The favored indicators of the Federal Reserve show a slowdown in price pressure, and expectations for interest rate cuts are heating up for 2025

On December 20, the inflation indicator favored by the Federal Reserve showed a moderate performance in November, which is a step in the right direction for policymakers seeking further interest rate cuts in 2025. These data should help alleviate Fed officials' concerns about inflation prospects. Fed officials released their latest forecasts this week, showing that prices and interest rates will be higher in 2025. These new forecasts triggered a sell-off of U.S. stocks as investors have already digested expectations of policy tightening. Details on prices show a general slowdown in inflation. Core service prices (a closely watched category excluding housing and energy) rose by 0.2% month-on-month, the lowest level since August. Core goods prices (excluding food and energy) fell for the first time in three months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

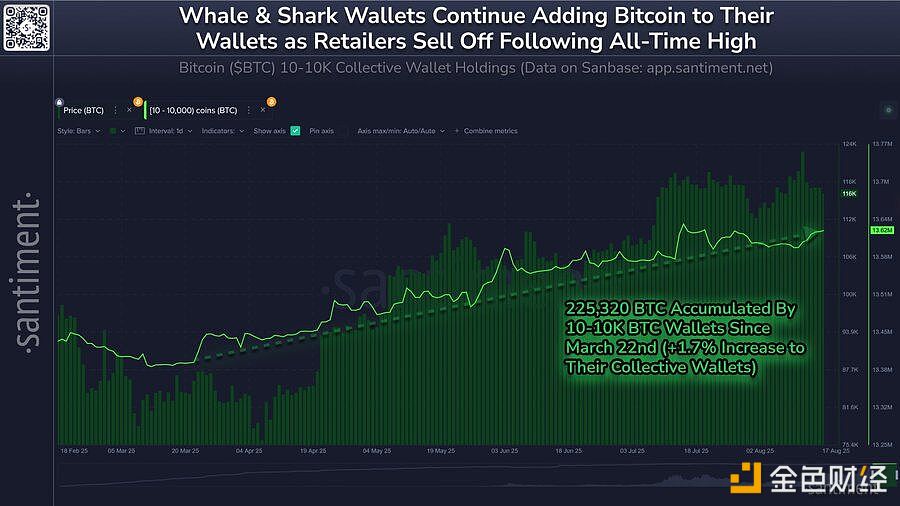

Since Last Week’s Pullback, Bitcoin Whales Have Accumulated 20,061 BTC

Data: "Big Brother Ma Ji" Jeffrey Huang's Long Positions Show Unrealized Losses of Nearly $10 Million