Analysis: The soaring interest rates on capital may lay the groundwork for a Bitcoin pullback

On December 6, Bitcoin fell after hitting a record high, with some traders already seeking to hedge deeper pullback risks. The funding rate is a key indicator of leverage in the cryptocurrency market and is currently approaching its highest level ever. This data suggests that traders are willing to pay a high premium to increase their long bets' leverage, and perpetual contracts are one of the most commonly used products for investors to double down on the directional trend of Bitcoin prices. As past bull markets have shown, high funding rates could potentially set up for pullbacks. Nathanaël Cohen, co-founder of digital asset hedge fund INDIGO Fund, said that while the funding rate is a good way to gauge market overheating, it can also be very dangerous as it may stay at high levels longer than expected. (Bloomberg)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Spot Ethereum ETFs Now Hold Over 5% of ETH Supply

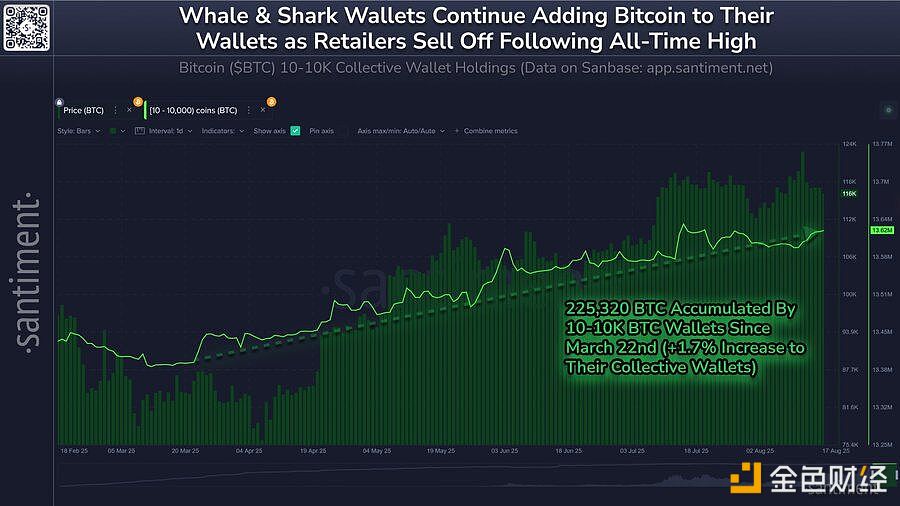

Since Last Week’s Pullback, Bitcoin Whales Have Accumulated 20,061 BTC