News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1US Stocks Surge as Crypto Reserve Companies Find Growth Hack2Eightco Secures $250M for $WLD Treasury Launch3Bitcoin Inches up to $112K as Stocks Hit Record Highs

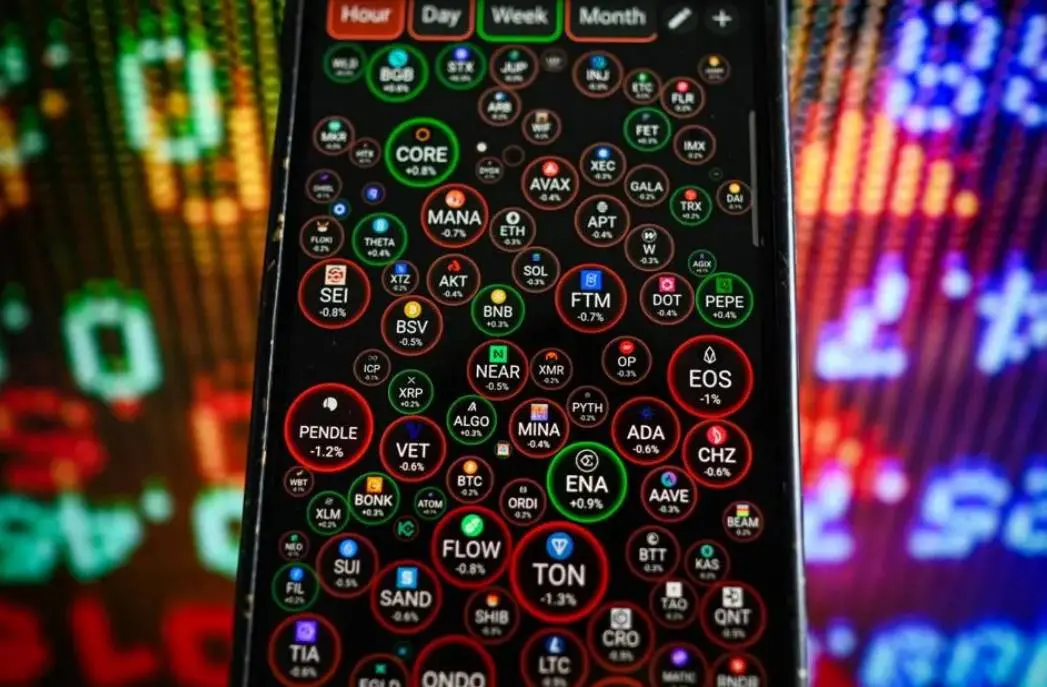

From "flood irrigation" to a differentiated landscape, will the altcoin season repeat the glory of 2021?

The altcoin season of 2021 erupted under a unique macro environment and market structure, but now, the market environment has changed significantly.

Chaincatcher·2025/09/09 12:26

a16z In-Depth Analysis: How Do Decentralized Platforms Make Profits? Pricing and Charging Strategies for Blockchain Startups

a16z points out that a well-designed fee structure is not at odds with decentralization—in fact, it is key to creating a functional decentralized market.

Chaincatcher·2025/09/09 12:25

OpenSea unveils final phase of pre-TGE rewards, with $SEA allocation details due in October

Cryptobriefing·2025/09/09 10:54

Bitcoin Mining Difficulty Reaches New Record High

Theccpress·2025/09/09 10:27

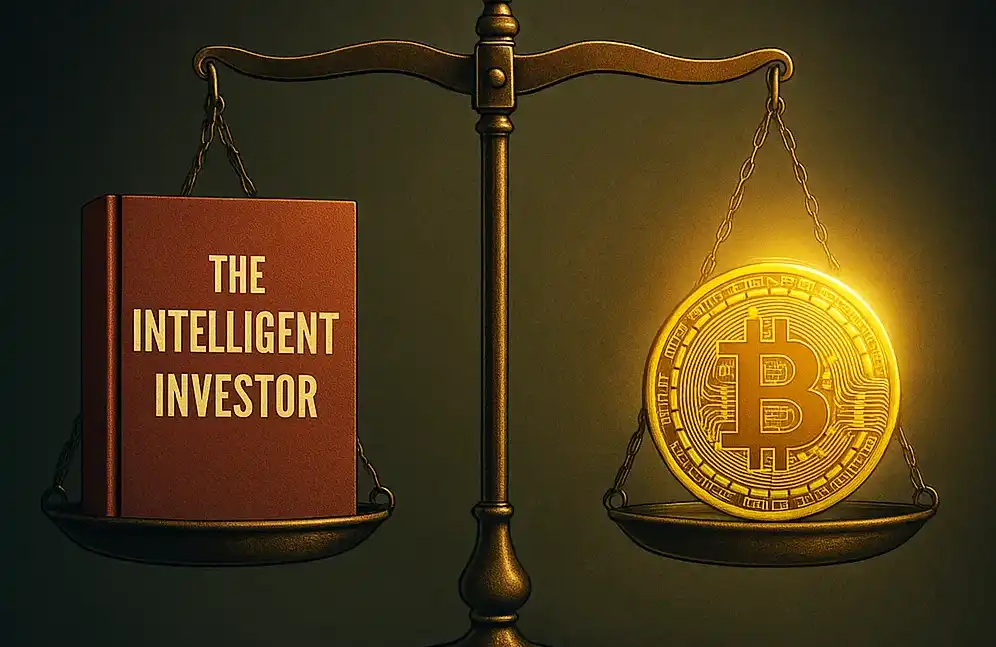

Smart Investing vs Ideological Investing: Who Will Lead the Future Capital Markets?

The Bitcoin Treasury Company embodies a new paradigm of ideological investment, blending financial innovation with ideological alignment.

BlockBeats·2025/09/09 09:53

Ethereum Price Poised for Bullish Breakout Amid Strong Fundamentals

TheCryptoUpdates·2025/09/09 09:15

The Rise of Bitcoin DeFi: Infrastructure Development and Market Boom

We are likely to see bitcoin evolve from "digital gold" into the most important foundational asset in the multi-chain DeFi ecosystem.

深潮·2025/09/09 09:12

Hyperliquid’s USDH Ticker Assigned via Onchain Vote

Coinlive·2025/09/09 07:39

Bitcoin’s Bull Run Continues Despite Short-Term Corrections

Coinlive·2025/09/09 07:39

HYPE Token Soars as Paxos Aims to Lead USDH Stablecoin

Coinlive·2025/09/09 07:39

Flash

- 12:23Bitget has launched USDT-margined SKY and OPEN perpetual contracts, and simultaneously listed 5 stock-related contracts.According to ChainCatcher, Bitget has announced in an official statement that it has launched USDT-margined perpetual contracts for SKY and OPEN, with maximum leverage of 75x and 20x respectively. Contract trading BOTs will also be available simultaneously. In addition, Bitget has launched stock-related contracts for projects such as PLTR, SLV, APP, ORCL, and GE, with leverage ranging from 1x to 10x. Users can trade through the official website or the Bitget APP.

- 12:14New White House Cryptocurrency Advisor: Establishing a U.S. Federal Cryptocurrency Reserve Is One of the Top PrioritiesJinse Finance reported that Patrick Witt, the new White House cryptocurrency advisor succeeding Bo Hines, stated that he will urge lawmakers to complete a comprehensive review of U.S. cryptocurrency policy and promote regulatory agencies to implement new stablecoin legislation. Currently, the three main priorities are the Senate's market structure legislative efforts, the rapid implementation of stablecoin legislation (namely the "Guiding and Empowering the Nation to Innovate United States Stablecoins Act" (GENIUS)), and the establishment of a U.S. federal cryptocurrency reserve.

- 12:13CFTC Acting Chairman: Considering Bringing Compliant Overseas Crypto Trading Platforms Under U.S. Cross-Border RegulationBlockBeats News, on September 9, FOX Business reporter Eleanor Terrett stated that Caroline D. Pham, Acting Chair of the U.S. Commodity Futures Trading Commission (CFTC), said in a recent speech that the agency is studying whether it can recognize overseas cryptocurrency trading platforms that follow sound, crypto-specific regulations (such as the EU's MiCA framework) under the U.S. cross-border regulatory framework. This statement comes shortly after the CFTC recently reaffirmed its long-standing Foreign Board of Trade (FBOTs) framework. This framework allows certain non-U.S. cryptocurrency trading platforms already regulated by foreign regulatory authorities to provide direct trading access to U.S. traders by registering with the CFTC as FBOTs, rather than as Designated Contract Markets (DCM).