The 2025 Altcoin Rotation: Why Ethereum and Smart Money Are Reallocating Capital from Bitcoin

- Institutional investors and crypto whales are shifting $1.6B+ to Ethereum in 2025, driven by staking yields, deflationary mechanics, and ETF inflows. - Ethereum's whale ownership rose to 22% of supply, with Dencun upgrades slashing Layer 2 costs by 90% and 26% of ETH staked for yields. - Altcoins like Best Wallet Token and Chainlink gain traction as Ethereum's 57.3% market dominance signals structural capital reallocation from Bitcoin. - Technical indicators show Ethereum testing $4,065 support, with ins

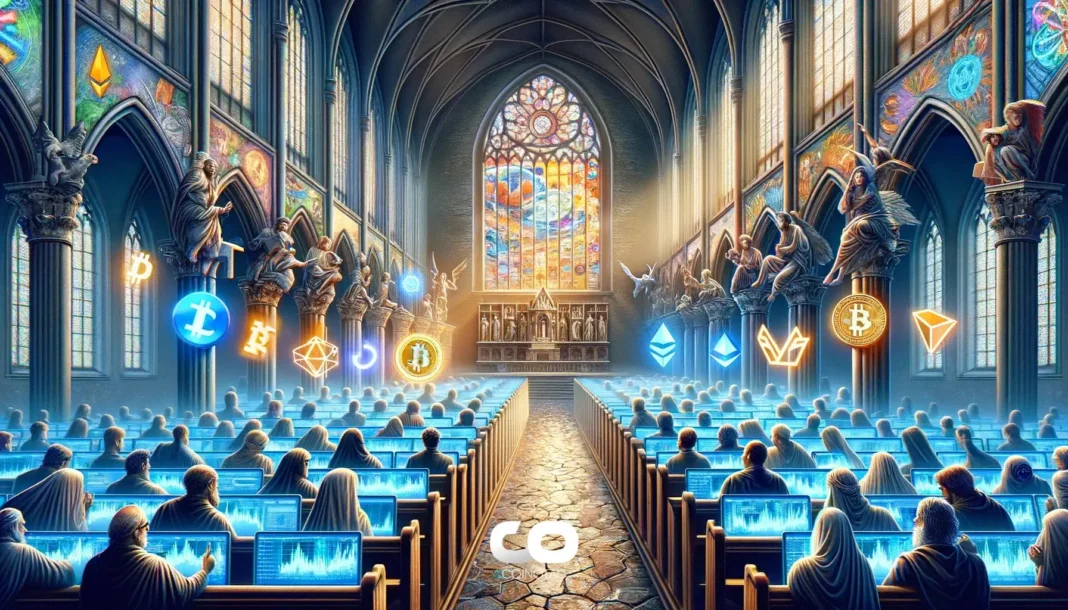

The cryptocurrency market in 2025 is witnessing a seismic shift in capital allocation, with institutional investors and whale-level actors systematically redirecting funds from Bitcoin to Ethereum and altcoins. This reallocation is driven by a confluence of yield opportunities, technological innovation, and regulatory tailwinds, particularly through Ethereum ETFs. For investors, understanding this trend is critical to positioning portfolios for a potential altseason that could redefine the crypto landscape.

Institutional and Whale Activity: A Clear Signal of Capital Reallocation

On-chain data reveals a stark divergence in capital flows. Ethereum's whale wallet count surged to 1,275 in August 2025, with 48 new addresses accumulating 10,000 ETH or more. Institutions like FalconX, Galaxy Digital , and BitGo facilitated $164 million in single-day ETH deposits, while BlackRock's iShares Ethereum ETF injected $255 million into the market. Meanwhile, Bitcoin ETFs faced $1 billion in cumulative outflows over six sessions, underscoring a strategic pivot.

Whale behavior further amplifies this trend. A $2.5 billion BTC-to-ETH conversion in August 2025 highlighted Ethereum's appeal for staking and DeFi. Ethereum's whale ownership now accounts for 22% of its circulating supply (up from 15% in October 2024), with mega whale holdings (100,000+ ETH) growing by 9.3%. These metrics signal a structural shift: Ethereum is no longer just a speculative asset but a foundational infrastructure layer for yield generation and decentralized finance.

Ethereum's Structural Advantages: Yield, Utility, and Deflationary Mechanics

Ethereum's dominance in the altcoin rotation is underpinned by its unique value proposition. The Dencun and EIP-4844 upgrades have slashed Layer 2 transaction costs by 90%, making Ethereum the most scalable smart contract platform. Staking yields of 1.9–3.5% APY attract capital, with 31.4 million ETH (26% of total supply) currently staked. Additionally, Ethereum's deflationary model—burning 4.5 million ETH since EIP-1559—creates scarcity, contrasting with Bitcoin's static supply.

Institutional validation reinforces this narrative. JPMorgan and Goldman Sachs project Ethereum to outperform Bitcoin in 2024–2025, citing its role in the $400 billion stablecoin market and DeFi's $153 billion total value locked (TVL). BlackRock's ETHA and Fidelity's FETH ETFs attracted $455 million in a single day in August, dwarfing Bitcoin ETF inflows. These developments position Ethereum as a bridge between traditional finance and Web3, offering both capital preservation and growth.

Altcoin Momentum: The Next Frontier of Capital Deployment

While Ethereum serves as the backbone, altcoins are capturing speculative and utility-driven capital. Tokens like Best Wallet Token (multi-chain governance), Chainlink (enterprise data oracles), and meme coins like Wall Street Pepe and TOKEN6900 are gaining traction. Best Wallet Token's Solana integration and Chainlink's enterprise partnerships highlight the appeal of projects with clear use cases. Meanwhile, meme coins thrive on community-driven narratives, attracting retail investors during bullish cycles.

The rotation is also evident in whale behavior. A $2.55 billion Ethereum purchase via Hyperliquid was immediately staked, removing it from circulation. Conversely, Bitcoin whales dumped $76 million in BTC to acquire $295 million in ETH, reflecting a preference for Ethereum's yield-generating ecosystem. This trend is further amplified by Ethereum's 57.3% market dominance in late August 2025, down from 60% in mid-July—a sign of broader capital dispersion.

Technical and Market Dynamics: A Bullish Setup for Ethereum and Altcoins

Ethereum's technical indicators suggest a breakout is imminent. The asset is testing the $4,065 support level, with a break above $4,624 targeting the $4,953 record high. Bitcoin, meanwhile, consolidates near its 200-day EMA at $100,887, with accumulation patterns indicating a potential rebound. However, Ethereum's structural advantages—staking yields, deflationary supply, and institutional adoption—make it a more compelling long-term play.

Investment Implications: Positioning for the Altseason

For investors, the 2025 altcoin rotation presents a strategic opportunity. Ethereum's institutional validation and technical upgrades make it a core holding, while altcoins offer high-growth potential for risk-tolerant portfolios. Key steps include:

1. Allocate to Ethereum ETFs (e.g., ETHA, FETH) to gain exposure to institutional-grade Ethereum.

2. Diversify into altcoins with strong fundamentals, such as Chainlink or Best Wallet Token.

3. Monitor whale activity via on-chain analytics platforms like Arkham and Lookonchain to identify early-stage trends.

As October and November historically deliver strong returns for crypto, the accumulation seen in August 2025 positions Ethereum and altcoins for a potential end-of-year bull run. The interplay of yield, innovation, and institutional flows suggests that capital reallocation is not a temporary shift but a structural evolution in the crypto market. Investors who act now may find themselves at the forefront of the next major wave of digital-asset growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

YZY Memecoin May Have Yielded Over $1M for 11 Wallets While Most Traders Suffered Losses

The Rise of Ethereum Treasuries: How Decentralized Governance is Reshaping Institutional Capital Efficiency in DeFi

- Ethereum-based DeFi treasuries are reshaping institutional capital strategies through decentralized governance and yield optimization. - DAOs like UkraineDAO ($100M+ raised) and MolochDAO demonstrate trustless, transparent fund management via smart contracts. - Regulatory progress (e.g., ETH ETFs, GENIUS Act) and institutional staking (e.g., BitMine's $150M/year rewards) drive adoption by pension funds and SWFs. - Risks like staking slashing and liquidity discounts prompt diversification strategies and i

How the Solana ETF Redefines Risk Preferences: A Behavioral Economics Perspective

- The REX-Osprey Solana + Staking ETF (SSK) launched in July 2025, combining Solana price exposure with a 7.3% staking yield, reshaping investor behavior through behavioral economics principles. - By leveraging the reflection effect, SSK mitigated emotional overreactions during price dips, retaining $164M in inflows despite Solana dropping below $180 in August 2025. - Institutional adoption and $316M AUM transformed Solana from speculative asset to strategic allocation tool, reflecting a risk preference re