News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Thomas J. Lee, Fundstrat's chief analyst, forecasts strong Q4 2025 growth in tech sectors like semiconductors and AI, citing SOX index momentum and AVGO's 20% YTD gains. - His strategic pivot to value stocks (Russell 2000) and energy sectors reflects diversification needs amid Fed rate cuts and Bitcoin's $100k milestone signaling risk-on sentiment. - Lee advocates rebalancing portfolios with inflation-linked ETFs (USAF) and small-cap allocations to hedge against macroeconomic uncertainties while maintain

- Ethereum has become Wall Street's blockchain infrastructure, with 50+ non-crypto firms building on its smart contract platform for DeFi, stablecoin settlements, and tokenized assets. - Institutional adoption surged to $27.66B in Ethereum ETFs by Q3 2025, driven by SEC-approved in-kind redemptions and regulatory clarity from the CLARITY/GENIUS Acts. - Pectra/Dencun upgrades reduced gas fees by 90%, enabling 10,000 TPS at $0.08/tx, while PoS transition cut energy use by 99%, reinforcing institutional confi

- MAGACOIN FINANCE (MAGA) emerges as a 2025 presale altcoin with 35x-25,000x ROI projections, combining deflationary mechanics and institutional validation. - Its 12% transaction burn rate and dual 100/100 security audits from HashEx/CertiK attract $1.4B in whale inflows, distinguishing it from typical meme coins. - Competing with XRP/SUI, MAGA leverages a DAO governance model and "PATRIOT50X" promo to accelerate adoption, with 12% supply remaining before Binance/Coinbase listings.

- XRP's 2025 SEC settlement resolved legal uncertainty, unlocking institutional adoption with $1.2B ETF inflows and 300+ banks using its cross-border payments. - XRP's $0.0002 fees and 1.5M daily transactions outperform Bitcoin/Ethereum's higher costs, driving 300+ financial institutions to adopt Ripple's ODL service. - Analysts project XRP could reach $5.25 by 2030, surpassing Bitcoin/Ethereum due to regulatory clarity, institutional momentum, and real-world payment utility. - XRP's $1.1B institutional pu

When Luna crashed, he did not shirk responsibility but instead gave a detailed account of what happened to Terra and what Galaxy Digital had misjudged.

The architecture of DeFi unleashes new financial freedom, breaking down barriers of geography, identity, and institutions.

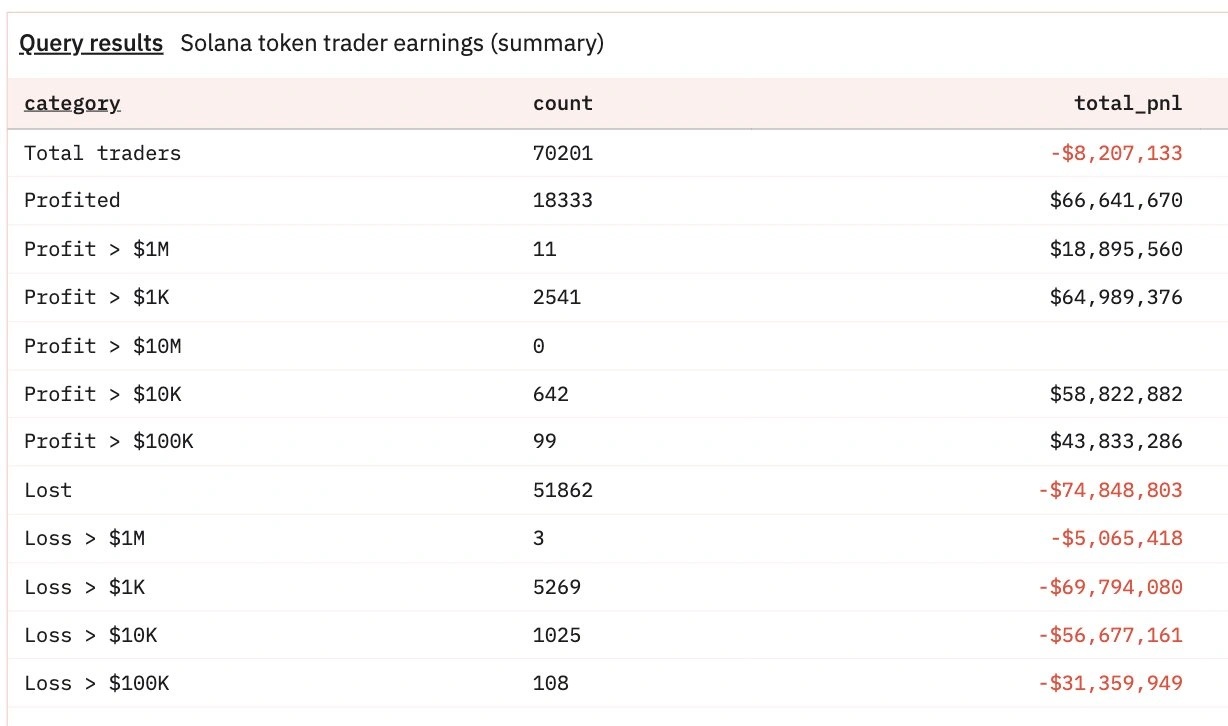

Share link:In this post: Over 51,000 YZY traders lost nearly $75 million within days of launch. Eleven wallets pocketed over $1 million each, capturing 30% of profits. Known traders and rug-pull orchestrators like “Naseem” and Hayden Davis were linked to multimillion-dollar gains.

Share link:In this post: FIST tokens rallied to new highs above $3.52, while receiving severe warnings on a potential liquidity crunch. Most FIST trading happens in a single PancakeSwap pair carrying 95% of daily volumes, where a single whale supplied 77% of liquidity. Fistbump aims to relaunch as a DEX project, though sparking doubts about an attempt to cash out after years of bear market.

- Solana's blockchain powers AI-driven industrial automation, enabling real-time data processing and secure microtransactions with 2,400 TPS and $0.036 per transaction. - AI reshapes manufacturing by displacing 1.7M U.S. jobs since 2000 but creates demand for AI trainers, cybersecurity experts, and green energy technicians with 22-44% projected growth by 2032. - Solana's 43% annualized return (2025) and REX-Osprey ETF adoption highlight its role as foundational infrastructure for AI-enhanced industries, de

- 09:29Data: A newly created wallet withdrew 276,030 LINK, worth $4.95 million, from a certain exchange.According to ChainCatcher, Onchain Lens has detected that a newly created wallet withdrew 276,030 LINK from an exchange, worth 4.95 million US dollars. Currently, this whale still holds 1,619,000 LINK.

- 09:11An address profited $675,000 from trading PING within two daysAccording to Jinse Finance, monitored by Lookonchain, trader 0xe688 made a profit of $675,000 from trading $PING in less than two days. Previously, the trader spent $89,000 to purchase 13.42 million $PING, then sold 6.72 million $PING for a profit of $377,000, and currently still holds 6.72 million $PING (worth $387,000), with a total profit of $675,000 (+759%).

- 09:08PYUSD attestation report: total circulation surpasses 2.6 billion, reaching a new high with approximately 125.5% growth since AugustChainCatcher news, Paxos has released an attestation report for the stablecoin PYUSD, issued by KPMG, one of the "Big Four accounting firms." The report reveals that as of October 15, the total tokens outstanding for PYUSD had risen to 2,638,336,904, reaching a new all-time high. The nominal value of redeemable collateral in total net assets was $2,652,728,424, which is higher than the total tokens outstanding of PYUSD. It is reported that Paxos did not release an attestation report for September, while in August it disclosed that the total PYUSD in circulation was 1,169,714,720, indicating that the circulation has increased by approximately 125.5% over the past two months.