shows that the probability of the "Bank of Japan raising interest rates by 25 basis points in December" on Polymarket is currently reported at 98%, while the probability of no change in interest rates is 2%. It is reported that the Bank of Japan plans to announce its interest rate decision on December 19.

- 12:41The hardcore bearish whale's 20x leveraged BTC short position is now floating a profit of over $18 million.According to ChainCatcher, as the market experienced a short-term decline, the hardcore bearish whale (0x5D2...9bb7), who had previously shorted BTC four times in a row, now has an unrealized profit of $18.151 million on a 20x leveraged Bitcoin short position. This whale currently holds about 820 BTC in this position, with an average entry price of $111,499.3 and a current liquidation price of $102,440.7.

News