News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

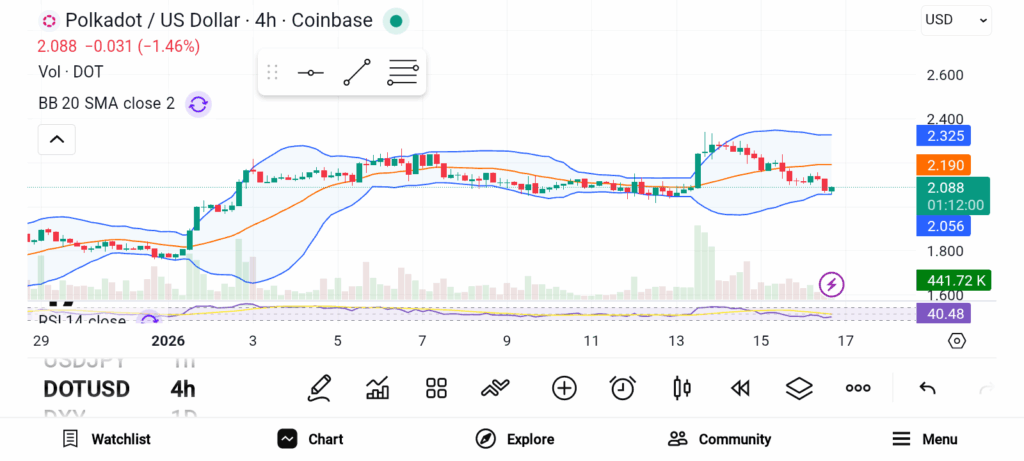

3 DeFi Altcoins to Accumulate in 2026 — DOT, UNI, AAVE

Cryptonewsland·2026/01/25 13:39

I feel quite uncertain regarding the consumer

101 finance·2026/01/25 13:33

Best Altcoins To Buy: DeepSnitch AI Nearing Its Final Week As Traders Eye 100x Launch, XRP and SHIB Show Signs of Rallying

BlockchainReporter·2026/01/25 13:30

10 Altcoins Experience Explosive Trading Volume in South Korea – XRP Not in the Top Five, Here’s the List

BitcoinSistemi·2026/01/25 13:21

Best Presale To Buy Today After Missing Hedera (HBAR) Early Price Opportunity

BlockchainReporter·2026/01/25 13:21

Indian police detain four over fraudulent investment scam

Cointelegraph·2026/01/25 13:09

See the Differences in Retirement Savings Across Age Groups in the U.S.

101 finance·2026/01/25 13:09

How people in the United States are incorporating AI into their jobs, based on recent Gallup survey results

101 finance·2026/01/25 13:06

Japanese Yen Weekly Outlook: USD/JPY Encounters Pressure with Upcoming Fed Decision

101 finance·2026/01/25 13:03

Flash

17:40

The current TVL of the RWA sector is $19.399 billions.According to Jinse Finance, data from DefiLlama shows that the total value locked (TVL) in the Real World Asset Tokenization (RWA) sector is $19.399 billions. Among them: ·Tether Gold TVL has reached $2.643 billions; ·Ondo Finance TVL has reached $2.587 billions; ·BlackRock BUIDL TVL has reached $2.45 billions.

17:02

Data: 503.88 BTC transferred from an anonymous address, routed through intermediaries, and deposited into an exchangeAccording to Arkham data, at 00:56, 503.88 BTC (worth approximately 44.24 million USD) were transferred from an anonymous address (starting with 1LmN1K...) to multiple addresses. Subsequently, 0.00031891 BTC of this amount was transferred to an exchange.

16:59

Tezos "Tallinn" upgrade officially launched, block time reduced to 6 secondsJinse Finance reported that Tezos, a first-layer blockchain network utilizing Proof of Stake (PoS), has completed its latest protocol upgrade—Tallinn—on Saturday, reducing the base layer block production time to 6 seconds. This upgrade marks the 20th protocol update for Tezos. According to Tezos' announcement, Tallinn not only shortens block times but also significantly reduces storage costs and network latency, resulting in faster network finality. In addition, Tallinn allows all network validators to confirm each block, rather than only a subset of validators as in previous protocol versions.