News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

BlackRock's crypto ETF fee revenue fell by 38%, indicating that the ETF business is not immune to market cycles.

Bitcoin has dominated the market in this cycle, attracting over $732 billions in new capital. Institutional participation and market structure have significantly strengthened, while tokenized assets and decentralized derivatives are rapidly reshaping the industry ecosystem.

What are the new features in Clanker's presale?

Quick Take Solana treasury Solmate and veteran crypto venture and infrastructure firm RockawayX announced plans for an all-stock merger expected to close early next year. Solmate previously announced plans for an aggressive M&A strategy to bolster its treasury and staking operations.

Quick Take The IMF warned Thursday that stablecoins could speed up currency substitution in countries with weak monetary systems, reducing central banks’ control over capital flows. The IMF said the rise of dollar-backed stablecoins and their easy cross-border use may push people and businesses in unstable economies to favor dollar stablecoins over local currencies.

Quick Take On Thursday, executives from the likes of Citadel Securities to Coinbase to Galaxy discussed tokenization at an SEC Investor Advisory Committee meeting. Thursday’s meeting comes a day after some tension arose among some crypto advocates against a letter submitted by Citadel Securities on Wednesday.

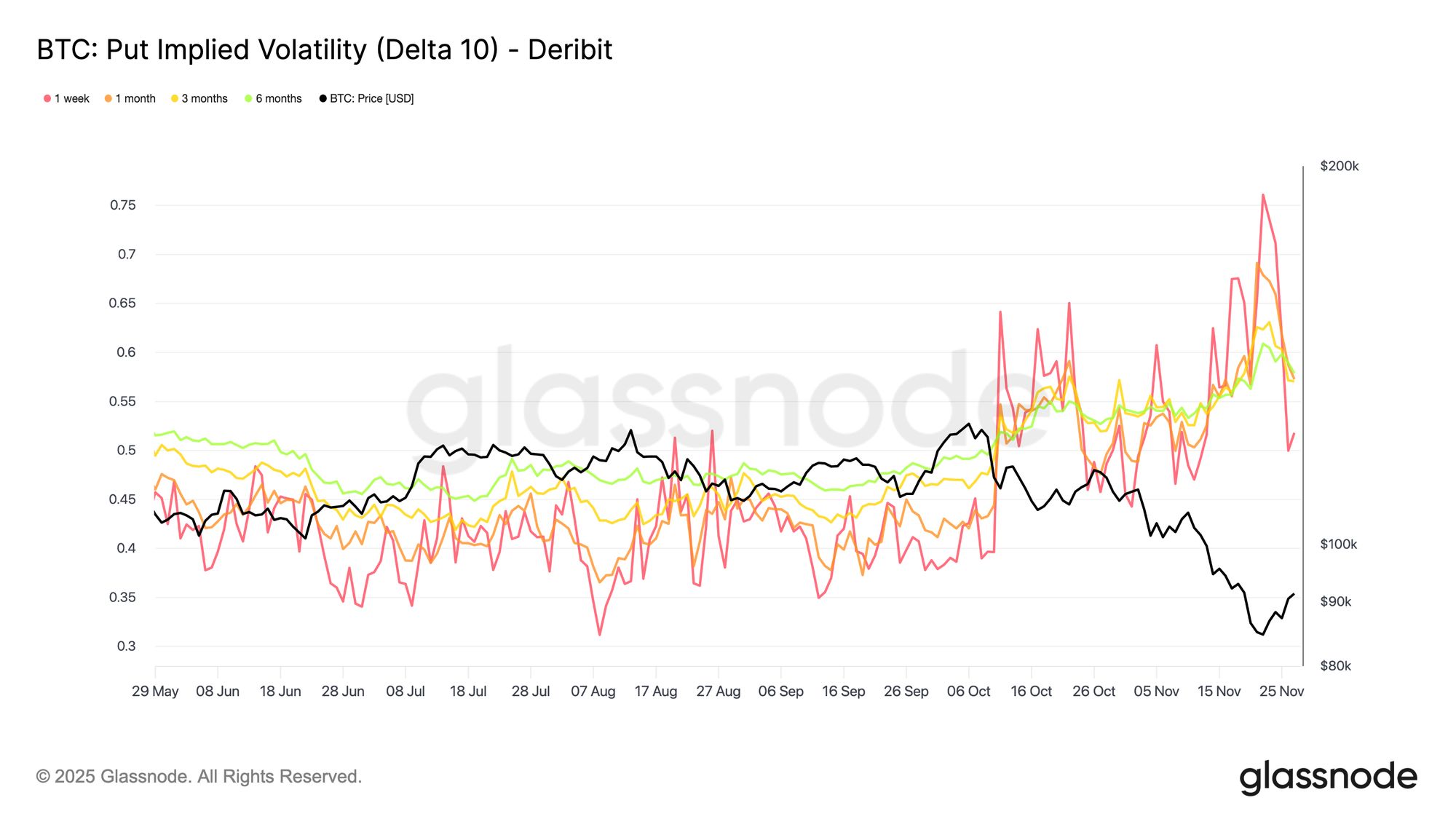

Interpolated implied volatilities across deltas and maturities for BTC, ETH, SOL, XRP, BNB, and PAXG are live in Studio, further expanding our options market coverage.

- 21:52Data: 18.7761 million ARB transferred to a certain exchange, worth approximately $4.1894 millionAccording to ChainCatcher, Arkham data shows that at 05:41, 18.7761 million ARB (worth approximately $4.1894 million) were transferred from an anonymous address (starting with 0xD20F...) to an exchange.

- 21:32Malaysian Crown Prince-backed telecom company Bullish Aim launches ringgit stablecoin RMJDTForesight News reported, citing Bloomberg, that the eldest son of the King of Malaysia is launching a stablecoin pegged to the country's fiat currency, targeting the cross-border payments market in the Asia-Pacific region. Telecom company Bullish Aim announced on Tuesday the launch of RMJDT—a new stablecoin backed by the Malaysian ringgit. The company is owned by Prince Ismail Ibrahim, a member of the Johor royal family and the current King of Malaysia. The stablecoin will be issued on the Layer 1 blockchain Zetrix. In addition to issuing the stablecoin, Bullish Aim will establish a Digital Asset Treasury (DAT) company and allocate 500 million ringgit (approximately $121.5 million) worth of Zetrix (ZETRIX) tokens as the initial treasury asset allocation.

- 21:31Stablecoin public chain Tempo has launched its public betaForesight News reported that the stablecoin public chain Tempo announced on Twitter that it has opened for public beta testing. According to the official disclosure, its current partners include Anthropic, Deutsche Bank, DoorDash, OpenAI, Revolut, Shopify, Standard Chartered Bank, Visa, Figure, Gusto, Kalshi, Klarna, Mastercard, and UBS.