News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Bitcoin options open interest hits an all-time high of $63B, with investors betting on higher prices, says CoinGlass.What Does This Mean for the Market?A Sign of Strength in Crypto Derivatives

- CEX spot trading surged 30.6% in Q3 2025 to $4.7T, driven by Bitcoin's $123k rally and institutional inflows after regulatory clarity. - Derivatives volume rose 29% to $26T, with Binance leading spot (43%) and derivatives (31.3%) markets despite regulatory scrutiny in South Korea. - LBank emerged as a growth leader with 4% global spot share, boosted by emerging asset strategies and CertiK partnerships. - Challenges persist: Binance faces $106M GOPAX compensation demands and a $19B crash backlash, highlig

- JPMorgan Chase will let institutional clients use Bitcoin and Ethereum as loan collateral by year-end, via third-party custodians. - The move follows broader crypto adoption by banks like Morgan Stanley and Fidelity amid Bitcoin's price surge and relaxed regulations. - CEO Jamie Dimon's softened stance reflects growing client demand and evolving global crypto frameworks in EU, Singapore, and UAE. - Third-party custody mitigates security risks while regulatory uncertainty and volatility remain key challen

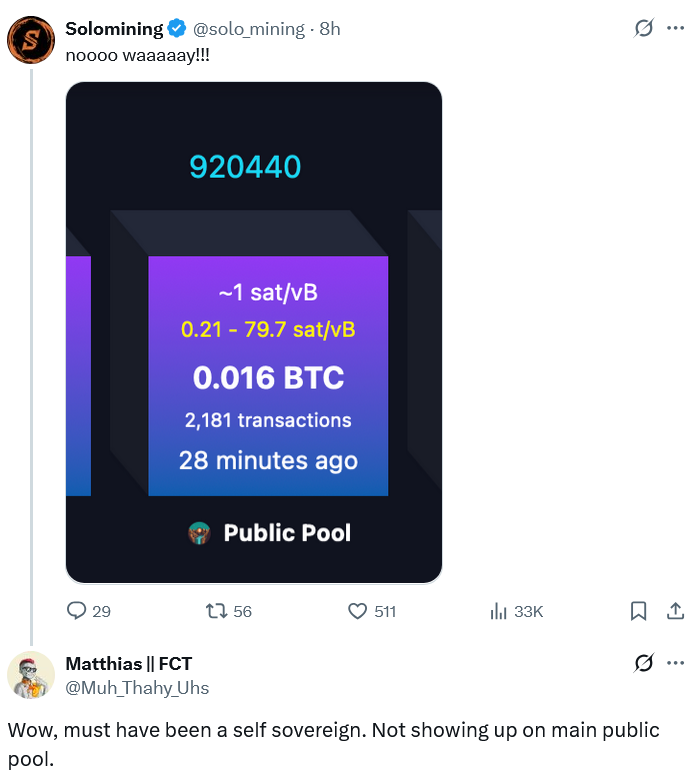

- Trump's pardon of Binance founder Zhao sparks global debate on crypto regulation and political influence. - Zhao, who paid $50M fine for AML failures, faces criticism for alleged ties to Trump's crypto ventures. - White House defends decision as overprosecution, while critics accuse administration of "pay-to-play" corruption. - Binance's BNB surged 15% post-pardon, with analysts calling it a potential "game-changer" for U.S. crypto. - Zhao pledged support for Trump's "crypto capital" vision, fueling spec

- 18:11Data: If ETH breaks through $4,083, the cumulative short liquidation intensity on major CEXs will reach $1.561 billions.According to ChainCatcher, citing data from Coinglass, if ETH breaks through $4,083, the cumulative short liquidation intensity on major CEXs will reach $1.561 billions. Conversely, if ETH falls below $3,697, the cumulative long liquidation intensity on major CEXs will reach $1.292 billions.

- 18:11Deutsche Bank now expects the Federal Reserve to announce the end of quantitative tightening next week instead of in December.Jinse Finance reported that Deutsche Bank strategists wrote in a report on Friday that they now expect the Federal Reserve to announce the halt of balance sheet reduction at next week's policy meeting, rather than at the December meeting, in order to avoid a "serious blow" to its policy credibility after repo rates continued to unexpectedly surge this week.

- 17:23The Federal Reserve's overnight reverse repurchase agreement (RRP) usage on Friday was $2.435 billion.Jinse Finance reported that the Federal Reserve's overnight reverse repurchase agreement (RRP) usage was $2.435 billion on Friday, compared to $6.941 billion in the previous trading day.