Trump Tariff Is Just a Trigger: Bitcoin Price Finds Key Support at $106,000 Amid Crypto Crash

The latest crypto crash has shaken global markets, but it’s clear that the Trump tariff announcement is only the spark—not the root cause. As panic selling swept across exchanges, many traders looked anxiously at the bitcoin price, searching for signs of stability. Technical analysis now points to $106,000 as a crucial support level for Bitcoin, which may be the market’s foundation during this turbulent period. But how deep do the issues run, and what can previous crypto crashes teach us about recovery?

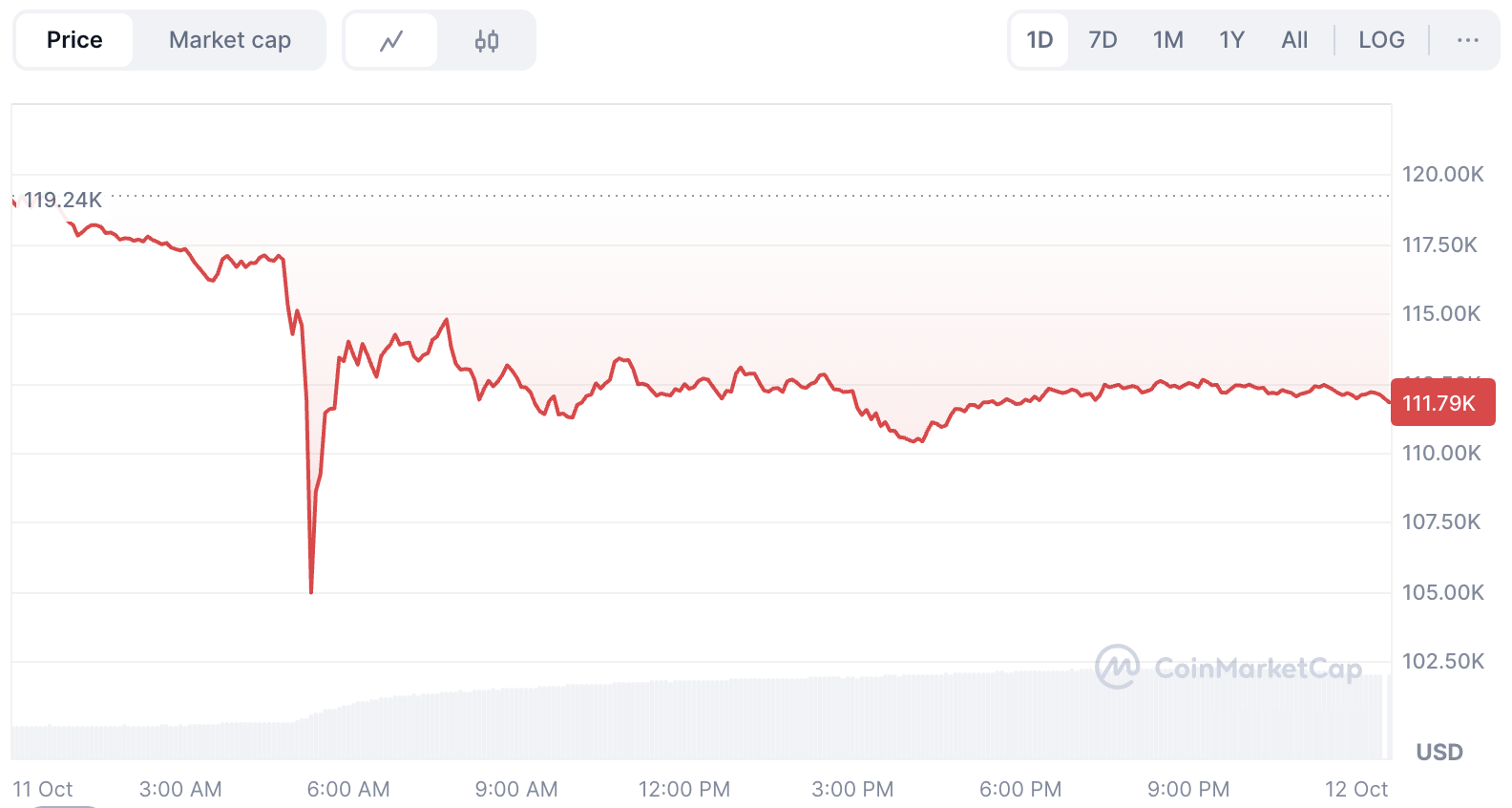

*Bitcoin Price

Source: CoinMarketCap

Crypto Market Performance and Unprecedented Liquidations

The crypto crash of October 11, 2025, marks one of the most violent sell-offs in digital asset history. According to Coinglass, within just 24 hours, the market faced liquidation volumes climbing to $19.1 billion, impacting over 1.62 million traders globally. The single largest liquidation order was seen on Hyperliquid’s ETH-USDT contract, totaling a staggering $203 million.

For Bitcoin, the sell-off triggered a drop from $119,317 down to $103,000, a loss of over 14%. Ethereum saw an even more acute decline, crashing over 17% within the same period. Many altcoins suffered catastrophic losses, with move than 90% declines for some projects—some tokens even approaching zero in value. Wrapped assets like WBETH and BETH weren’t spared either, experiencing sharp devaluations.

Stablecoins, trusted by investors to preserve value, also showed vulnerabilities during this crypto crash. USDE deviated from its dollar peg, plunging as low as $0.62 before eventually recovering. The waves of liquidations and frantic trading brought the world’s largest exchanges, such as Binance, to technical limits, causing temporary outages and withdrawal delays. The speed and intensity of the crypto crash highlighted the system’s fragility during periods of high volatility and thinning liquidity.

Why Trump Tariff Is Just a Trigger

While mainstream headlines attributed the latest crypto crash to the new Trump tariff—a plan to implement 100% tariffs on Chinese imports—industry analysis suggests this event merely accelerated problems that had been brewing within the digital asset ecosystem.

A significant factor behind the breadth and depth of losses was a breakdown in market-making liquidity. Leading crypto market makers allocate the majority of their capital to top-tier (“Tier 0” and “Tier 1”) assets, while support for lesser-known projects remains limited. When the Trump tariff headline broke, and risk-off sentiment took over, they withdrew liquidity from smaller tokens to protect primary allocations. This left most altcoins exposed; with minimal buy-side depth, prices collapsed on even moderate selling pressure.

In addition to market-makers reallocating capital, leverage compounded the crypto crash. The market saw about 200,000 ETH forcibly liquidated on-chain as sharp downside moves cascaded through leveraged lending and borrowing positions. Centralized exchanges, too, saw automated margin calls and cross-margin liquidations, resulting in indiscriminate selling—further dragging down the bitcoin price and altcoins. These chain reactions revealed vulnerabilities that were present long before the Trump tariff emerged as a market-moving headline.

Bitcoin Price: $106,000 as a Safe Support Level

During this intense crypto crash, technical analysis and order books have highlighted $106,000 as a critical support level for the bitcoin price. This figure represents a confluence of buy walls and historical trading interest, making it a potential anchor for market stabilization.

Options data shows that below $106,000, large institutional players and algorithms may be incentivized to enter the market as buyers, while market-makers will actively hedge exposures by accumulating spot Bitcoin. The $106,000 threshold is thus not only psychological but structural—its defense or failure will shape risk appetite in the coming weeks. If the bitcoin price can maintain this level through the volatility, it may mark the bottom of the current cycle and set the stage for eventual recovery. A decisive break lower, however, could pave the way for further losses across the entire digital asset market.

Recovery Timeline: What Past Crypto Crashes Suggest

To gauge how long it may take for the market to recover from the 2025 crypto crash, we can look at data from previous major dislocations in the crypto sector:

-

“312” Crypto Crash (March 2020):

Bitcoin collapsed from $9,200 to $4,800 in a matter of days. The recovery was steady but strong—279 days (around 9 months) later, Bitcoin had broken past 2017’s record and entered a new bull phase. -

“519” Crypto Crash (May 2021):

As leverage and restrictive policies gripped global markets, Bitcoin dived from $57,000 to $30,000 (-47%). It took almost 6 months for BTC to recover and set new highs. -

FTX Collapse (November 2022):

The failure of the FTX exchange dragged Bitcoin to $15,400, with the entire market losing trust in major institutions. It wasn’t until early 2024—after 15 months—that confidence and prices finally returned to pre-crash levels.

For the present crypto crash, with the bitcoin price falling from $119,317 to $103,000, history points to a likely recovery timeline of 6 months to over a year. The duration will depend on how quickly confidence, institutional liquidity, and regulatory clarity (especially around policies like the Trump tariff) return to the market.

Conclusion

The October 2025 crypto crash stands as one of the largest and most disruptive events in digital asset history. While the Trump tariff news acted as a sharp trigger, the real culprits were structural weaknesses in market liquidity and leverage. The bitcoin price at $106,000 will remain a focal point for traders and analysts—its ability to hold could determine the market narrative throughout the rest of the year.

History shows that the road to recovery may be long, but patient investors have historically been rewarded after major crypto crashes. As the dust settles, the market’s next move will depend on macroeconomic conditions, regulatory developments, and—above all—how quickly confidence is restored to the industry.