Goldman Sachs Jumps On Crypto Bandwagon With Plans for Three Tokenization Projects In 2024

Goldman Sachs is joining other Wall Street giants in diversifying into crypto with plans to launch three tokenization projects this year amid growing interest from clients.

The funds will target institutional clients in the US and Europe, the global head of digital assets Mathew McDermott told Fortune in an interview, adding that the investment bank also plans to create marketplaces for tokenized real-world assets (RWA).

McDermott attributed the initiative to an “uptick in interest from clients” in digital assets. He noted that the success of Bitcoin exchange-traded funds (ETFs) in the US had “renewed momentum in crypto.”

Since starting trading in January, US spot Bitcoin ETFs have attracted over $50 billion in assets under management.

Tokenized RWAs Gain Traction Among US Firms

The recent initiative by Goldman Sachs comes amid a growing interest in tokenized RWAs among US firms.

The $10 trillion asset manager BlackRock has already dipped its toes into the tokenization space with its BlackRock USD Institutional Digital Liquidity Fund ( BUIDL ), which has around $500 million in assets under management.

Franklin Templeton also has $400 million in assets under management for its OnChain US Government Money Fund ( FOBXX ) and a BENJI token on the Polygon and Stellar blockchains.

McDermott noted that Goldman Sachs would not use public blockchains like Ethereum for tokenization projects like BlackRock did. Instead, it plans to use permissioned networks to remain compliant.

The investment bank also plans to expand into crypto with “execution” and “sub-custody,” McDermott said. However, this expansion will depend on whether the US government softens its stance towards the crypto industry.

Also Read:

- Donald Trump To Speak At Major Bitcoin Conference As Polls Show His Crypto Embrace Could Win Votes

- Notcoin Price Prediction: NOT Plummets 7% As This P2E DOGE-Themed Rival Zooms Towards $6 Million

- Pepe Price Plunges 7% In A Week As Traders Pivot To This Layer-2 Derivative And Its 596% APY

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Toncoin Price Prediction 2026: TON Eyes $15 as Qubetics Presale Enters Final Phase

Best Altcoins to Invest in Now: Qubetics, OKB, Toncoin Rise as FCA Lifts ETN Ban

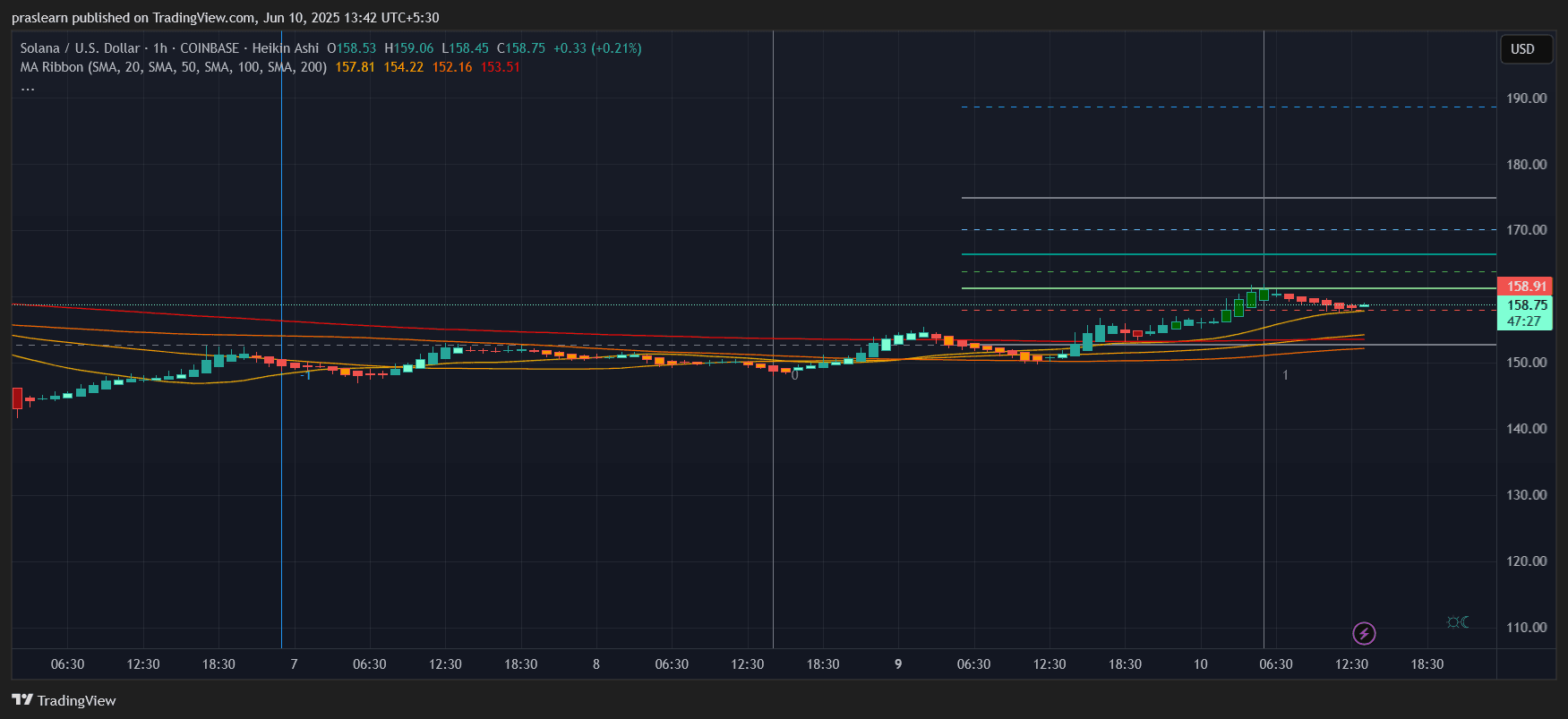

Solana Price Prediction: Can SOL Break $170 This Week?

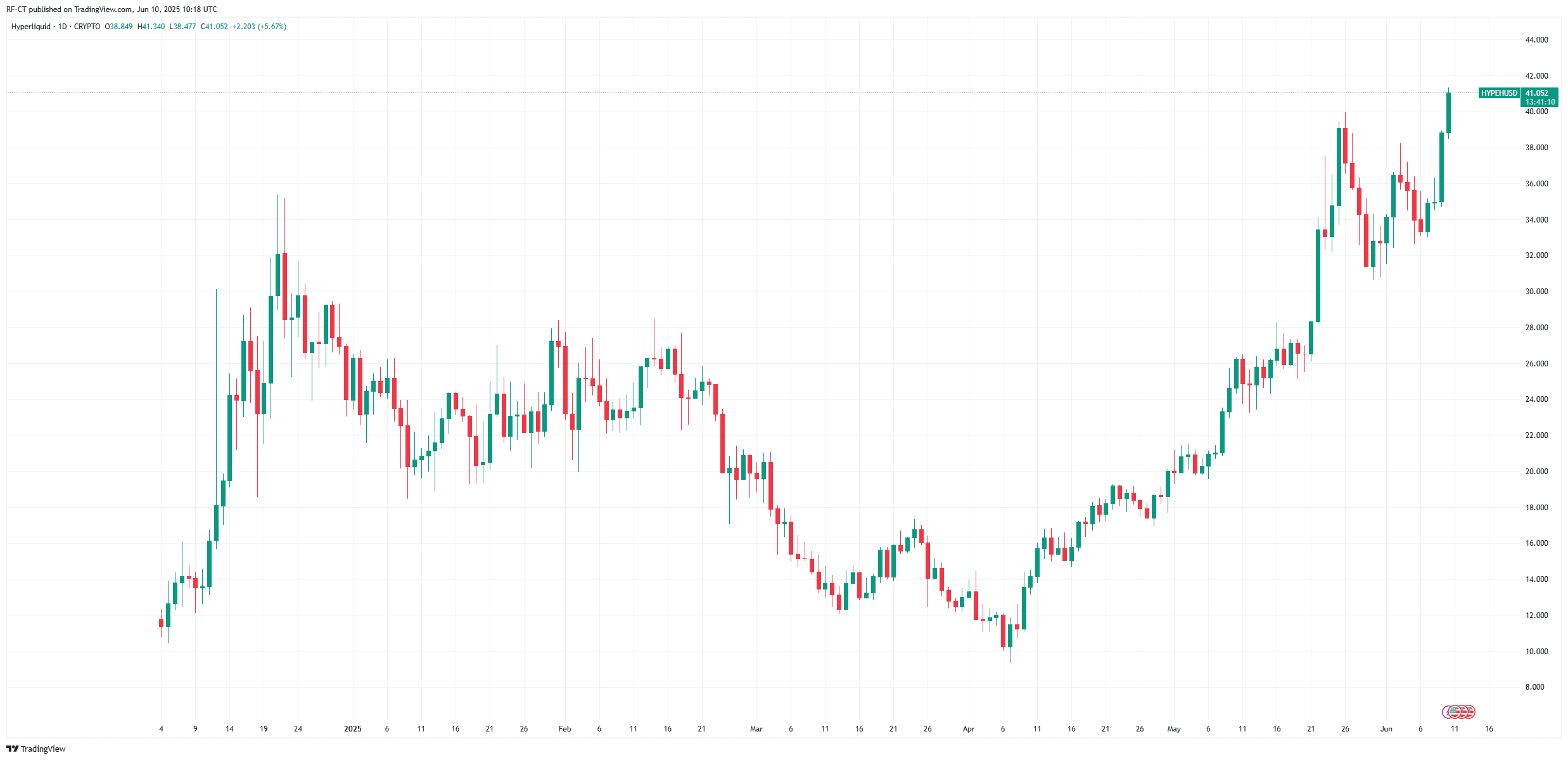

Hyperliquid Hits New ATH Today: What's the Hype about HYPE?