Faster Than Apple, Faster Than Bitcoin: Ethereum Hits $500 Billion

The world’s second-largest crypto has achieved a historic feat by reaching a market capitalization of 500 billion dollars faster than any other major company or even Bitcoin. This achievement is accompanied by a doubling of gains for long-term holders. But how far can ETH climb before profit-taking rekindles volatility?

In brief

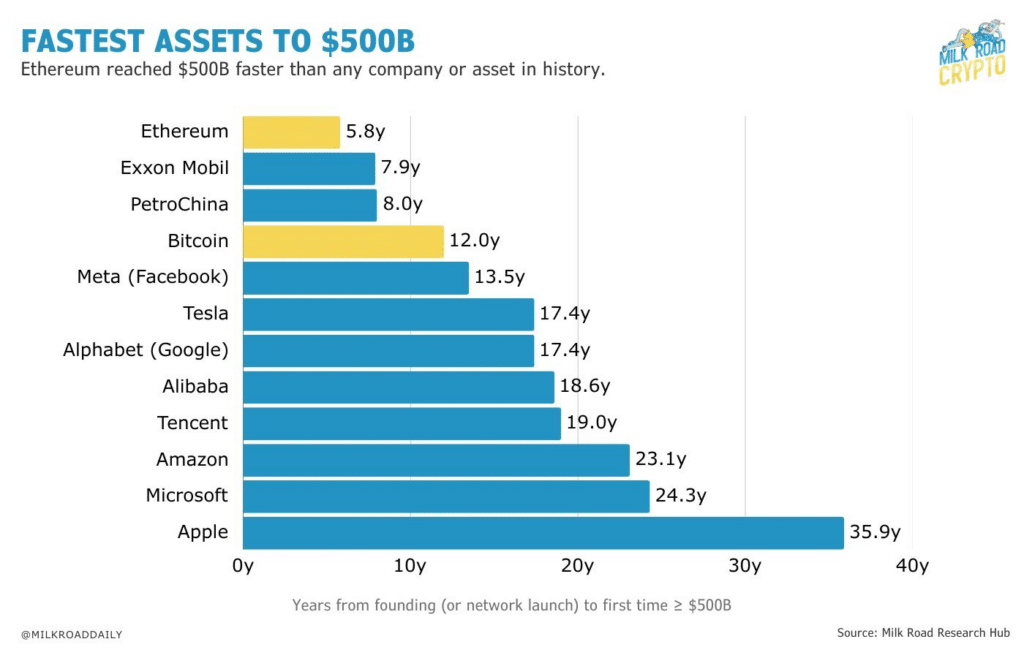

- Ethereum becomes the fastest asset in history to cross the 500 billion dollar market capitalization threshold.

- The price of ETH reached a new all-time high at 4,946 dollars, fueled by a wave of institutional accumulation.

- Unrealized gains of long-term investors have doubled, with an MVRV ratio at 2.15.

- Glassnode warns of increased volatility and potential selling pressures.

Ethereum breaks all records of rapid valuation

Ethereum has just written a new page in financial history. The crypto founded by Vitalik Buterin crossed the symbolic 500 billion dollar capitalization bar at an unprecedented speed.

Neither the world’s largest companies nor even bitcoin at the peak of its bullish cycles had reached this threshold so quickly.

This performance rests on a record of 4,946 dollars reached last week, driven by massive accumulation led by institutional investors and market “whales.”

The latter reallocate their capital from bitcoin to Ethereum, an unprecedented shift reflecting a profound change in the hierarchy of digital assets.

The enthusiasm goes beyond the circle of speculators. Listed companies, such as SharpLink Gaming , strengthen their balance sheets by accumulating ETH by the billions, making crypto a strategic reserve asset. This institutional adoption propels Ethereum well beyond the “altcoin” label.

With a market dominance of 14.98%, at its highest since September 2024, Ethereum is nibbling away at bitcoin’s territory , which fell to 58.2%. This rebalancing illustrates a fundamental mutation: investors now favor Ethereum’s versatility, the engine of DeFi, NFTs, and tokenization solutions, rather than bitcoin’s sole function as a store of value.

Ethereum becomes the fastest asset to surpass 500 billion $ in capitalization, ahead of the largest companies and Bitcoin. (Source: MilkRoadDaily)

Ethereum becomes the fastest asset to surpass 500 billion $ in capitalization, ahead of the largest companies and Bitcoin. (Source: MilkRoadDaily)

Warning signs at the heart of the euphoria

Behind this historic rise, some technical signals urge caution. According to Glassnode, Ethereum’s market value to realized value (MVRV) ratio has now reached 2.15.

This indicator, comparing the current capitalization to the average acquisition cost of circulating tokens, shows that investors hold unrealized gains on average exceeding double their initial investment.

Such a level reflects the rally’s strength but also serves as a warning. In the past, notably at the end of 2020 and early 2024, similar MVRVs preceded phases of high volatility and waves of massive profit-taking.

The risk is all the greater as ETH reserves on centralized platforms have dropped to 18.3 million units, a historic low. With reduced available supply, each buy or sell order has an increased impact on prices, enhancing the likelihood of sharp short-term movements.

A revolution that redefines the crypto ecosystem

Ethereum’s rise goes beyond a mere speculative phenomenon. It marks a fundamental transition in the crypto universe.

Unlike bitcoin, confined to the role of a store of value, Ethereum establishes itself as the infrastructure of a financial ecosystem. DeFi, tokenization, NFTs, layer-two solutions: all concrete applications that justify this exceptional valuation.

This dynamic profoundly transforms investment strategies. Institutions no longer seek just a “digital gold,” but an asset generating returns within a rapidly expanding ecosystem.

In short, the 500 billion dollar record may be just the beginning of a broader revolution, where Ethereum asserts itself as the technical foundation of decentralized finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google: Why We Want to Build Our Own Blockchain GCUL

This is more like a consortium blockchain dedicated to stablecoins.

In-depth Analysis of USD.AI: Backed by YZi Labs Investment, Enjoying Both Stable Returns and AI Dividends

USD.AI generates yields through AI hardware collateralization, filling the gap in computing resource financing.

The Prophet Returning from the Cold

Chainlink has not replaced traditional financial systems; instead, they have built a translation layer that enables traditional financial systems to "speak the language of blockchain."

[Long Thread] Besides securing a $10 million investment from WLFI, what makes Falcon stand out?