Bitcoin plunges, $900 million liquidated: Prelude to the September curse?

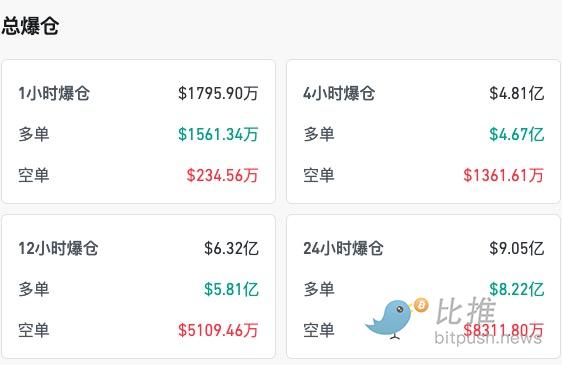

This Monday, volatility in the crypto market intensified. Bitcoin briefly fell below the $110,000 mark, hitting a low of $109,324, the lowest since early July. Ethereum also briefly dropped below $4,400, with a 24-hour decline of nearly 8%. This round of decline triggered large-scale liquidations across the market: according to CoinGlass data, as of the time of writing, the 24-hour liquidation amount exceeded $900 million, with Ethereum long positions losing about $322 million and Bitcoin long positions losing $207 million.

The market’s chain reaction was swift, with major altcoins coming under pressure across the board: Solana plunged more than 8% in a single day, XRP fell 6%, and mid- and small-cap tokens such as PENDLE, LDO, and PENGU recorded double-digit declines, with daily drops as high as 13%.

Historical Pattern: The “September Curse”

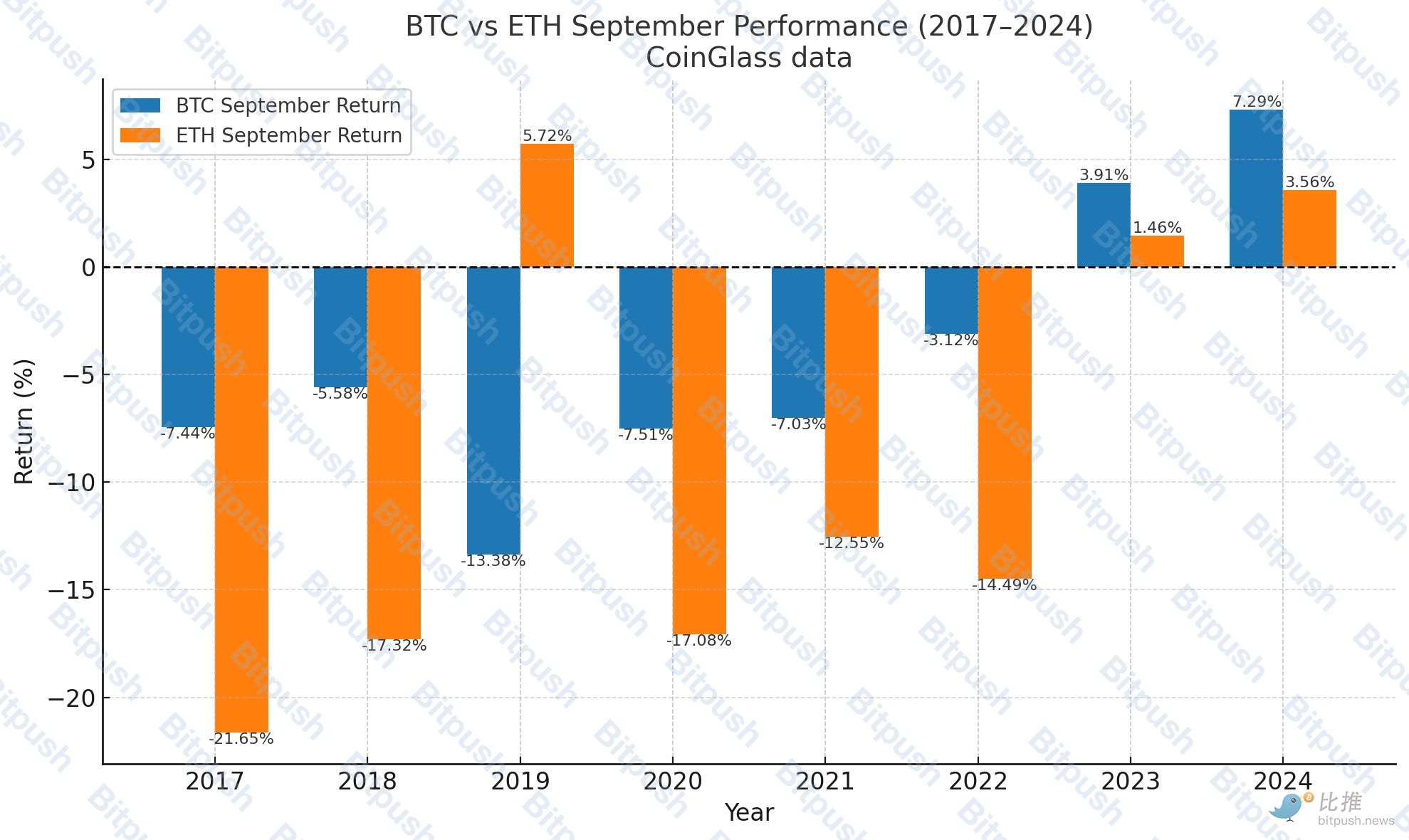

Investor caution is not unfounded. Statistics from CoinGlass show that September is one of the worst-performing months for Bitcoin and Ethereum.

The chart above compares the actual monthly returns of BTC and ETH in September from 2017 to 2024. It shows:

-

BTC performed negatively in most years during September, with only 2023 (+3.91%) and 2024 (+7.29%) recording gains.

-

ETH’s September declines are usually larger, with 2017 (–21.65%), 2020 (–17.08%), and 2022 (–14.49%) significantly underperforming BTC.

-

Only in 2019 (ETH +5.72% vs BTC –13.38%), 2023, and 2024 did ETH outperform BTC.

This “September curse” has appeared in every bull market cycle. In 2013, 2017, and 2021, after a strong summer rebound, Bitcoin experienced sharp corrections in September.

Analyst Views: Short-term Trend Reversal

Renowned analyst Benjamin Cowen pointed out that the strength seen in July and August often reverses in September, and Bitcoin is highly likely to test the bull market support zone near $110,000. He also warned that Ethereum may briefly hit new highs but could then drop by 20–30%, while altcoins could see declines of 30–50%.

Another active market analyst, Doctor Profit, supplemented with a more pessimistic view from macro and psychological perspectives. He believes that the Federal Reserve’s rate cut in September is less of a positive and more of a trigger for uncertainty. Unlike the “soft landing rate cut” of 2024, this time could be a true “major turning point,” leading to a simultaneous correction in both the stock and crypto markets.

On the price level, he also emphasized that there is still a CME gap at $93k–$95k on the BTC chart, with a large amount of liquidity concentrated there, while retail investors’ entry points are generally in the $110k–$120k range or even higher. To flush out these “weak hands,” the price must fall into their “maximum pain zone.”

In his strategy, he stated that he has gradually reduced his BTC and ETH spot holdings and shifted to short-term short positions.

The latest capital flow data shows that ETF enthusiasm is cooling. According to SoSoValue, last week spot Bitcoin ETFs saw outflows of $1.17 billion, the second-largest weekly net outflow in history; spot Ethereum ETFs saw outflows of $237.7 million, the third-largest on record. This indicates that institutional funds are temporarily turning to the sidelines, weakening support for the spot market.

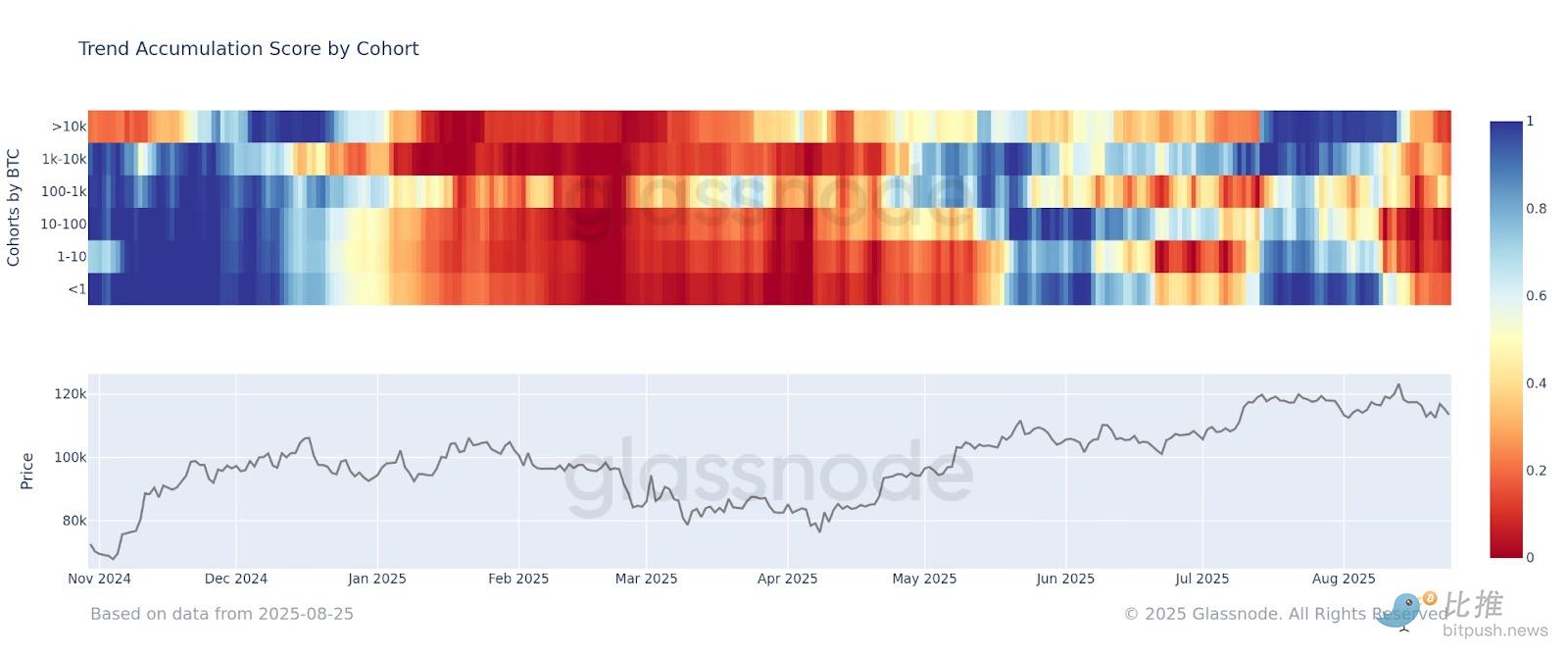

On-chain data also reveals structural signals. Glassnode pointed out that all Bitcoin holder groups “have collectively entered the distribution phase,” highlighting that the market is experiencing widespread selling pressure. After Ethereum hit a new high of $4,946 and then retreated, the MVRV indicator rose to 2.15, meaning investors are holding more than twice their unrealized gains on average. Historically, this level is similar to December 2020 and March 2024, both of which preceded periods of high volatility and profit-taking.

Macro Factors: Federal Reserve and Interest Rate Risks

Uncertainty in the macro environment is further intensifying market tension. Last Friday, Federal Reserve Chair Powell hinted at a possible rate cut in September, briefly boosting market optimism. However, both Cowen and Doctor Profit remind that a rate cut is not necessarily positive and may instead lead to a rise in long-term US Treasury yields, thereby suppressing risk assets. This is quite similar to the situation in September 2023, when a rate cut actually marked the bottom of the bond market, followed by a surge in yields. In addition, Benjamin Cowen pointed out that the latest Producer Price Index (PPI) data shows that inflation is “hotter than expected,” which undoubtedly adds extra pressure to the market. With inflationary pressures not fully alleviated, a policy shift by the Federal Reserve could trigger new market turmoil.

Outlook and Conclusion

Looking at historical patterns, analyst views, and the macro environment, it is clear that September poses multiple pressures on the crypto market:

-

Seasonal Downturn — Historically, September has averaged significant losses;

-

Macro Uncertainty — Federal Reserve policy could become a market watershed;

-

Imbalanced Capital Structure — Institutional outflows, retail investors chasing highs;

-

Increased On-chain Selling Pressure — All holder groups are distributing, and whale trades are disturbing the market.

Although Cowen and Doctor Profit differ in their assessment of the correction’s magnitude, the consensus is: September is not the turning point for a bull market uptrend, but rather a test that must be faced.

However, from a longer-term perspective, this shakeout may also be a necessary step for the bull market to continue. The market needs to clear overheated positions in the “maximum pain zone” to make room for the next rally. If the shakeout is sufficient, BTC could still hit new highs in the subsequent cycle, and ETH’s long-term bullish logic will not change because of this.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google: Why We Want to Build Our Own Blockchain GCUL

This is more like a consortium blockchain dedicated to stablecoins.

In-depth Analysis of USD.AI: Backed by YZi Labs Investment, Enjoying Both Stable Returns and AI Dividends

USD.AI generates yields through AI hardware collateralization, filling the gap in computing resource financing.

The Prophet Returning from the Cold

Chainlink has not replaced traditional financial systems; instead, they have built a translation layer that enables traditional financial systems to "speak the language of blockchain."

[Long Thread] Besides securing a $10 million investment from WLFI, what makes Falcon stand out?