News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The player in the trenches understands the direction of liquidity. They grasp a simple truth: the era of a singular memecoin season is no more.

Aster faces heavy selling pressure with RSI and CMF signaling strong outflows. Holding above $1.17 is key to avoiding a deeper fall toward $1.00.

For companies exposed to the dual risks of the crypto market and the stock market, has the worst already passed?

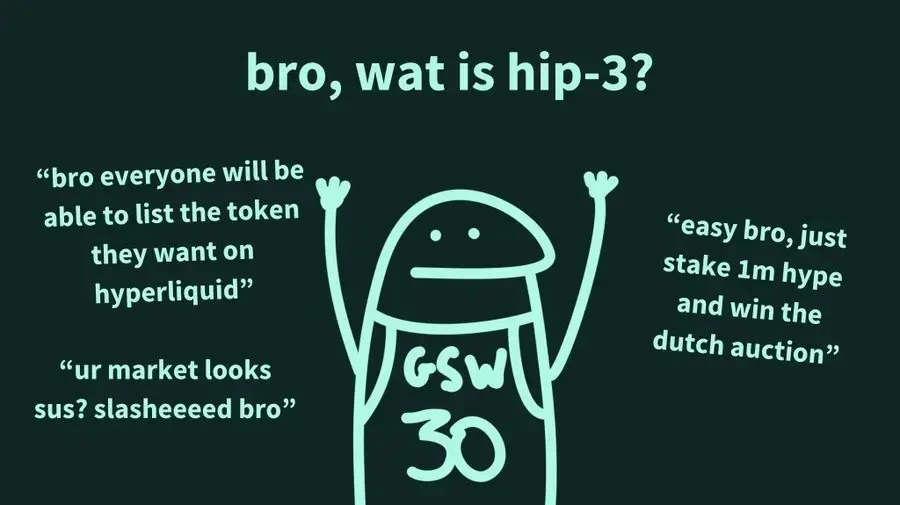

HIP-3 is a major improvement proposal for the Hyperliquid exchange, aimed at decentralizing the launch process of perpetual contract markets by allowing any developer to deploy new contract trading markets on HyperCore.

Bitcoin rebounds as trade tensions ease and Israeli hostages are released, with buyers returning to the market after last week's cryptocurrency crash.

Yieldbasis recently completed a $5 million funding round (accounting for 2.5% of total supply) through Kraken and Legion, with a fully diluted valuation (FDV) of $200 million.

- 14:02U.S. labor cost growth drops to 3.5%, easing inflationary pressuresAccording to ChainCatcher, citing Golden Ten Data, data from the U.S. Bureau of Labor Statistics shows that the annual increase in labor costs slowed to 3.5% in the third quarter, marking the slowest growth rate in four years, with a quarter-on-quarter increase of 0.8%. This data indicates that the job market continues to cool, which helps to ease inflationary pressures. Many employers are slowing down hiring, and some companies have started layoffs, reflecting a decline in workers' confidence in job-hopping prospects.

- 13:36Fidelity: Buyers purchased around 430,000 bitcoins near $85,500, which may serve as an important support level.Jinse Finance reported that Fidelity Digital Assets, a subsidiary of Fidelity, stated on the X platform that as macro expectations shift, bitcoin has regained upward momentum, with its current price fluctuating in the $90,000 range. Trading data shows that around $85,500 (about 32% below the all-time high), the bitcoin buying volume reached approximately 430,000 coins, indicating that this price level will be an important support. Currently, market volatility has stabilized, and Fidelity will closely monitor the market's reaction to today's Federal Reserve meeting.

- 13:31TRON ECO launches Holiday Odyssey to kick off the Christmas and New Year exploration journeyAccording to ChainCatcher, as reported on the official Twitter account, TRON ECO has announced the Holiday Odyssey special event, which will be held from December 10, 2025, to January 18, 2026. In collaboration with ecosystem projects such as SunPump, WINkLink, BitTorrent, JUST, AINFT, and OSK, the event will create an interstellar exploration journey spanning Christmas and New Year. Users can participate in interactions and creative activities to collect holiday rewards across five themed planets, collectively illuminating the TRON ecosystem universe. The pre-heating phase has already begun, and more surprises will be revealed soon.