News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 5) |BTC Drops Below $100K Amid Market Panic; Chainlink Conference Focuses on TradFi–DeFi Integration; Perp DEX October Volume Hits $1.75 Trillion2Research Report|In-Depth Analysis and Market Cap of Momentum (MMT)3Bitcoin (BTC) Testing Key MA Fractal Support — Will It Repeat the Bounce Back?

MARA Q3 Revenue Up 92% YoY, Net Profit Reaches $123 Million

Bitget·2025/11/05 02:56

Wall Street continues to sell off—how much further will bitcoin fall?

Liquidations across the entire network reached $2 billion, BTC failed to hold the $100,000 mark, hitting a six-month low.

BlockBeats·2025/11/05 02:33

"Black Tuesday" for US Stock Retail Investors: Meme Stocks and Crypto Plunge Amid Earnings Reports and Short-Selling Pressure

Although retail investors still made a net purchase of $560 million that day, it was not enough to prevent the Nasdaq from plunging more than 2%.

BlockBeats·2025/11/05 02:32

Solana ETFs show strength, but SOL price lost its yearly uptrend: Is $120 next?

Cointelegraph·2025/11/05 02:06

Key support in jeopardy, Bitcoin may face a deep correction

Bitpush·2025/11/05 02:05

Wall Street Continues to Sell Off, How Low Will Bitcoin Drop?

BlockBeats·2025/11/04 23:38

That summer, I sniped altcoins on DEX and made 50 million dollars.

Starting from just $40,000, we ultimately sniped more than 200 altcoins across over 10 different blockchains.

深潮·2025/11/04 22:49

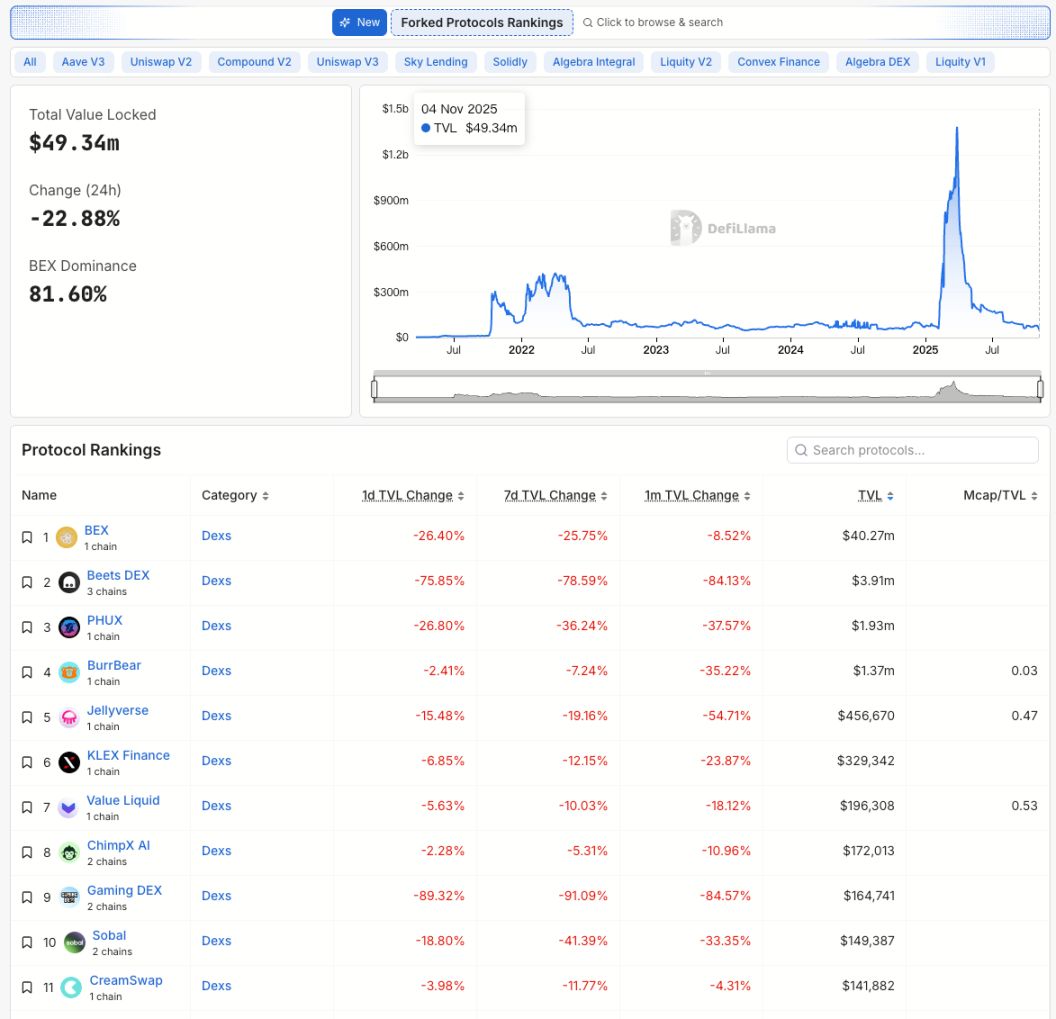

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

深潮·2025/11/04 22:48

Berachain: All funds stolen due to the vulnerability have been recovered.

Cointime·2025/11/04 22:48

The Butterfly Effect of the Balancer Hack: Why Did $XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.

深潮·2025/11/04 22:48

Flash

- 03:34Institutional Analysis: Broad Market Sell-off Emerges, Fear SpreadsAccording to Golden Ten Data, CMC Markets sales trader Oriano Lizza stated that the market downturn has been somewhat delayed, and the issue of overvaluation has finally surfaced. Investors are watching to see if new catalysts will emerge to sustain the upward momentum. This broad-based market sell-off is the first time such a widespread situation has been seen, with almost no distinction between asset classes, which may indicate that fear is gradually spreading.

- 03:33Berachain Co-founder: Honey SC/Mint and swap functions are now operating normallyChainCatcher news, Berachain co-founder Smokey stated that due to the BEX exchange rate freeze, there are still some anomalies in the Hub's annual interest rates and certain pricing. Some users encounter a 500 error message when accessing the Honey page, which appears to be related to geographic location. The Honey SC/Mint and swap functions are operating normally, and the frontend team has been scheduled to fix this error so that all affected users can access the page properly.

- 03:33Shanghai Securities News: The positioning of digital RMB in the monetary hierarchy may shift from M0 to M1Foresight News reported, citing Shanghai Securities News, that a series of policy signals indicate that the development of digital RMB has entered a critical transition period from pilot exploration to system improvement. Analysts believe that the current positioning of digital RMB as M0 (currency in circulation) has gradually revealed many limitations in practice, such as the non-interest-bearing feature leading to insufficient user willingness to hold, and the separation from the banking account system exacerbating usage difficulties. Therefore, shifting its positioning to M1 is seen as key to solving the above issues. Liu Xiaochun, Deputy Director of Shanghai New Finance Research Institute and Deputy Director of China Financial Research Institute at Shanghai Jiao Tong University, stated that there are two envisioned paths to achieve this transformation: one is to directly promote the digitization of deposits, converting personal savings and corporate deposits into digital M1, thereby achieving seamless integration between bank accounts and digital wallets. The other is to introduce a new dedicated savings form, allowing funds to be transferred from existing deposit accounts to digital wallets, but still included as on-balance-sheet liabilities of commercial banks, with interest calculated at the demand deposit rate or a slightly lower rate.