Chainlink Price in Trouble?

Chainlink (LINK) , one of the foundational projects in the decentralized oracle space, is showing signs of weakness after a brief recovery attempt in April. With the price now trending lower on both daily and hourly timeframes, traders are closely watching to see whether LINK can hold its critical support levels —or if a deeper correction is imminent.

Let’s break down the technical setup in detail and analyze what the charts are really saying.

Chainlink Price Prediction: Resistance Still Dominates

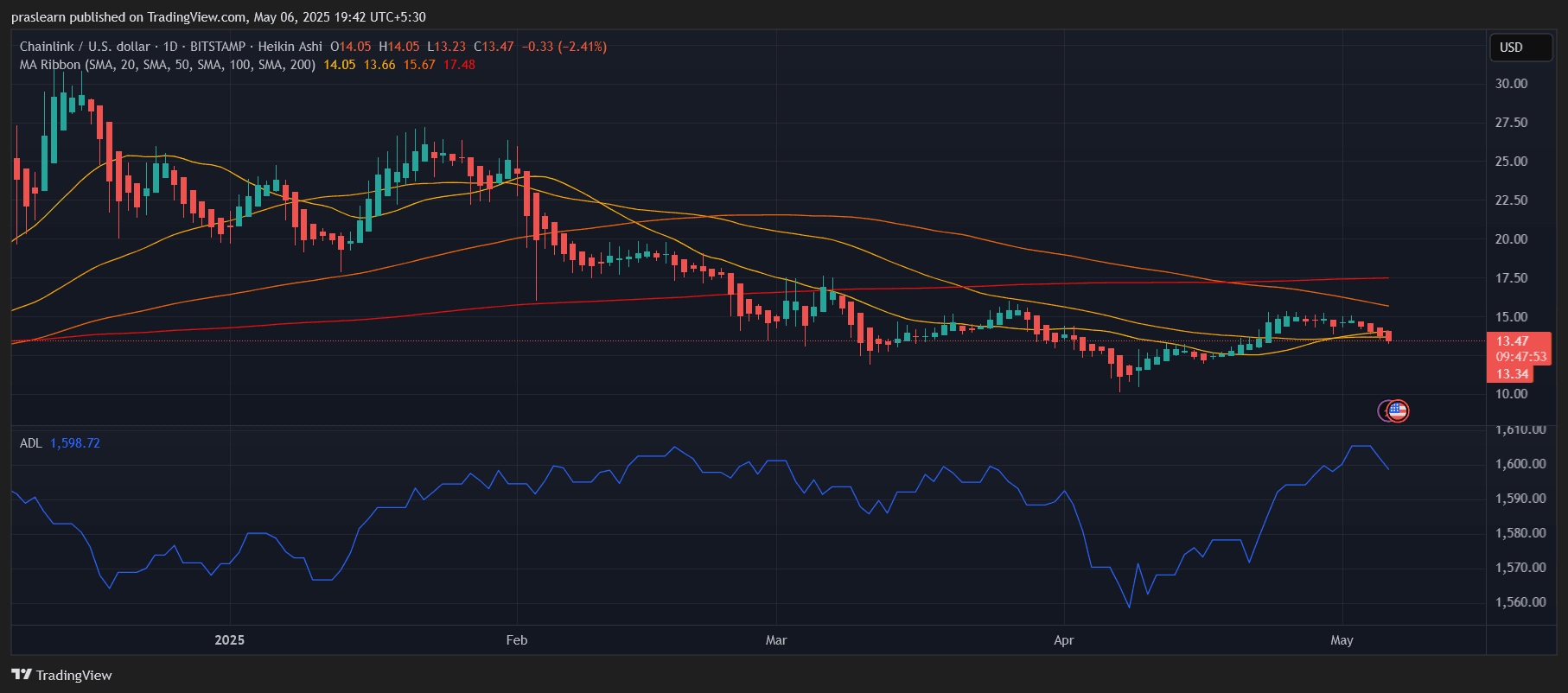

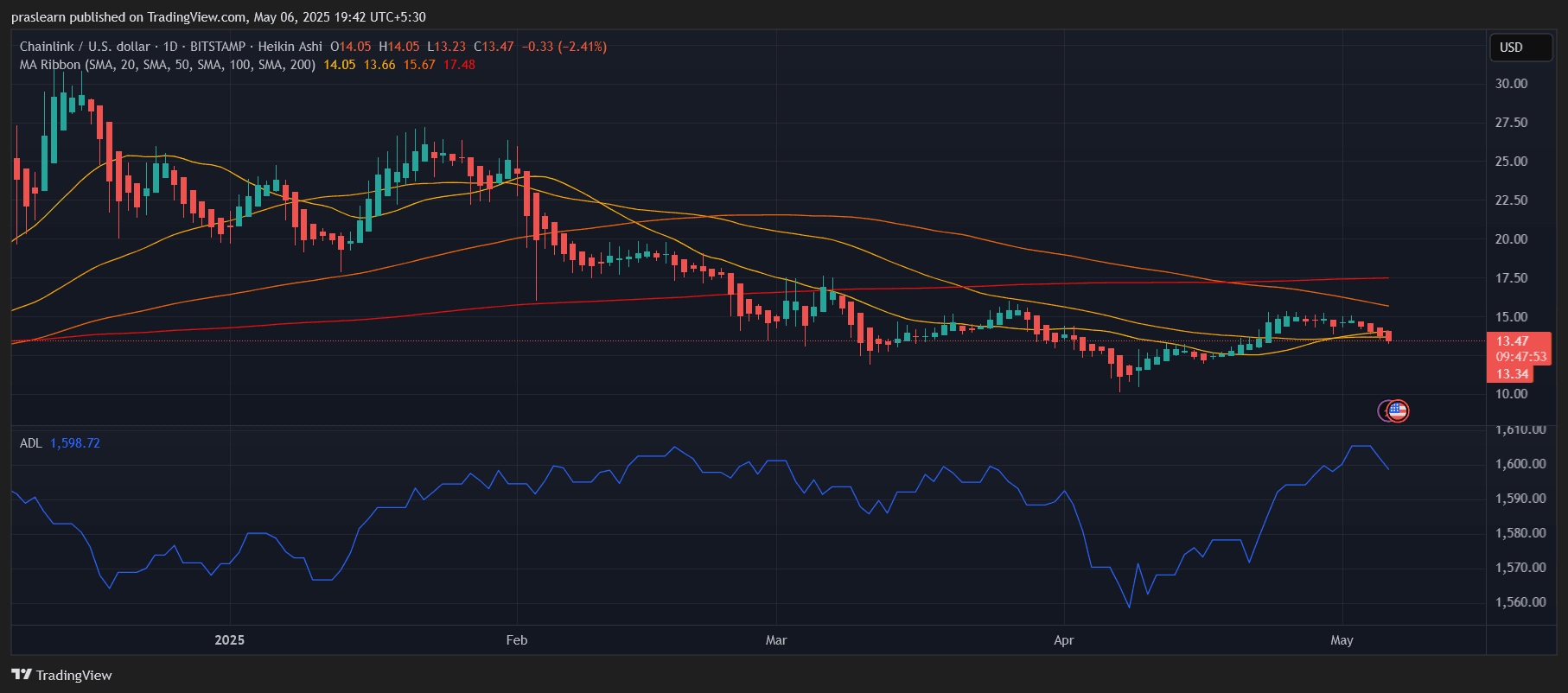

LINK/USD 1 Day Chart- TradingView

LINK/USD 1 Day Chart- TradingView

On the daily timeframe, Chainlink is currently trading near $13.47 , down approximately 2.4% in the most recent candle. After bouncing from a low near $11 in April, LINK staged a moderate recovery but faced immediate rejection just below the 200-day simple moving average (SMA), which sits around $17.48.

The MA ribbon clearly shows all key moving averages (20, 50, 100, and 200 SMAs) still sloping downward, forming a bearish alignment. This means the longer-term trend remains bearish despite short-term attempts at rallies.

Notably, LINK price failed to break the 100-day SMA (~$15.67), which has acted as dynamic resistance for weeks. Each time the price approached this zone, sellers stepped in with high volume.

The Heikin Ashi candles are now printing consistent red bodies, suggesting a shift in short-term sentiment from optimism to caution.

On the volume side, although the Accumulation/Distribution Line (ADL) shows accumulation since early April, the divergence between price and volume may soon resolve—either in a breakout above $15 or a drop below $13.

Key Daily Support Levels:

- $13.00 – Current short-term support

- $12.20 – March support zone

- $11.00 – April swing low

Resistance to Watch:

- $15.50 – Major resistance from April

- $17.50 – 200-day SMA and previous top

- $20.00 – Psychological resistance level

Hourly Chart Insights: Bearish Pressure Mounting

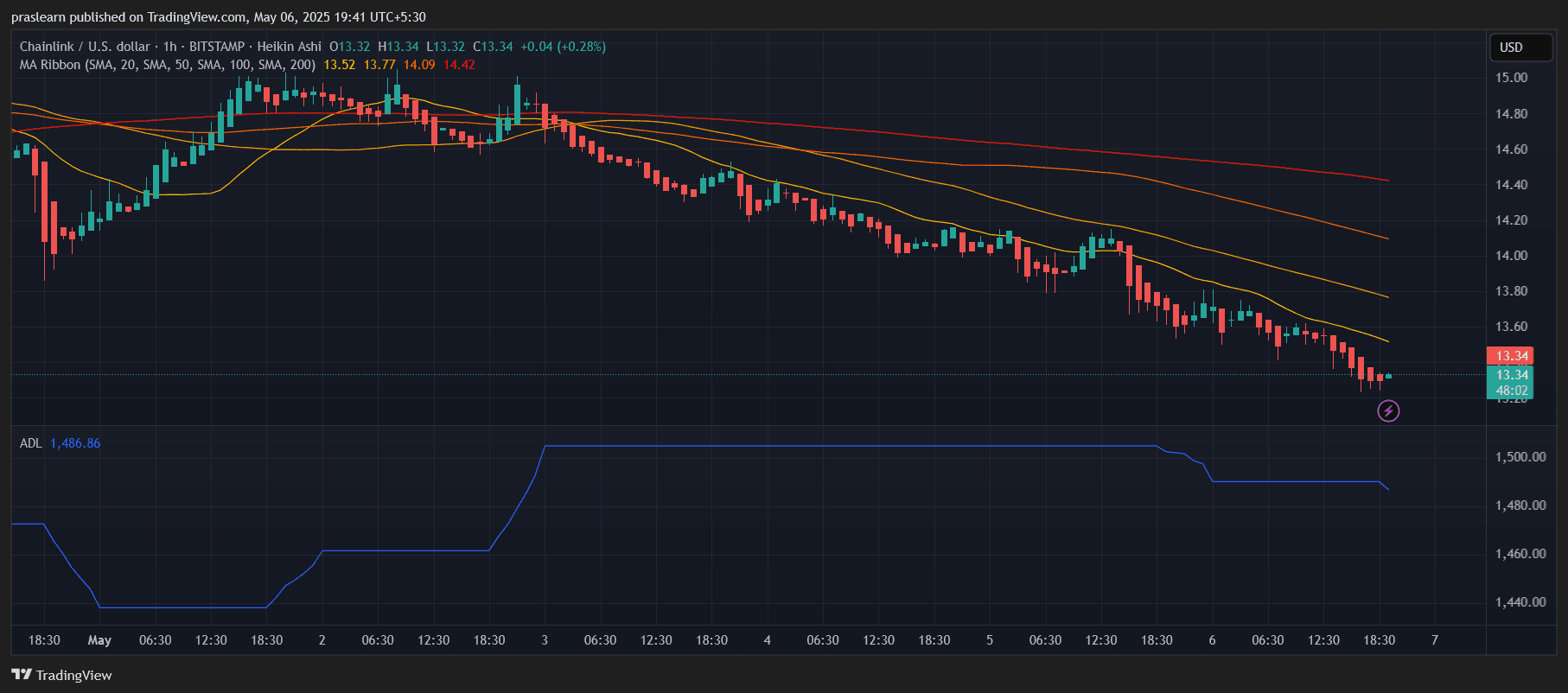

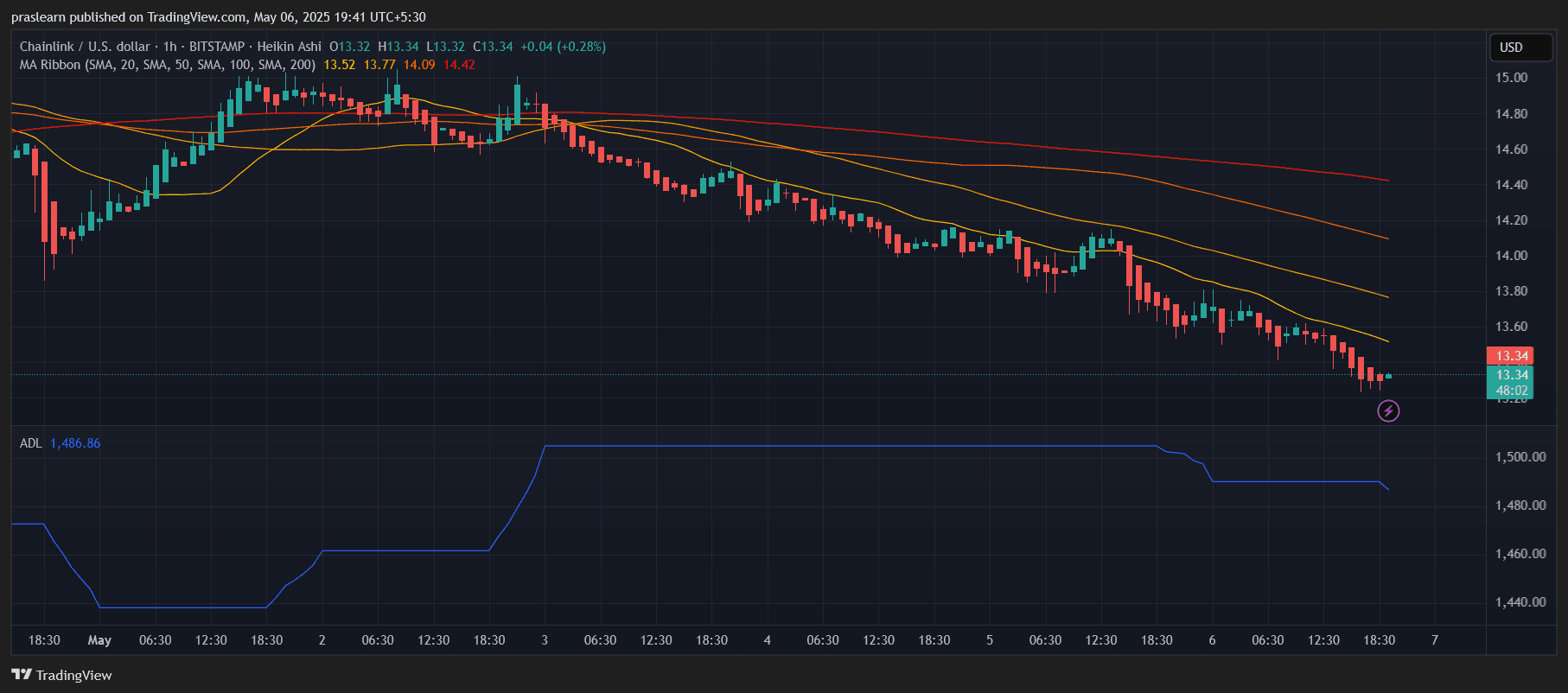

LINK/USD 1 Hr Chart- TradingVIew

LINK/USD 1 Hr Chart- TradingVIew

Zooming into the 1-hour chart, the weakness becomes more evident. LINK has been steadily grinding lower since May 3, with a clear series of lower highs and lower lows. The price is now stuck below all major intraday SMAs (20, 50, 100, 200), which are all trending downward—a textbook bearish setup.

The hourly MA Ribbon shows continued overhead resistance, especially around the $14 zone, where price rejections have been common.

One interesting observation is that despite the drop, there is a flattening of the ADL (Accumulation/Distribution Line) on the hourly chart. This may indicate some buyers accumulating at lower levels, but so far, they haven’t gained enough strength to reverse the trend.

A break above $14.20, ideally accompanied by a bullish engulfing candle and spike in volume, could trigger a short squeeze toward $15. But until that happens, the short-term outlook remains bearish.

Momentum, Market Sentiment & What Comes Next

Chainlink price recovery rally has stalled , and both intraday and swing traders are now facing a moment of truth. If $13 fails to hold as support, it could open the door to a retest of $12.20 or even $11.00 in the coming days. This would align with the broader crypto market correction, especially if Bitcoin and Ethereum fail to hold their own key support levels.

However, if bulls can defend the $13.00 zone and reclaim $14.50, a more sustained rally toward the $17–$18 range could be on the table, especially if the daily ADL starts to rise again.

Chainlink Price Prediction: Bearish Bias Until $15 Breaks

While Chainlink’s fundamentals remain strong in the long term, its current technical outlook leans bearish. The rejection at the 100-day SMA, weakening short-term momentum, and overhead resistance all suggest that LINK is likely to remain under pressure unless buyers step in aggressively above $14.50.

Until then, traders should watch the $13.00 zone very closely—it could determine whether LINK consolidates sideways or slides toward deeper support levels.

Chainlink (LINK) , one of the foundational projects in the decentralized oracle space, is showing signs of weakness after a brief recovery attempt in April. With the price now trending lower on both daily and hourly timeframes, traders are closely watching to see whether LINK can hold its critical support levels —or if a deeper correction is imminent.

Let’s break down the technical setup in detail and analyze what the charts are really saying.

Chainlink Price Prediction: Resistance Still Dominates

LINK/USD 1 Day Chart- TradingView

LINK/USD 1 Day Chart- TradingView

On the daily timeframe, Chainlink is currently trading near $13.47 , down approximately 2.4% in the most recent candle. After bouncing from a low near $11 in April, LINK staged a moderate recovery but faced immediate rejection just below the 200-day simple moving average (SMA), which sits around $17.48.

The MA ribbon clearly shows all key moving averages (20, 50, 100, and 200 SMAs) still sloping downward, forming a bearish alignment. This means the longer-term trend remains bearish despite short-term attempts at rallies.

Notably, LINK price failed to break the 100-day SMA (~$15.67), which has acted as dynamic resistance for weeks. Each time the price approached this zone, sellers stepped in with high volume.

The Heikin Ashi candles are now printing consistent red bodies, suggesting a shift in short-term sentiment from optimism to caution.

On the volume side, although the Accumulation/Distribution Line (ADL) shows accumulation since early April, the divergence between price and volume may soon resolve—either in a breakout above $15 or a drop below $13.

Key Daily Support Levels:

- $13.00 – Current short-term support

- $12.20 – March support zone

- $11.00 – April swing low

Resistance to Watch:

- $15.50 – Major resistance from April

- $17.50 – 200-day SMA and previous top

- $20.00 – Psychological resistance level

Hourly Chart Insights: Bearish Pressure Mounting

LINK/USD 1 Hr Chart- TradingVIew

LINK/USD 1 Hr Chart- TradingVIew

Zooming into the 1-hour chart, the weakness becomes more evident. LINK has been steadily grinding lower since May 3, with a clear series of lower highs and lower lows. The price is now stuck below all major intraday SMAs (20, 50, 100, 200), which are all trending downward—a textbook bearish setup.

The hourly MA Ribbon shows continued overhead resistance, especially around the $14 zone, where price rejections have been common.

One interesting observation is that despite the drop, there is a flattening of the ADL (Accumulation/Distribution Line) on the hourly chart. This may indicate some buyers accumulating at lower levels, but so far, they haven’t gained enough strength to reverse the trend.

A break above $14.20, ideally accompanied by a bullish engulfing candle and spike in volume, could trigger a short squeeze toward $15. But until that happens, the short-term outlook remains bearish.

Momentum, Market Sentiment & What Comes Next

Chainlink price recovery rally has stalled , and both intraday and swing traders are now facing a moment of truth. If $13 fails to hold as support, it could open the door to a retest of $12.20 or even $11.00 in the coming days. This would align with the broader crypto market correction, especially if Bitcoin and Ethereum fail to hold their own key support levels.

However, if bulls can defend the $13.00 zone and reclaim $14.50, a more sustained rally toward the $17–$18 range could be on the table, especially if the daily ADL starts to rise again.

Chainlink Price Prediction: Bearish Bias Until $15 Breaks

While Chainlink’s fundamentals remain strong in the long term, its current technical outlook leans bearish. The rejection at the 100-day SMA, weakening short-term momentum, and overhead resistance all suggest that LINK is likely to remain under pressure unless buyers step in aggressively above $14.50.

Until then, traders should watch the $13.00 zone very closely—it could determine whether LINK consolidates sideways or slides toward deeper support levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google: Why We Want to Build Our Own Blockchain GCUL

This is more like a consortium blockchain dedicated to stablecoins.

In-depth Analysis of USD.AI: Backed by YZi Labs Investment, Enjoying Both Stable Returns and AI Dividends

USD.AI generates yields through AI hardware collateralization, filling the gap in computing resource financing.

The Prophet Returning from the Cold

Chainlink has not replaced traditional financial systems; instead, they have built a translation layer that enables traditional financial systems to "speak the language of blockchain."

[Long Thread] Besides securing a $10 million investment from WLFI, what makes Falcon stand out?