Truth Social files for ETF holding BTC, ETH, SOL, XRP and CRO

Truth Social, the media platform affiliated with US President Donald Trump, has submitted a new application to the US Securities and Exchange Commission (SEC) for a spot crypto exchange-traded fund (ETF).

The proposed vehicle, titled the Truth Social Crypto Blue Chip ETF, aims to provide direct exposure to a basket of leading digital assets, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and Cronos (CRO).

The news had a limited market impact on more established digital assets like BTC, ETH, SOL, and XRP. However, it boosted CRO’s value by more than 12% to a monthly high of $0.09202.

Truth Social Crypto Blue Chip ETF

According to the July 8 SEC filing, the ETF portfolio will be structured to hold approximately 70% Bitcoin, 15% Ethereum, 8% Solana, 5% Cronos, and 2% XRP by value.

If approved, the ETF will be listed and traded on NYSE Arca, though the fund’s ticker symbol has not yet been disclosed.

The proposed ETF will operate as a passive investment vehicle, tracking the market prices of its underlying crypto without using leverage, derivatives, or speculative trading strategies. The fund will also participate in staking for assets such as Ethereum, Solana, and Cronos, enabling it to generate staking rewards.

The filing names Crypto.com’s institutional arm, Foris DAX Trust Company, as the custodian responsible for safeguarding the fund’s assets.

Yorkville America Digital Asset Management will act as the ETF’s sponsor, overseeing operations and compliance. CF Benchmarks Ltd., a well-known index provider, will be tasked with calculating and publishing US dollar valuations for the fund’s digital assets.

In addition, the Trust may allow in-kind transactions, where Authorized Participants exchange crypto directly for ETF shares, if the NYSE Arca receives the necessary regulatory approval. However, the timeline for this approval remains uncertain.

Crypto ETFs

This application follows Trump Media’s earlier filing for a separate spot Bitcoin and Ethereum ETF, which proposes a simpler 75% BTC and 25% ETH allocation.

Both filings arrive as the SEC weighs a streamlined process for listing crypto ETFs, potentially signaling broader institutional adoption soon.

Nate Geraci, president of NovaDiusWealth, opined that the industry might not see any new ETF approval until this framework is implemented. He said:

“Some issuers don’t believe this framework will be fully implemented until early fall. So, no spot crypto ETF approvals until then.”

The post Truth Social files for ETF holding BTC, ETH, SOL, XRP and CRO appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

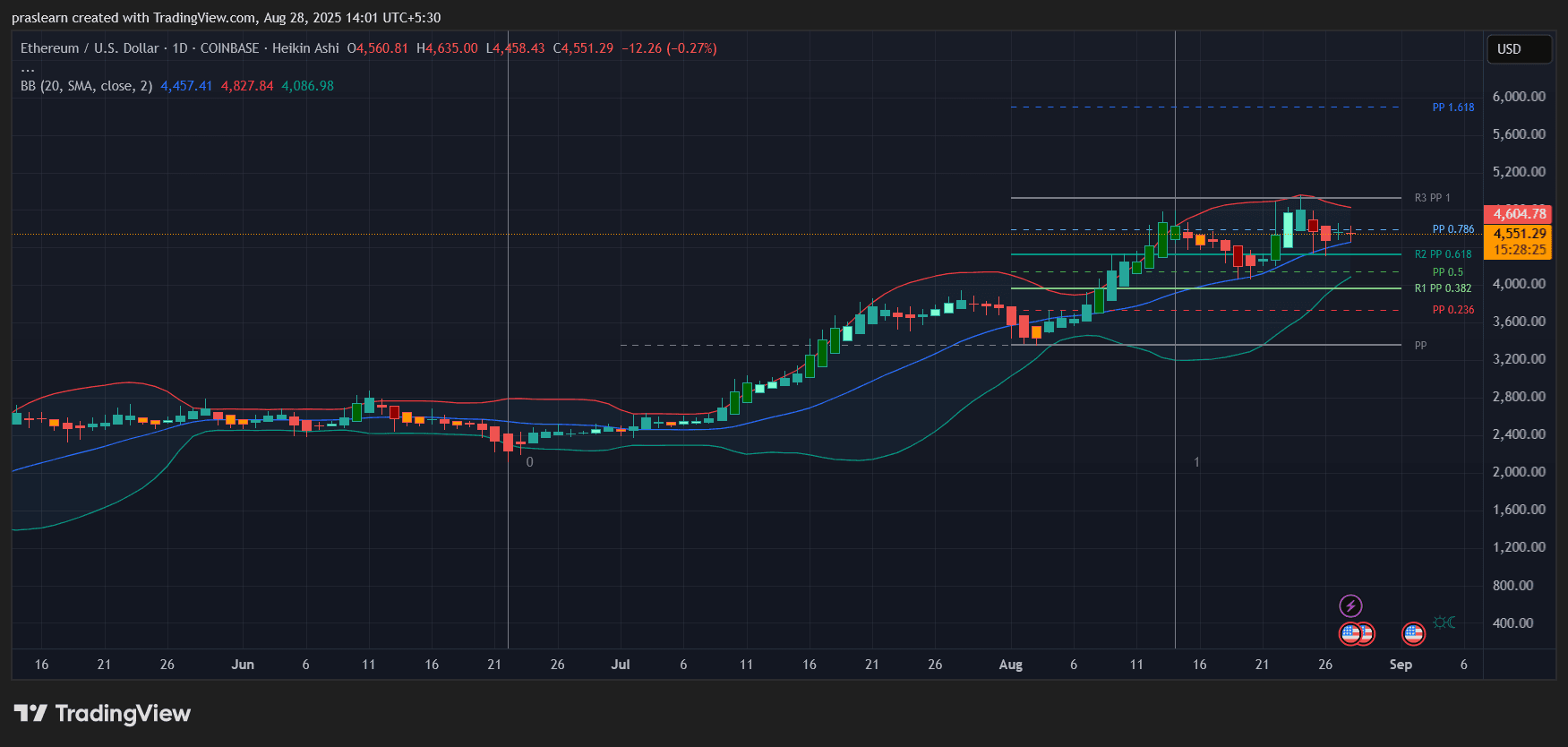

Ethereum's Institutional Takeover and Market Cap Overtaking Bitcoin: A Scarcity-Driven Revolution

- Ethereum's dynamic deflationary model, driven by EIP-1559 and institutional buying, is challenging Bitcoin's dominance by creating engineered scarcity. - BitMine's weekly ETH purchases and staking strategy reduced supply by 45,300 ETH in Q2 2025, boosting staking yields and institutional confidence. - Ethereum ETFs attracted $9.4B in Q2 2025, outpacing Bitcoin, as institutions view ETH as a utility asset with compounding value. - Analysts project Ethereum's market cap to overtake Bitcoin by 2025, driven

ETH Inflows Smash Bitcoin: Price Breakout Coming?

INJ +217.72% in 24Hr Amid Volatile Short-Term Price Fluctuations

- INJ surged 217.72% in 24 hours to $13.62 on Aug 28, 2025, followed by a 747.79% seven-day drop. - Analysts attribute volatility to on-chain activity, tokenomics changes, and shifting market sentiment. - Despite a 310.61% monthly gain, INJ fell 3063.2% annually, highlighting speculative momentum over intrinsic value. - Technical indicators confirm high volatility, with sharp spikes and reversals typical of leveraged crypto assets.

S Coin's Strategic Position in the Altcoin Recovery Amid Fed Easing

- Fed's dovish pivot boosts risk assets as rate cuts loom, with 50% chance of September 2025 easing. - Ethereum's 41% August surge and Dencun upgrades drive altcoin momentum, with S Coin (S) emerging as strategic play. - S Coin's $650M TVL surge, FeeM model, and Ethereum alignment position it for capital inflows amid macro-driven crypto reallocation. - Institutional ETFs holding 8% ETH supply and S Coin's $0.3173 price consolidation highlight market structure shifts. - Technical indicators suggest S Coin c